Cosel (TSE:6905) Returns to Q2 Profit, Testing Bullish Earnings Recovery Narrative

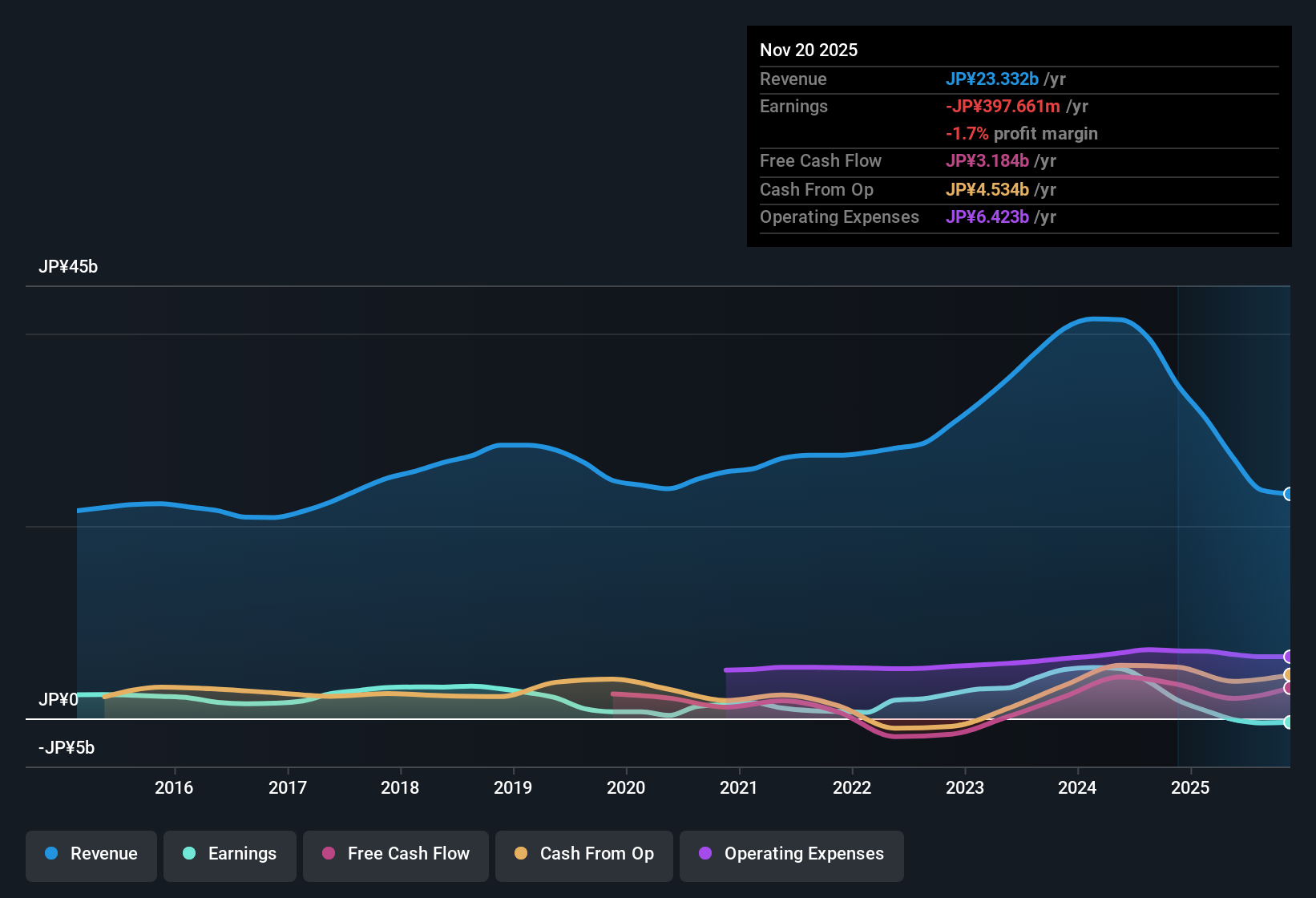

Cosel (TSE:6905) just posted Q2 2026 results with revenue of ¥6.1 billion and Basic EPS of ¥1.51, marking a clear break from the losses that have weighed on its trailing twelve month EPS of negative ¥9.67. The company has seen quarterly revenue oscillate between ¥5.1 billion and ¥6.4 billion over the past six periods, while EPS has swung from a high of ¥110.97 to negative territory, underscoring how volatile margins have been even as the top line holds in a relatively tight band.

See our full analysis for Cosel.With the latest numbers on the table, the next step is to line them up against the dominant narratives around Cosel's growth, risks, and path back to sustainable profitability.

Curious how numbers become stories that shape markets? Explore Community Narratives

Q2 swing back to ¥62 million profit

- Net income excluding extra items moved to ¥62 million in Q2 2026 after three straight loss making quarters, compared with a ¥68 million loss just one period ago.

- Bulls point to this shift as early evidence of the forecast earnings recovery, yet trailing twelve month net income is still a ¥397.661 million loss, so:

- Forecast earnings growth of about 74.94 percent per year and an expectation of profitability within three years need to be weighed against that negative twelve month base.

- The gradual 1.2 percent per year reduction in losses over five years fits the bullish story, but the recent run of negative quarters before Q2 shows the path is not smooth.

Revenue stuck near ¥24.0 billion while growth forecasts stay high

- On a trailing basis, revenue has eased from ¥39.456 billion in early 2025 to ¥23.332 billion by Q2 2026, even though forward looking estimates call for about 18 percent annual revenue growth, well above the broader Japan market’s 4.6 percent.

- Optimistic projections that above market growth will drive a sustained uptrend face a mixed backdrop because:

- Quarterly revenue has hovered in a relatively tight band between roughly ¥5.1 billion and ¥6.4 billion across the last six reported periods rather than showing a clear acceleration.

- The large drop in trailing revenue from over ¥30.0 billion in mid 2025 to the low ¥20.0 billion range contrasts with the high growth outlook and highlights how much improvement is being assumed.

Premium multiples and 5 percent dividend lean on future growth

- The stock trades around ¥1,100 with a price to sales ratio of 1.9 times, above both the Japan electrical industry at 1.0 times and peers at 1.4 times, while the DCF fair value is ¥1,112.44 and the dividend yield is about 5 percent but not covered by trailing earnings.

- Skeptics highlight that this valuation set up leans heavily on the bullish forecasts because:

- The company remains loss making on a twelve month view despite Q2’s profit, so the 5 percent dividend currently lacks earnings support even as the share price sits only slightly below DCF fair value.

- Paying a premium sales multiple to industry and peers looks demanding when trailing EPS is negative ¥9.67 and net income over the last year totals a ¥397.661 million loss.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Cosel's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite Q2's return to profit, Cosel still faces shrinking trailing revenue, inconsistent earnings and uncovered dividends that rely heavily on ambitious recovery forecasts.

If you want steadier performance instead of volatile margins and stop start profitability, use our stable growth stocks screener (2105 results) to quickly focus on businesses delivering reliably consistent growth now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com