United Community Banks (UCB): Is the Recent Share Price Recovery Supported by Its Valuation?

United Community Banks (UCB) has been quietly grinding higher, with the stock up about 8% over the past month and roughly 5% over the past year. This hints at improving sentiment around its fundamentals.

See our latest analysis for United Community Banks.

Zooming out, that solid 1 month share price return of just over 8 percent has helped the stock claw back ground, even as the latest 1 day move was slightly negative. The 1 year total shareholder return of around 5 percent points to steady but not explosive momentum.

With a regional bank like United Community Banks regaining its footing, it can also be worth scanning the sector for other names quietly strengthening their balance sheets and earnings profiles through solid balance sheet and fundamentals stocks screener (None results).

With revenue and earnings both growing at a healthy clip, and the shares still trading at a meaningful discount to analysts’ price targets and some intrinsic value estimates, is UCB now a genuine value opportunity, or is the market already discounting brighter days ahead?

Most Popular Narrative: 7.6% Undervalued

Compared with United Community Banks' last close at $32.26, the most followed narrative points to a modestly higher fair value anchored in steady compounding.

To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Given the current share price of $32.61, the analyst price target of $34.92 is 6.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

Want to see what justifies this higher fair value? The narrative leans on accelerating revenue, fatter margins, and a future profit multiple that might surprise bank investors.

Result: Fair Value of $34.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heightened competition for deposits and any deterioration in commercial real estate credit quality could quickly challenge the current undervaluation thesis.

Find out about the key risks to this United Community Banks narrative.

Another View: Earnings Multiple Sends a Mixed Signal

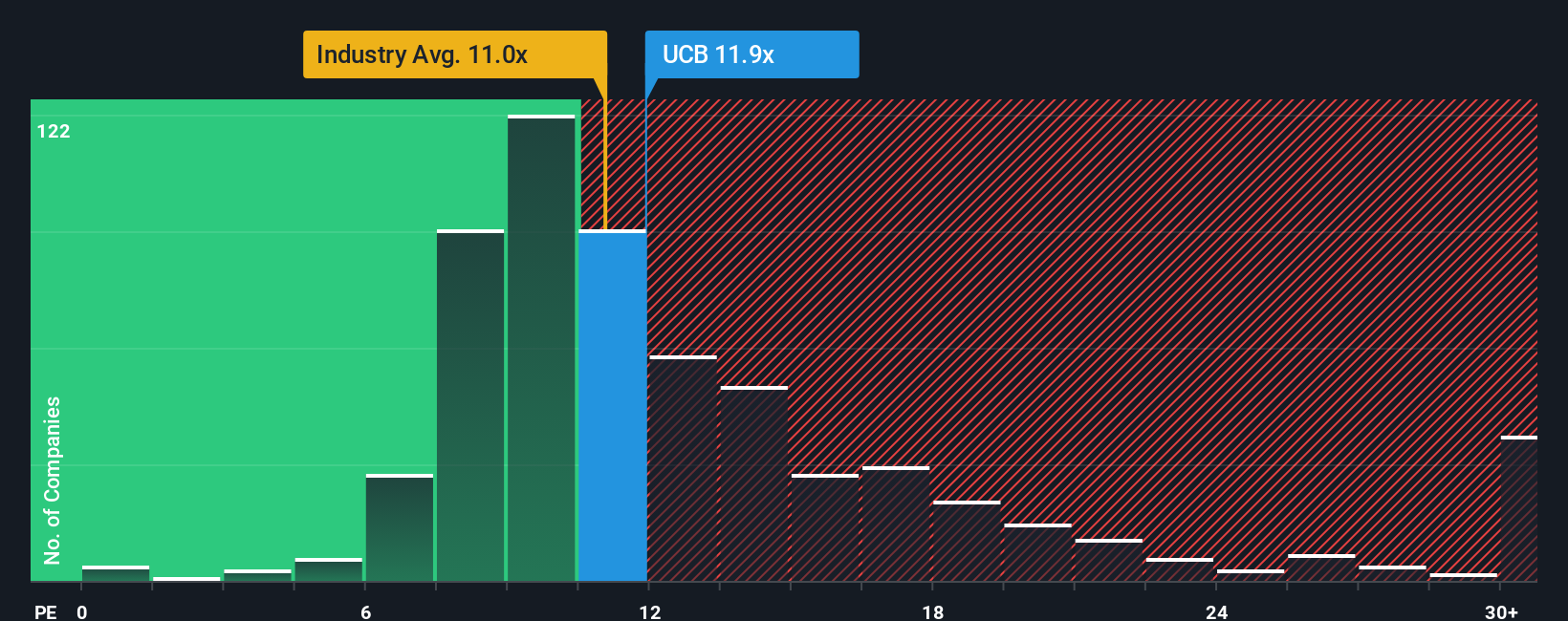

Step away from the narrative fair value and UCB looks less of a clear bargain. Its price to earnings ratio sits at 12.8 times, slightly above the US banks industry at 12 times and just above its own fair ratio of 12.3 times, hinting at limited margin of safety if growth cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own United Community Banks Narrative

If you are skeptical of this interpretation or prefer hands on research, you can assemble a personalized view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding United Community Banks.

Looking for more investment ideas you do not want to miss?

Before you move on, consider scanning fresh opportunities on Simply Wall St's powerful screener, where data backed ideas surface in minutes.

- Amplify your potential upside by targeting mispriced opportunities through these 913 undervalued stocks based on cash flows grounded in cash flow strength and solid fundamentals.

- Explore innovation by focusing on companies working on automation and intelligence via these 24 AI penny stocks.

- Strengthen your income stream by focusing on reliable payers using these 13 dividend stocks with yields > 3% with yields above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com