Assessing Artivion (AORT) Valuation After Analyst Upgrades and New On-X Valve Clinical Data

Artivion (AORT) climbed about 5% after positive analyst commentary related to its On-X mechanical heart valve, with new clinical studies indicating a potentially larger U.S. market and stronger demand among younger patients.

See our latest analysis for Artivion.

The latest enthusiasm around On-X comes on top of a strong run, with Artivion's share price up sharply this year and a three year total shareholder return of nearly 300 percent signaling sustained momentum rather than a one off spike.

If this kind of medical device story has your attention, it could be a good moment to explore other healthcare names using healthcare stocks as a starting point for fresh ideas.

But after such a sharp multi year run and a stock now trading close to fresh analyst targets, is Artivion still flying under the radar, or has the market already priced in the next leg of growth?

Most Popular Narrative Narrative: 10.0% Undervalued

With shares last closing at $46.55 against a narrative fair value of $51.71, the storyline points to meaningful upside if its growth path holds.

Expansion of On-X valve usage supported by new clinical data showing mortality benefits for younger patients and effective cross-selling from AMDS training sessions is enabling Artivion to capture increased market share globally, driving double-digit revenue growth and providing upside to profitability through higher volumes and ASPs.

Want to see what kind of growth and margin lift could justify that premium future earnings multiple? The projections behind this fair value may surprise you.

Result: Fair Value of $51.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained double digit growth is not guaranteed. Regulatory delays and hospital pricing pressure are both capable of quickly undermining bullish earnings and valuation assumptions.

Find out about the key risks to this Artivion narrative.

Another View on Valuation

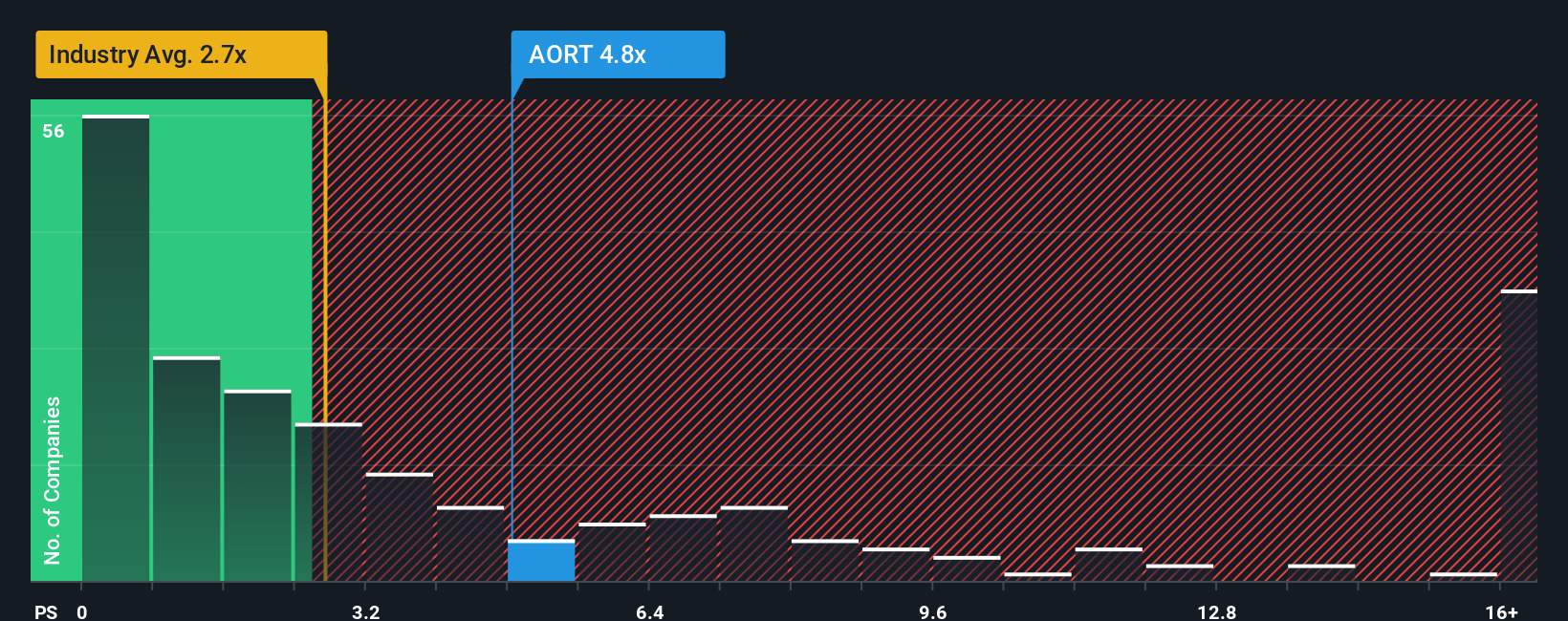

While the narrative framework suggests Artivion is 10 percent undervalued, a simple price to sales lens points the other way. At 5.2 times sales versus 3.1 times for the US medical equipment sector and a 2.7 times fair ratio, the stock screens clearly expensive. Which signal do you trust?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Artivion Narrative

If you want to dive into the numbers yourself and challenge this storyline, you can shape a fresh one in just minutes, Do it your way.

A great starting point for your Artivion research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for more investing angles?

Before markets move again, put your curiosity to work by scanning fresh opportunities on Simply Wall St's Screener, so promising ideas do not slip past you.

- Capture potential multi baggers early by targeting fast growing names among these 3624 penny stocks with strong financials with improving fundamentals and room to scale.

- Position yourself at the frontier of automation and data by tracking breakthrough innovators across these 25 AI penny stocks pushing real world AI adoption.

- Lock in quality at a discount by focusing on these 914 undervalued stocks based on cash flows where cash flow strength outpaces the current market price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com