Kyowa Kirin (TSE:4151) Valuation Check After New KOMZIFTI Menin Inhibitor Data in AML Trial

Kyowa Kirin (TSE:4151) just gave investors a fresh data point to chew on, with new KOMZIFTI combination trial results in acute myeloid leukemia highlighting encouraging activity alongside a clean looking safety profile.

See our latest analysis for Kyowa Kirin.

Those KOMZIFTI data land as Kyowa Kirin’s 90 day share price return of 7.9% and roughly 9% year to date share price gain suggest sentiment is quietly improving, even though the three year total shareholder return is still in negative territory.

If these AML results have you rethinking where growth in healthcare could come from next, it is worth exploring other potential ideas across healthcare stocks.

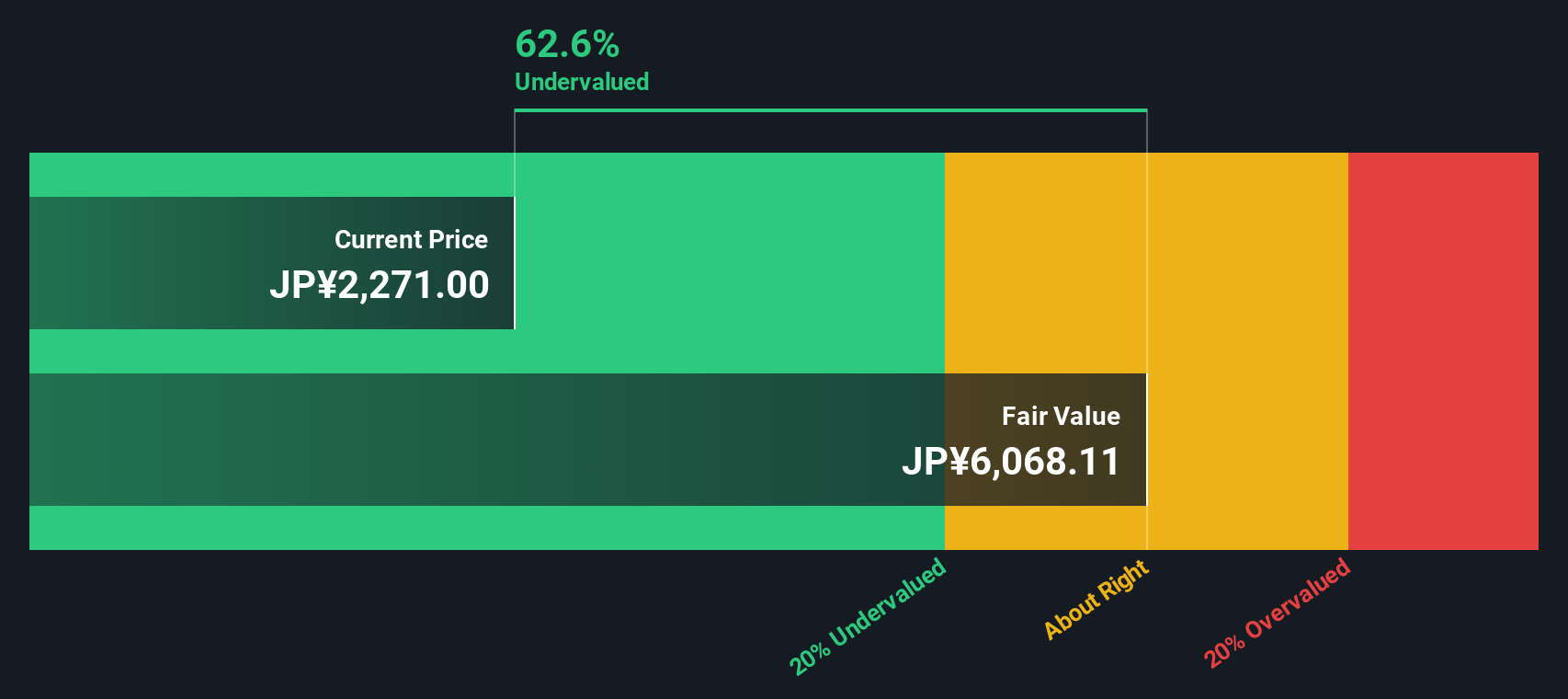

With earnings growing faster than revenue and the share price sitting only a touch below analyst targets, investors now face the key question: is Kyowa Kirin a quietly undervalued growth story or already priced for its next leg higher?

Price-to-Earnings of 36.3x: Is it justified?

Kyowa Kirin's share price at ¥2,536 implies a rich valuation, with the stock trading on a 36.3x price-to-earnings multiple that points to an overvalued stance versus peers.

The price-to-earnings ratio compares the current share price to the company’s earnings per share, giving a snapshot of how much investors are willing to pay for each unit of profit. For a mature pharmaceuticals business like Kyowa Kirin, this multiple effectively reflects the market’s expectations for future earnings growth and the quality or durability of those profits.

Right now, the market is assigning Kyowa Kirin a 36.3x price-to-earnings ratio, well above both the Japanese pharmaceuticals peer average of 16.5x and the estimated fair price-to-earnings ratio of 23.6x that our models suggest as a more reasonable anchor. That gap indicates investors are pricing in a much stronger earnings trajectory or premium positioning than history and fair ratio estimates would typically support, leaving limited room for disappointment if growth or margins fall short of these high expectations.

Explore the SWS fair ratio for Kyowa Kirin

Result: Price-to-Earnings of 36.3x (OVERVALUED)

However, looming patent cliffs and clinical trial setbacks for its pipeline candidates could quickly undermine today’s rich multiple and fragile shift in sentiment.

Find out about the key risks to this Kyowa Kirin narrative.

Another View: DCF Signals a Very Different Story

While the price to earnings multiple presents Kyowa Kirin as expensive, our DCF model is considerably more conservative. It suggests fair value around ¥19.83 versus the current ¥2,536 share price. This indicates the stock may be significantly overvalued and raises the question of how long sentiment can diverge from cash flow fundamentals.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kyowa Kirin for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kyowa Kirin Narrative

If you are not fully aligned with this view, or simply want to dive into the numbers yourself, you can build a personalised version in under three minutes, starting with Do it your way.

A great starting point for your Kyowa Kirin research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Kyowa Kirin might only be the first step, and if you stop here you could miss out on other compelling opportunities shaping the next wave of returns.

- Capture early momentum by backing quality upstarts through these 3624 penny stocks with strong financials that pair smaller market caps with resilient balance sheets and improving fundamentals.

- Ride transformative technology trends by targeting innovators in intelligent automation and data analytics via these 25 AI penny stocks before the crowd fully wakes up.

- Lock in potential upside by focusing on companies trading below their intrinsic worth using these 914 undervalued stocks based on cash flows, giving your portfolio a margin of safety.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com