Hayward (HAYW): Revisiting Valuation After Earnings Beat and Sector-Leading Guidance Upgrade

Stronger Earnings Spark Investor Interest

Hayward Holdings (HAYW) just posted earnings that cleared the bar on both organic revenue and EBITDA, then followed up with the biggest full year guidance raise in its peer group.

That combination of upside results and a confident outlook has nudged the stock up about 4% over the past month, prompting investors to revisit how this pool equipment maker is positioned heading into next year.

See our latest analysis for Hayward Holdings.

Zooming out, the roughly 7% 3 month share price return and modest 1 year total shareholder return of 3.6% suggest steady, not explosive, momentum as investors reassess Hayward's earnings power.

If Hayward's move has you rethinking cyclical names, this could be a good moment to explore auto manufacturers for other operationally sensitive businesses with potentially improving demand backdrops.

With revenue accelerating, guidance moving higher, and shares still trading below the average analyst target, the key question now is simple: Is Hayward quietly undervalued or already reflecting the next leg of growth?

Most Popular Narrative Narrative: 9.7% Undervalued

With Hayward Holdings last closing at $15.99 against a most popular narrative fair value near $17.71, the storyline suggests that upside may still be available.

Rising demand for energy efficient and eco friendly pool products, combined with an aging installed pool base in the US and Europe that requires modernization, creates a durable replacement cycle, supporting consistent aftermarket revenue and higher gross margins as product mix shifts to newer, premium solutions.

Want to see how steady demand, fatter margins, and a richer future earnings multiple all fit together into that valuation? The full narrative connects every dot.

Result: Fair Value of $17.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained repair-over-replacement trends and tougher competition on pricing could easily undercut the margin expansion story embedded in that valuation.

Find out about the key risks to this Hayward Holdings narrative.

Another Angle on Valuation

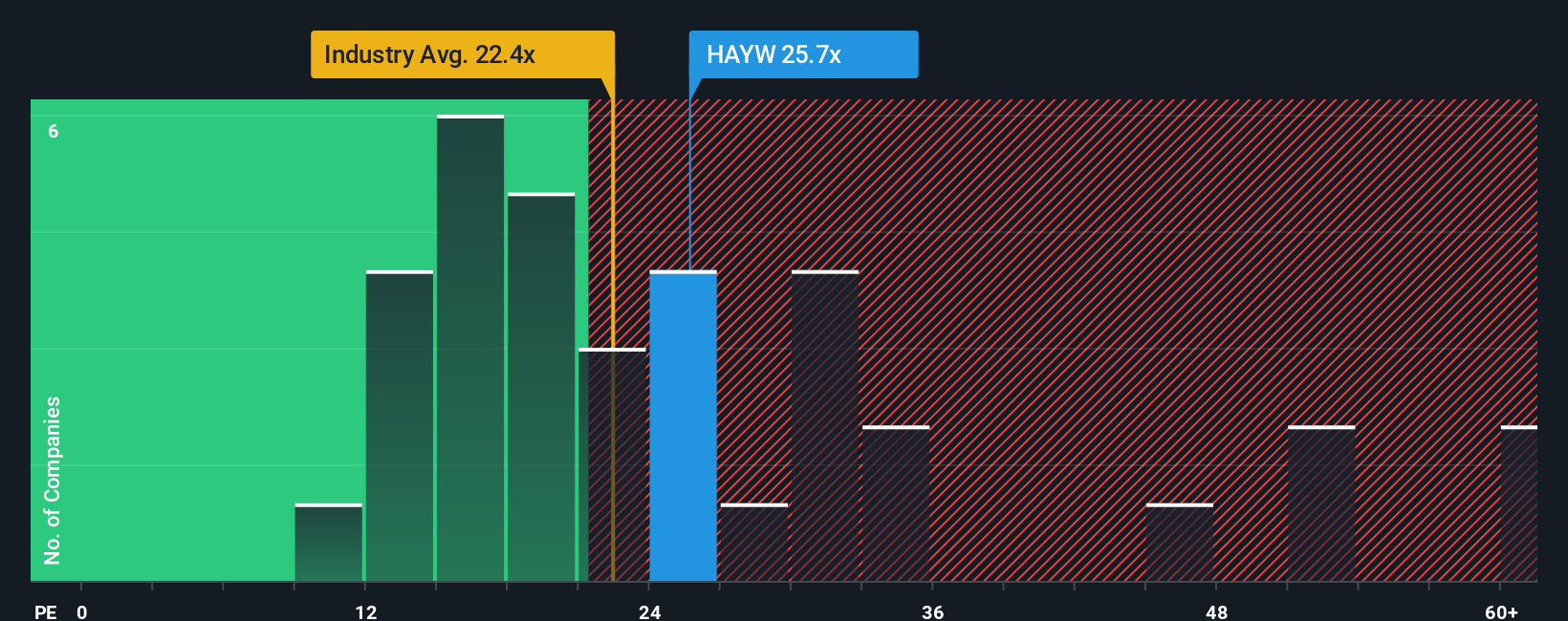

Look past the narrative fair value and Hayward starts to look less forgiving. At about 25.1 times earnings, it trades below peer averages near 29.1 times, but well above the US Building industry at 19.7 times and a fair ratio closer to 22.2 times. This hints at limited margin for error if growth cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hayward Holdings Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Hayward Holdings.

Looking for your next investing move?

Do not stop at one opportunity when Simply Wall St Screener can help you quickly spot fresh ideas that match your strategy before the market catches on.

- Strengthen your income game by scanning for reliable payers through these 13 dividend stocks with yields > 3% and keep cash flow working hard for you.

- Position yourself ahead of the next productivity boom by targeting innovators in these 25 AI penny stocks that are reshaping entire industries.

- Capitalize on market mispricing by zeroing in on quality companies trading below their potential using these 914 undervalued stocks based on cash flows before others react.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com