Winnebago Industries, Inc.'s (NYSE:WGO) 34% Price Boost Is Out Of Tune With Revenues

Winnebago Industries, Inc. (NYSE:WGO) shareholders have had their patience rewarded with a 34% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 13% over that time.

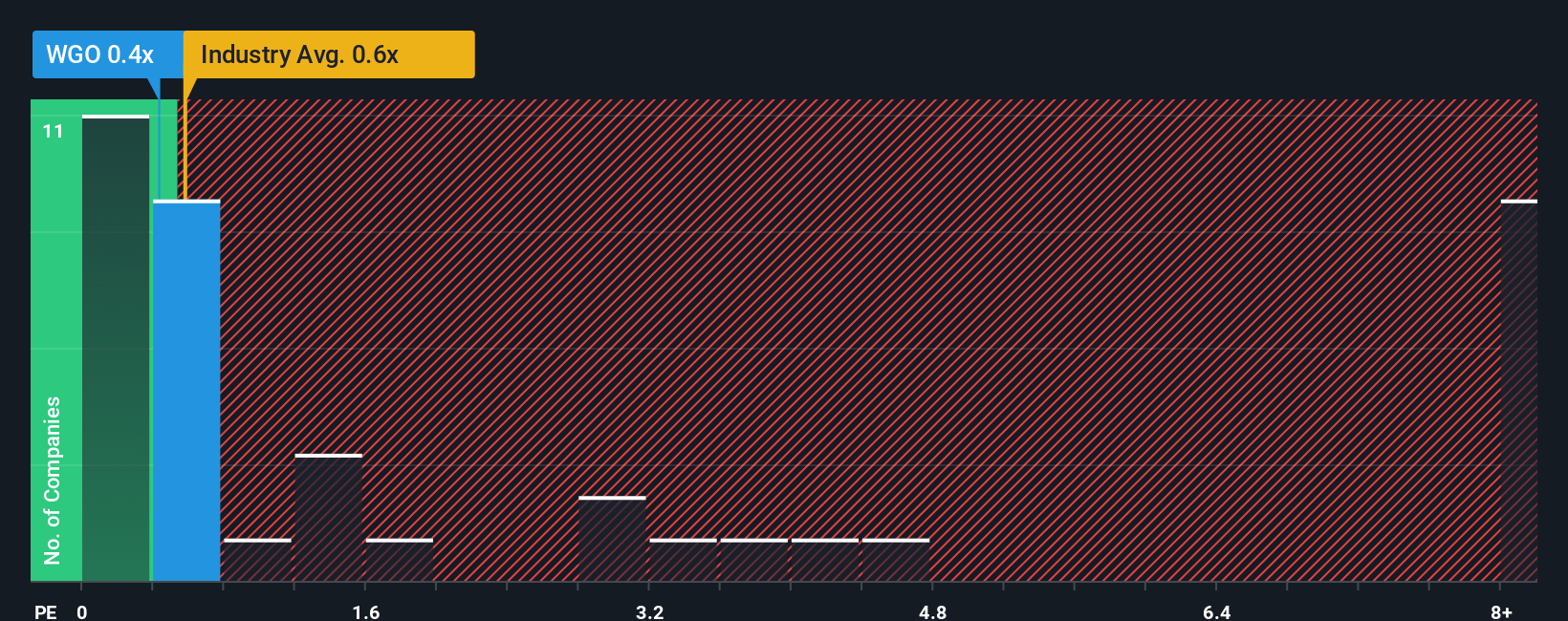

Although its price has surged higher, it's still not a stretch to say that Winnebago Industries' price-to-sales (or "P/S") ratio of 0.4x right now seems quite "middle-of-the-road" compared to the Auto industry in the United States, where the median P/S ratio is around 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Winnebago Industries

How Winnebago Industries Has Been Performing

Winnebago Industries' revenue growth of late has been pretty similar to most other companies. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. Those who are bullish on Winnebago Industries will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

Want the full picture on analyst estimates for the company? Then our free report on Winnebago Industries will help you uncover what's on the horizon.How Is Winnebago Industries' Revenue Growth Trending?

In order to justify its P/S ratio, Winnebago Industries would need to produce growth that's similar to the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with revenue down 40% overall from three years ago. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 5.2% each year over the next three years. With the industry predicted to deliver 16% growth each year, the company is positioned for a weaker revenue result.

In light of this, it's curious that Winnebago Industries' P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What Does Winnebago Industries' P/S Mean For Investors?

Winnebago Industries appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Given that Winnebago Industries' revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Winnebago Industries with six simple checks on some of these key factors.

If you're unsure about the strength of Winnebago Industries' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.