Assessing ASML After a 30% Rally and Conflicting Cash Flow and Earnings Signals

- If you are wondering whether ASML Holding is still worth buying after its huge run, or if you have missed the boat on this chip equipment giant, you are in the right place to unpack what the current price is really telling us.

- Despite a recent dip of 2.6% over the last week, ASML is still up 1.7% over the past month, 30.7% year to date, and 32.7% over the last year, which keeps expectations and risk perceptions running high.

- Those moves are happening against a backdrop of ongoing demand for cutting edge lithography tools as chipmakers work to expand capacity for AI data centers and advanced nodes. This sits alongside continuing geopolitical scrutiny of export controls to China and other regions that could reshape where ASML's future sales come from. At the same time, long term themes such as AI, high performance computing, and automotive chips continue to support a broader narrative that ASML plays a central role in a multi year semiconductor build out.

- On our fundamentals based framework, ASML currently scores 3 out of 6 on our valuation checks, giving it a middle of the road valuation score. In the rest of this article we will walk through what different valuation approaches suggest about that price, before finishing with a more intuitive way to think about what ASML might really be worth.

Approach 1: ASML Holding Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and discounting them back to today, to reflect risk and the time value of money.

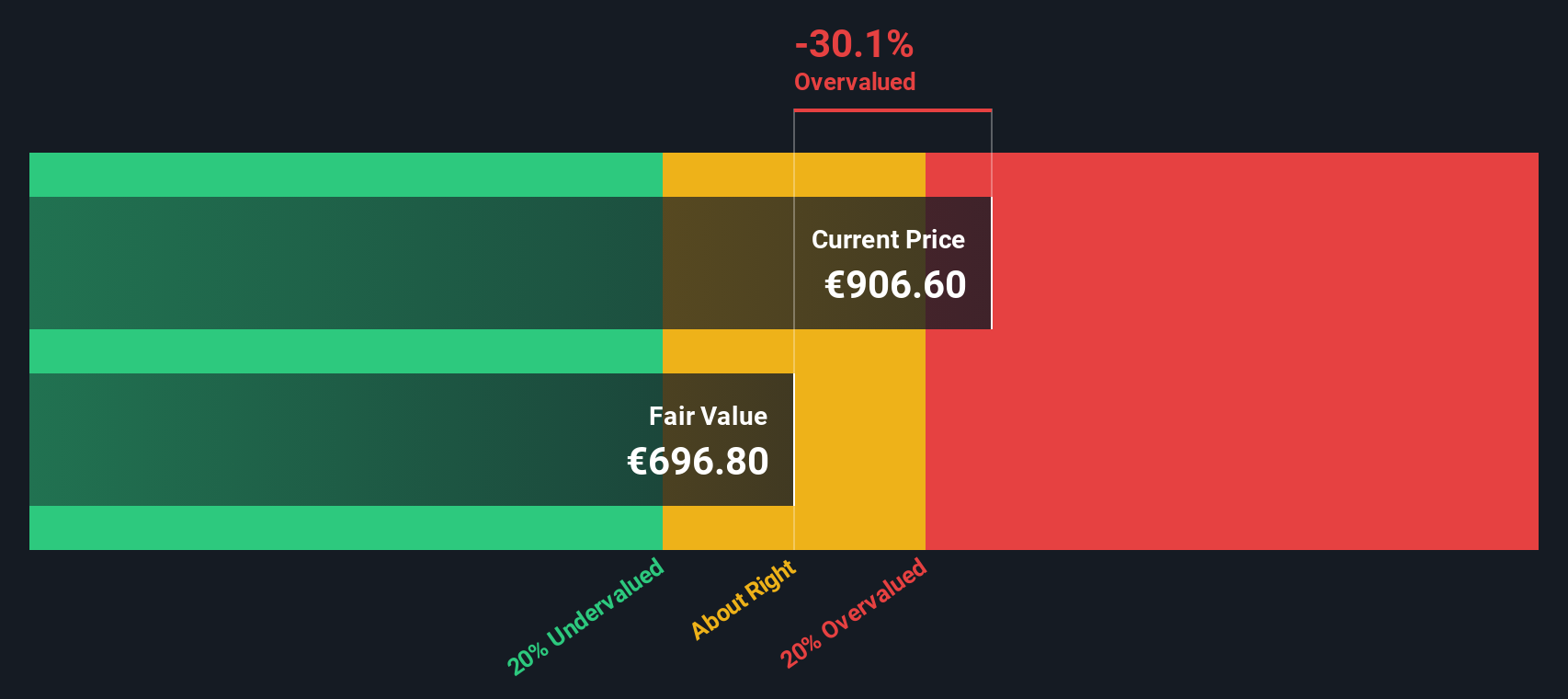

For ASML Holding, the model starts with last twelve month free cash flow of about €8.6 billion and uses analyst forecasts for the next few years, then extrapolates further out. Under this 2 stage Free Cash Flow to Equity approach, free cash flow is projected to rise to roughly €23.0 billion by 2035, based on expectations that demand for advanced lithography tools will build.

When all of those projected cash flows are discounted back and summed, the model arrives at an intrinsic value of around €698 per share. Compared with the current market price, this implies ASML is about 29.2% overvalued on a cash flow basis, which indicates that investors are paying a premium for its growth story.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests ASML Holding may be overvalued by 29.2%. Discover 913 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: ASML Holding Price vs Earnings

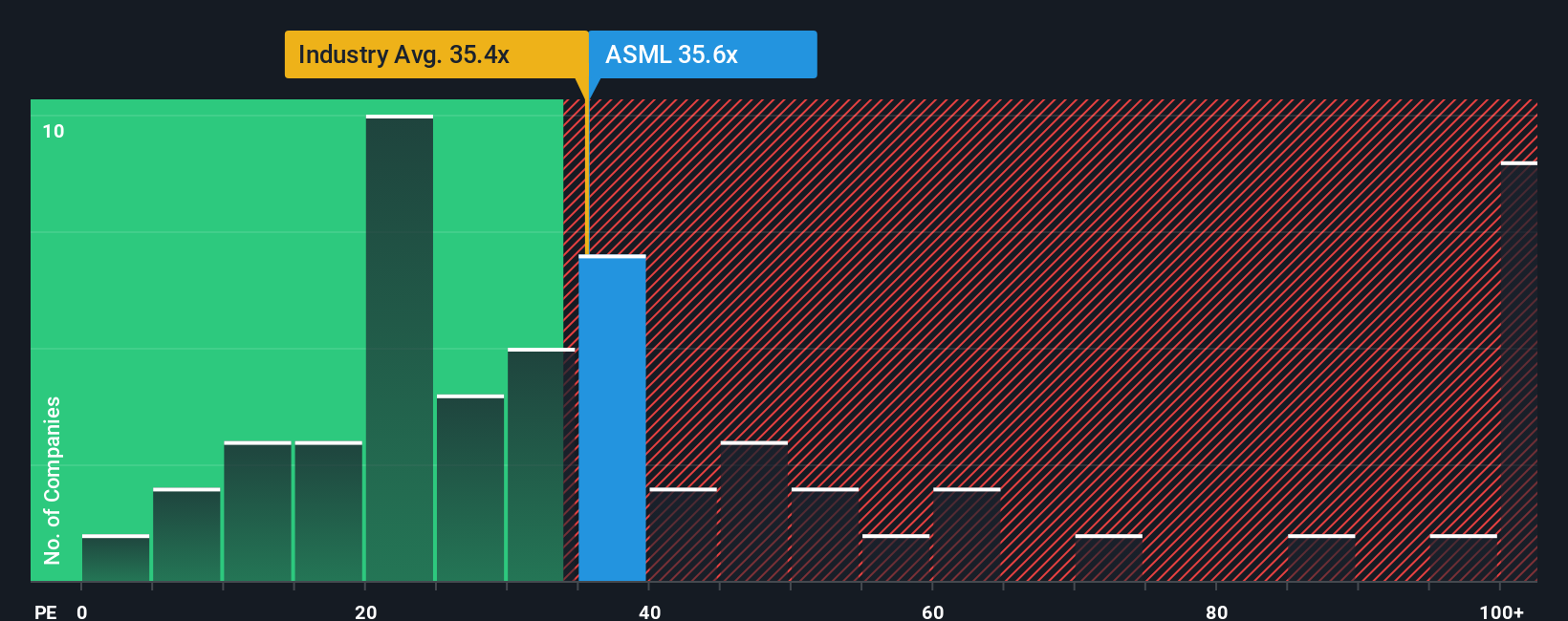

For profitable, established businesses like ASML, the price to earnings ratio is often the clearest shorthand for how much investors are willing to pay for each unit of current profit. It conveniently blends expectations about future growth and perceived risk into a single number that can be compared across time and against other companies.

In general, faster, more resilient growers deserve a higher, or premium, PE ratio, while slower, riskier firms usually trade on lower multiples. ASML currently trades around 36.9x earnings, which is above the broader Semiconductor industry average of about 34.9x but below the 41.4x average of its closest high quality peers. That already signals investors see it as a premium name, but not the most aggressively priced in its group.

Simply Wall St's Fair Ratio framework goes a step further by estimating what multiple ASML should trade on, given its specific earnings growth outlook, margins, risk profile, industry and size. For ASML, that Fair Ratio comes out to roughly 42.9x, meaning the stock trades materially below where this framework suggests it could reasonably sit. On this lens, ASML screens as undervalued relative to its fundamentals rather than expensive.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ASML Holding Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of ASML Holding’s story with the numbers behind its future revenue, earnings, margins and fair value. A Narrative is your personal investment storyline, where you spell out what you think will happen to the business, translate that into a financial forecast, and then into a fair value that can be compared directly with today’s share price to decide whether ASML looks like a buy, hold or sell. Narratives are available inside Simply Wall St’s Community page, where millions of investors can quickly build and follow them, and they update dynamically as new information like news, earnings or guidance arrives. For example, one ASML Narrative on the platform might see the company as a long term AI infrastructure winner with a fair value near €1,000, while another, more cautious view could anchor closer to €500, and those two perspectives will lead to very different decisions when set against the current market price.

For ASML Holding however we will make it really easy for you with previews of two leading ASML Holding Narratives:

Fair value: €1,000.00

Implied undervaluation vs last close: -10.3%

Forecast revenue growth: 17.26%

- Sees ASML as a long term compounder thanks to its monopoly position in EUV lithography, supplying mission critical tools to leading chipmakers like TSMC, Intel and Samsung.

- Highlights strong Q2 2025 execution, including robust margins, healthy bookings, recurring Installed Base Management revenue and ongoing cash returns via buybacks and dividends.

- Views the post earnings share price pullback and cautious near term outlook as a potential opportunity, arguing that secular AI and advanced node demand outweigh cyclical and geopolitical risks.

Fair value: €864.91

Implied overvaluation vs last close: 4.3%

Forecast revenue growth: 9.65%

- Emphasizes that while ASML holds a powerful technological and quasi monopolistic position in EUV tools, this success increases the risk of eventual disruption and political pressure.

- Flags export controls and China’s drive for semiconductor self sufficiency as key strategic threats, even if demand from the US and Europe can partially offset a potential decline in Chinese sales.

- Argues that, given geopolitical, concentration and execution risks, investors may wish to be cautious about paying a premium multiple when the current share price already sits above this narrative’s fair value estimate.

Do you think there's more to the story for ASML Holding? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com