Simcere Pharmaceutical Group (SEHK:2096): Valuation Check After ENZESHU Insurance Inclusion and ENDOSTAR NRDL Renewal

Simcere Pharmaceutical Group (SEHK:2096) just secured national insurance coverage in China for its cancer therapy ENZESHU from January 2026, while its long-standing product ENDOSTAR won renewal under the National Reimbursement Drug List.

See our latest analysis for Simcere Pharmaceutical Group.

At HK$13.11, the stock has already delivered a powerful year to date share price return, and the roughly 97 percent one year total shareholder return suggests investors are steadily pricing in stronger growth prospects as ENZESHU and ENDOSTAR gain policy support.

If ENZESHU's insurance win has you rethinking the healthcare opportunity in China, this could be a good moment to explore other healthcare stocks that might benefit from similar structural tailwinds.

With earnings growing faster than revenue and the shares still trading at a discount to analyst targets and intrinsic value estimates, investors now face a key question: is Simcere undervalued, or is the market already pricing in future growth?

Price-to-Earnings of 35x: Is it justified?

On current numbers, Simcere trades at a price-to-earnings ratio of 35x, a level that implies the market is paying up for future growth beyond what is already reflected in the HK$13.11 share price.

The price-to-earnings multiple compares the company’s market value to its current earnings, a key yardstick for profitable drug makers where investors often pay premiums for scalable pipelines and policy supported therapies. At 35x earnings, buyers are effectively betting that Simcere’s profit base will keep compounding as ENZESHU, ENDOSTAR and other portfolio drugs deepen their reach.

That optimism stands in stark contrast to both the estimated fair price-to-earnings ratio of 24.9x and the Hong Kong pharmaceuticals industry average of 13.2x. This implies a rich valuation even after allowing for stronger growth. If sentiment cools or execution slips, the market could gravitate back toward that lower fair ratio level.

Explore the SWS fair ratio for Simcere Pharmaceutical Group

Result: Price-to-Earnings of 35x (OVERVALUED)

However, sustained multiple expansion is far from guaranteed, as competitive oncology pipelines and potential policy shifts in China could quickly challenge current growth assumptions.

Find out about the key risks to this Simcere Pharmaceutical Group narrative.

Another View: DCF Points the Other Way

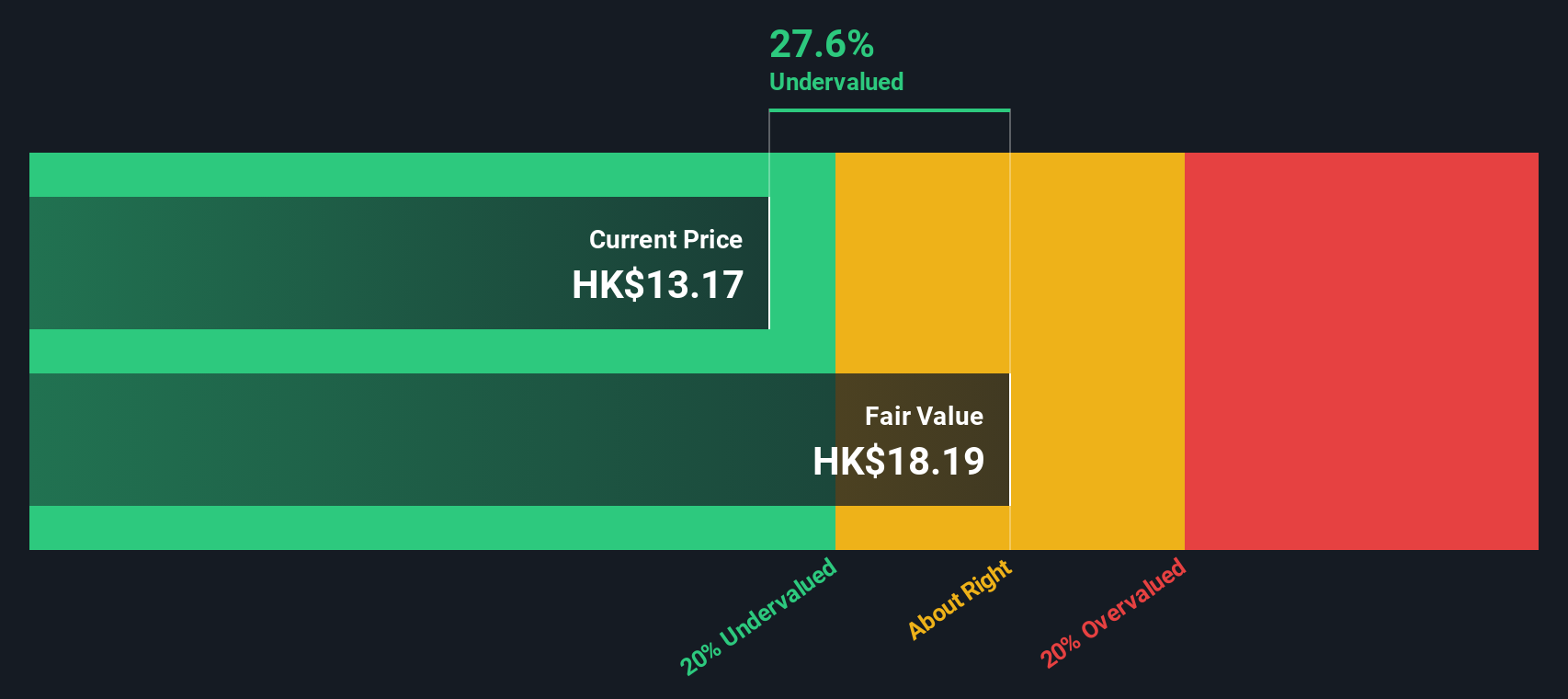

Our DCF model paints a very different picture, suggesting fair value around HK$18.32 versus the current HK$13.11 price. That implies the shares may be about 28 percent undervalued, which challenges the rich 35x earnings multiple. Which story should investors trust more: the market or the cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Simcere Pharmaceutical Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Simcere Pharmaceutical Group Narrative

If you see the numbers differently or want to dig into the details yourself, you can build a complete view in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Simcere Pharmaceutical Group.

Ready for more investing opportunities?

Before the market moves on without you, use the Simply Wall St Screener to uncover fresh ideas that match your strategy and turn research into action.

- Capture potential multi baggers early by scanning these 3625 penny stocks with strong financials with solid business foundations and room to scale.

- Position your portfolio at the frontier of technology by targeting these 25 AI penny stocks shaping the next wave of intelligent software and automation.

- Lock in quality at compelling prices by focusing on these 914 undervalued stocks based on cash flows where current cash flows suggest meaningful upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com