Is It Too Late To Consider TotalEnergies After Strong Five Year Share Price Gains?

- Wondering if TotalEnergies is still a smart buy at today’s price, or if most of the upside has already been captured? Let us break down what the current share price is really implying about its long term value.

- The stock has been relatively steady in the short term, up 0.4% over the last week and 0.7% over the past month, but it has quietly delivered a solid 3.9% year to date and 14.3% over the last year, on top of a 110.6% gain across five years.

- Recent share price resilience has come as TotalEnergies continues to pursue a balanced strategy between traditional hydrocarbons and growing low carbon investments, including further spending on LNG and renewables projects. At the same time, shifting energy market dynamics and ongoing debates around windfall taxes and regulation in Europe have kept risk perceptions in flux, which helps explain the more measured but positive move in the shares.

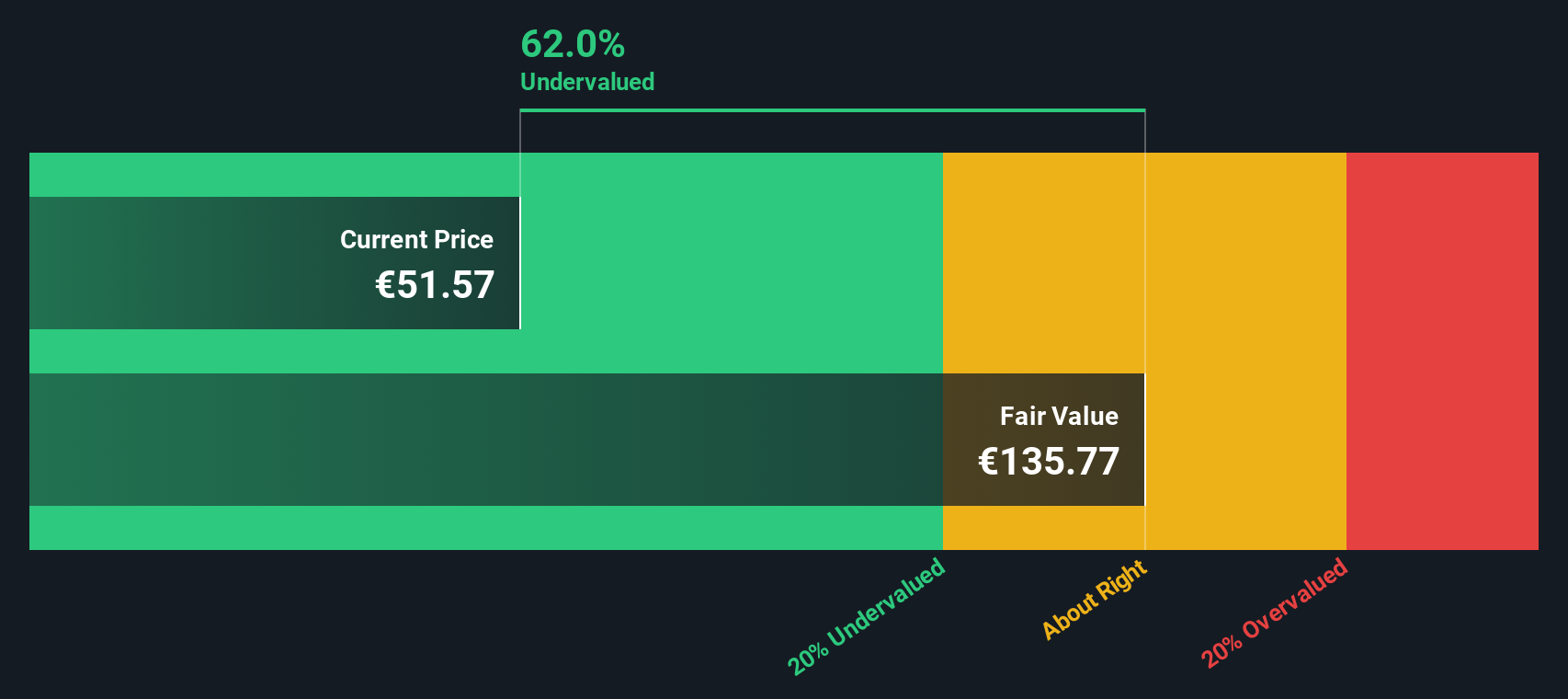

- Right now, TotalEnergies scores a 5/6 valuation check score, suggesting it screens as undervalued on most of our key metrics. You can see the detailed breakdown in our valuation summary. In the next sections we will examine the different valuation methods behind that score, and then finish by exploring an even more insightful way to think about what the market is really pricing in.

Approach 1: TotalEnergies Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company is worth by projecting the cash it can generate in the future and discounting those cash flows back to today’s value.

For TotalEnergies, the latest twelve month free cash flow is about $14.2 billion. Analysts provide detailed forecasts for the next few years, and beyond that Simply Wall St extends the trend, resulting in projected free cash flow of roughly $24.4 billion in ten years’ time. These future cash flows are then discounted using a required rate of return to reflect risk and the time value of money, based on a 2 Stage Free Cash Flow to Equity model.

On this basis, the estimated intrinsic value comes out at around €184.11 per share. The current market price is roughly 69.7% lower. That comparison suggests the shares are trading at a substantial discount to the cash flows the business is expected to generate.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests TotalEnergies is undervalued by 69.7%. Track this in your watchlist or portfolio, or discover 914 more undervalued stocks based on cash flows.

Approach 2: TotalEnergies Price vs Earnings

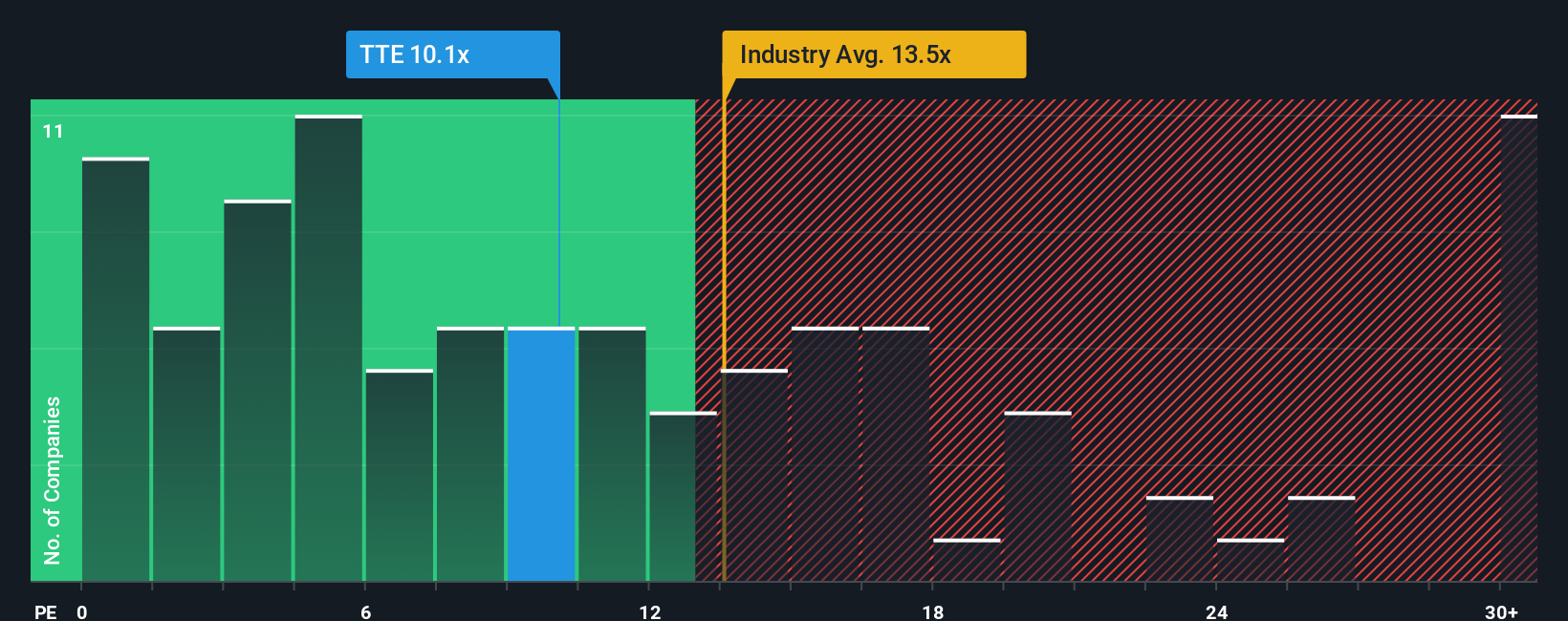

For a consistently profitable business like TotalEnergies, the price to earnings, or PE, ratio is a useful yardstick because it directly compares what investors pay today with the company’s current earnings power. In general, companies with stronger growth prospects and lower perceived risk tend to justify a higher, or more expensive, PE multiple, while slower growing or riskier firms should trade at lower multiples.

TotalEnergies currently trades on a PE of about 9.9x, which is below both the Oil and Gas industry average of roughly 13.2x and the broader peer group average near 22.6x. To go a step further, Simply Wall St calculates a proprietary “Fair Ratio” for each company. For TotalEnergies, this Fair PE Ratio is around 17.6x, reflecting its specific blend of earnings growth, profit margins, size, industry position and risk profile.

This tailored Fair Ratio is more informative than a simple comparison with peers or the industry, because it adjusts for the company’s own fundamentals rather than assuming all Oil and Gas stocks deserve the same multiple. Comparing the Fair Ratio of 17.6x with the current 9.9x suggests the market is pricing TotalEnergies at a meaningful discount to what its fundamentals would typically warrant.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1465 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your TotalEnergies Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple tool on Simply Wall St’s Community page that lets you connect your view of TotalEnergies’ story to a set of forecasts and a Fair Value. You can then compare that Fair Value to today’s price to consider whether to buy, hold, or sell, with the numbers updating dynamically as new news or earnings arrive. For example, one TotalEnergies Narrative might lean into expanding LNG and renewables, stronger margins and disciplined divestments to justify a Fair Value near the higher analyst target of about €77.6. A more cautious Narrative might focus on weaker oil prices, transition risks and geopolitical uncertainty to land closer to the lower end near €52.8. Both perspectives are valid as long as the story, forecast and valuation stay logically linked.

Do you think there's more to the story for TotalEnergies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com