Is Tilray a Value Opportunity After Recent Product Expansion and Share Price Rebound?

- If you have been wondering whether Tilray Brands is a beaten down opportunity or a value trap, you are not alone. This article is going to unpack that question head on.

- The stock is still down about 11.4% over the last year and 23.6% year to date, but a 16.0% gain over the past month, despite an 8.1% dip in the last week, suggests sentiment may be starting to shift.

- Recent headlines have focused on Tilray expanding its product portfolio and deepening its presence in key cannabis and beverage markets, moves that investors often interpret as positioning for long term growth. At the same time, regulatory developments around cannabis in North America continue to sway expectations about how quickly that growth could actually materialize, which helps explain the stock's choppy trading.

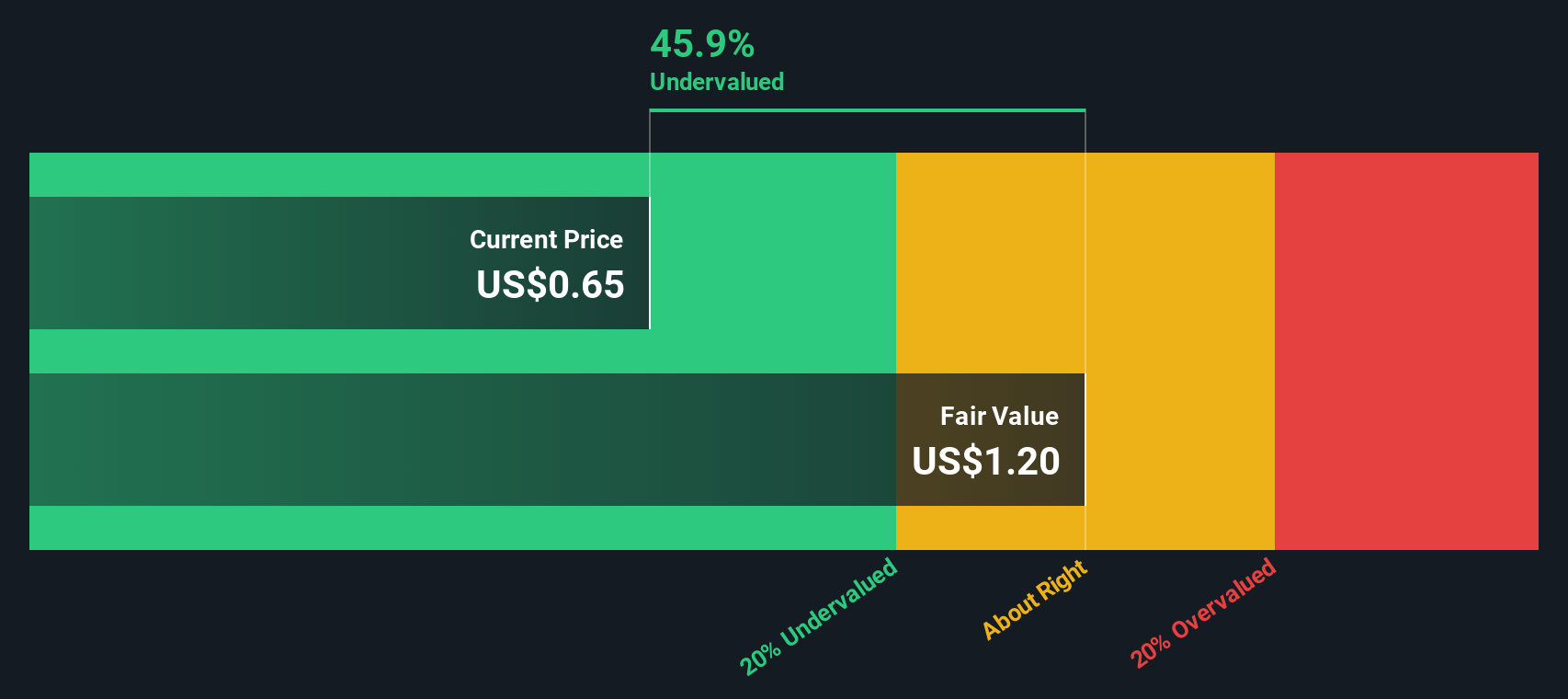

- On our valuation framework Tilray scores a 3 out of 6 for being undervalued. This hints that parts of the business might be mispriced while others look more fully valued. Next we will break that down across different valuation approaches before finishing with an even more intuitive way to think about what the stock is really worth.

Find out why Tilray Brands's -11.4% return over the last year is lagging behind its peers.

Approach 1: Tilray Brands Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow model estimates what a business is worth by projecting its future cash flows and discounting them back to today, using a required rate of return. For Tilray Brands, the model starts with last twelve months Free Cash Flow of roughly $93 million in the red, indicating the company is still burning cash as it scales.

Analysts and internal estimates see that shifting into positive territory over time, with projected Free Cash Flow rising to about $43 million by 2030. Between 2026 and 2035, annual FCF is expected to climb steadily as the cannabis and beverage operations mature. Simply Wall St extrapolates beyond the first few analyst covered years to complete the picture.

When those projected cash flows are discounted back to today, the DCF model arrives at an intrinsic value of about $10.97 per share. That is roughly 1.8% above the current share price, implying Tilray is trading very close to what its cash flows justify right now.

Result: ABOUT RIGHT

Tilray Brands is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

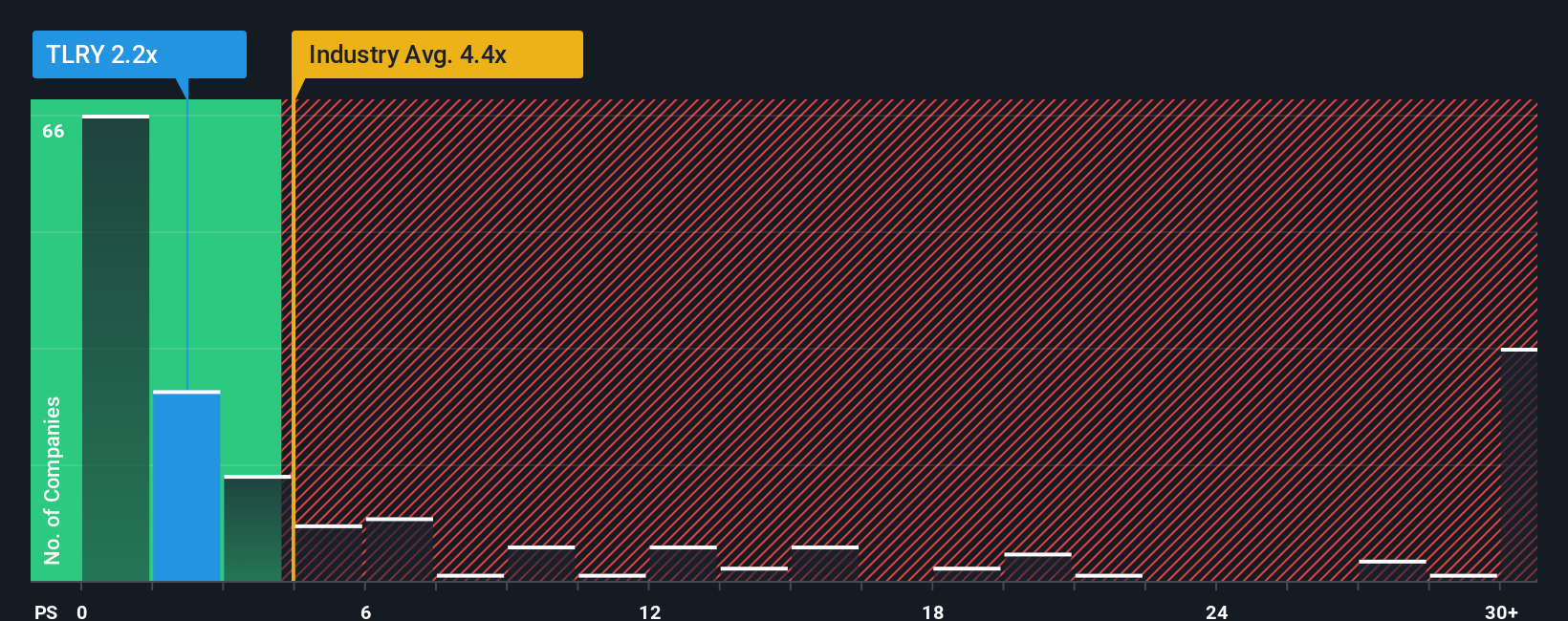

Approach 2: Tilray Brands Price vs Sales

For companies like Tilray Brands that are still working toward consistent profitability, the Price to Sales ratio is often a more useful yardstick than earnings based metrics, because it focuses on the scale of revenue the market is paying for rather than volatile or negative earnings.

In general, higher growth expectations and lower perceived risk justify a higher normal multiple, while slower growth or greater uncertainty should translate into a lower one. Tilray currently trades on a Price to Sales ratio of about 1.55x, which is well below both the pharmaceuticals industry average of roughly 4.33x and a broader peer group that sits around 11.83x.

Simply Wall St also uses a proprietary Fair Ratio to estimate what multiple might be appropriate for Tilray once its growth outlook, profitability profile, industry, market cap and key risks are all factored in. This is more tailored than a straight peer comparison, which can be distorted by outliers or companies at very different stages of maturity. Tilray’s Fair Ratio is estimated at around 2.38x, meaning the stock trades at a noticeable discount to what this framework suggests is reasonable.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Tilray Brands Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simple stories you build around a company that connect your view of its future revenue, earnings and margins to a financial forecast and a fair value estimate. On Simply Wall St’s Community page, Narratives let you frame Tilray Brands in your own words, then automatically translate that story into numbers so you can compare your Fair Value to the current share price and decide whether it looks like a buy, hold or sell. Because Narratives are dynamic, they update as new news, earnings or regulatory changes come through so your view is never frozen in time. For Tilray, one investor’s bullish Narrative might lean on international medical expansion, category diversification and operational efficiencies to justify a Fair Value closer to about $16 per share. A more cautious investor, focused on regulatory delays, price compression and ongoing losses, might anchor on analyst targets nearer $0.60 to $1.50, and Narratives make these differing perspectives visible, comparable and actionable.

Do you think there's more to the story for Tilray Brands? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com