China Science and Education (SEHK:1756) Margin Compression Reinforces Cautious Narratives Despite Revenue Growth

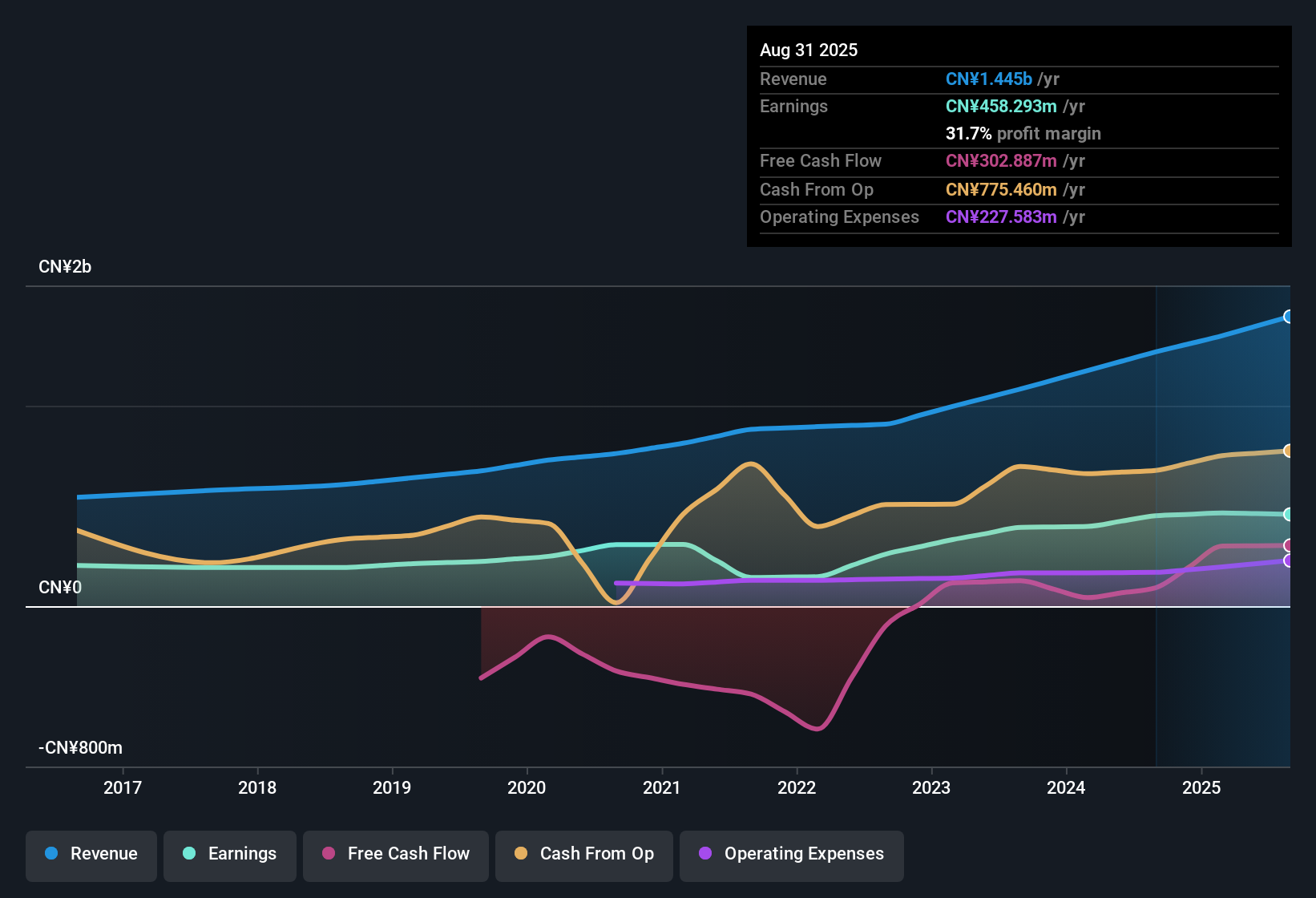

China Science and Education Industry Group (SEHK:1756) has just posted its FY 2025 second half results with revenue of CNY 724.6 million and EPS of CNY 0.19, while trailing twelve month revenue sits at CNY 1.45 billion and EPS at CNY 0.38, as earnings growth over the last year eased to 1.6% and net profit margin slipped from 35.6% to 31.7%. The company has seen revenue climb from CNY 628.4 million in 2H 2024 to CNY 724.6 million in 2H 2025 and TTM revenue move from CNY 1.27 billion to CNY 1.45 billion, setting up a story of solid top line progress but tighter margins that investors will weigh carefully as they interpret the latest earnings print.

See our full analysis for China Science and Education Industry Group.With the headline numbers on the table, the next step is to see how this mix of revenue growth, softer margins, and modest earnings gains lines up against the prevailing narratives investors have been using to frame China Science and Education Industry Group.

Curious how numbers become stories that shape markets? Explore Community Narratives

Five year EPS growth at 17.2% vs 1.6% this year

- On a trailing twelve month basis, earnings have grown 1.6% over the past year compared with 17.2% per year over the last five years, pointing to a clear gap between recent momentum and the longer term trend.

- Supporters of a bullish view see the 17.2% multi year earnings growth as the anchor for long run compounding. However, the latest 1.6% increase forces a check on how durable that pace really is

- Multi year EPS expansion is visible in the trailing twelve month EPS figure of CNY 0.38, which sits above the CNY 0.19 per half year prints now, but the step down from 17.2% to 1.6% growth suggests that near term contribution is more modest than the historical average.

- Investors weighing a bullish case will likely compare that slower 1.6% growth with the still solid TTM net income of CNY 458.3 million, asking whether past compounding can continue without a reacceleration in the headline growth rate.

Margins ease from 35.6% to 31.7%

- Trailing net profit margin has moved from 35.6% to 31.7% over the last twelve months, while TTM net income of CNY 458.3 million now sits on revenue of CNY 1.45 billion, so more of each sales yuan is being absorbed by costs than a year ago.

- Critics taking a more bearish stance focus on that 3.9 percentage point margin decline as a sign that profitability is under pressure even though revenue has grown

- The combination of higher trailing twelve month revenue, up from CNY 1.27 billion to CNY 1.45 billion, and lower margins at 31.7% undercuts a simple bear argument that demand is weakening, instead pointing their attention directly to cost structure and pricing.

- With net income excluding extra items at CNY 223.98 million in 2H 2025 versus CNY 231.18 million in 2H 2024 even as that half year revenue rose from CNY 628.4 million to CNY 724.6 million, bears can argue that incremental sales are currently generating less profit than before.

P/E at 1.6x and 53.8% below DCF fair value

- The shares trade on a trailing P/E of 1.6 times earnings compared with 6.2 times for peers and 7.5 times for the wider Hong Kong consumer services group, and also sit around HK$0.66 versus a DCF fair value of about HK$1.43, which implies a discount of roughly 53.8% to that valuation model.

- What stands out for a bullish minded investor is how this low multiple and 53.8% gap to DCF fair value sit alongside the company’s record of 17.2% annual earnings growth over five years

- The 1.6 times P/E is backed by trailing twelve month net income of CNY 458.3 million and EPS of CNY 0.38, so the market is paying a relatively small price for each unit of profit compared with peers on 6.2 times earnings.

- Even after factoring in the slower 1.6% earnings growth and margin move from 35.6% to 31.7%, the contrast between HK$0.66 and the HK$1.43 DCF fair value gives bulls a concrete valuation gap they can point to as potential upside if operations stabilize.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on China Science and Education Industry Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

China Science and Education Industry Group’s slower earnings growth and easing margins highlight pressure on profitability even as revenue continues to rise.

If this decelerating profit profile makes you cautious, use our stable growth stocks screener (2105 results) to quickly focus on companies delivering steadier earnings expansion and more predictable performance through different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com