Ross Stores (ROST): Has the Recent Share Price Climb Left the Stock Fairly Valued?

Ross Stores (ROST) has quietly climbed over the past month, gaining about 14% and roughly 25% in the past 3 months. That kind of steady strength usually signals investors are reassessing the retailer’s earnings power.

See our latest analysis for Ross Stores.

Zooming out, that recent 1 month share price return of almost 14% is part of a broader uptrend. The year to date share price return and 1 year total shareholder return are both comfortably positive, suggesting momentum is still building as investors warm to its growth profile and risk balance.

If Ross Stores strong run has you thinking about what else might be gaining traction, now is a good time to explore fast growing stocks with high insider ownership.

Yet with the share price now hovering just below analyst targets and our model suggesting it trades at a premium to intrinsic value, investors may be asking whether Ross Stores remains a buyable compounder or whether the market is already baking in years of growth.

Most Popular Narrative Narrative: 1% Undervalued

With Ross Stores last closing at $182.41 against a narrative fair value of about $183, the story hinges on steady growth and richer future earnings power.

Investments in supply chain infrastructure and operational initiatives (e.g., new distribution center, store refreshes, rollout of self checkout) are establishing a foundation for greater operating leverage and cost discipline, which should benefit net margins as these investments scale. Over time, expected price equilibrium across the sector will enable improvement in merchandise margin and earnings.

Want to see what kind of revenue runway, stable margins, and elevated earnings multiple are being baked into that near at market fair value? The underlying projections may surprise you.

Result: Fair Value of $183.41 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this narrative could unravel if tariffs and distribution costs keep squeezing margins, or if aggressive store expansion leads to cannibalization and weaker same store growth.

Find out about the key risks to this Ross Stores narrative.

Another Way To Look At Value

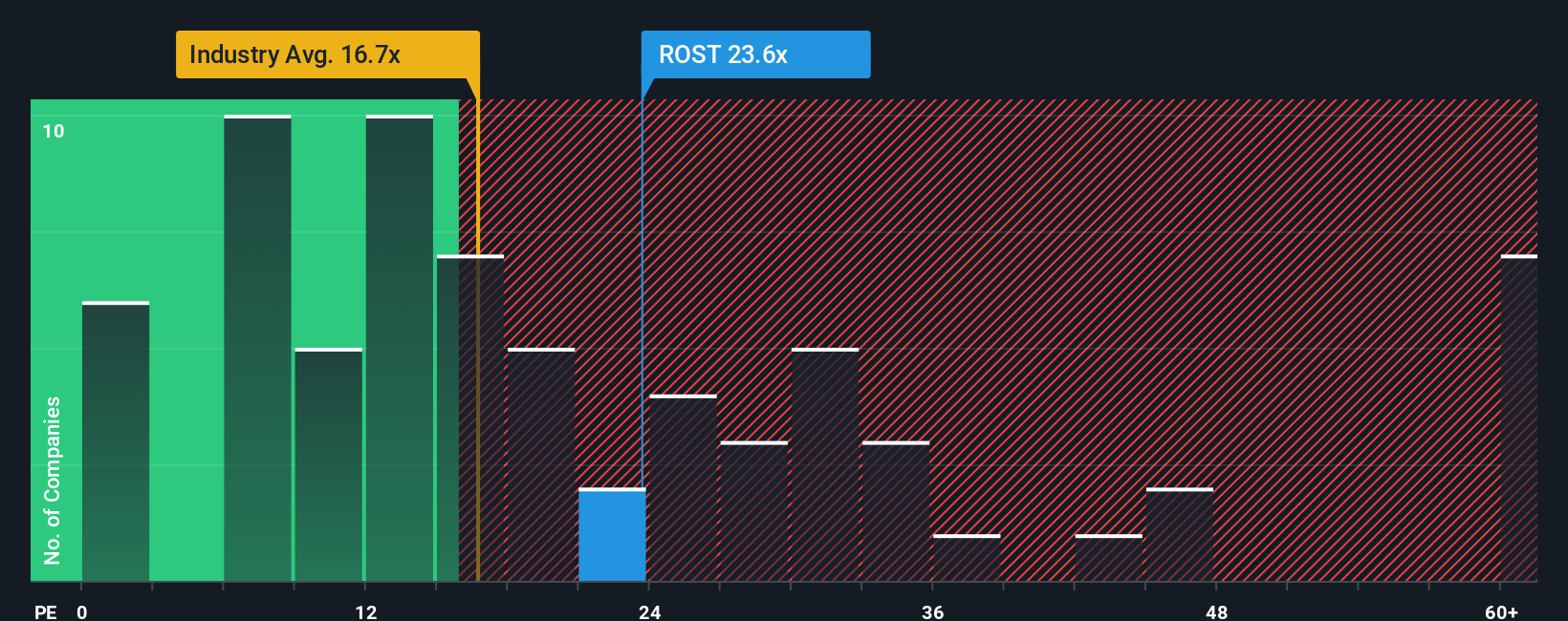

Our valuation using earnings multiples paints a tougher picture. Ross trades on a 28.3x P/E, well above the US Specialty Retail average of 21.1x, peers at 22.9x, and a 19.5x fair ratio that the market could drift toward, raising the risk of multiple compression.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ross Stores Narrative

If you see the numbers differently or would rather rely on your own deep dive, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Ross Stores research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop at Ross. Broaden your watchlist now with targeted stock ideas from the Simply Wall St Screener so you are not chasing yesterday’s winners.

- Capture overlooked value by screening companies trading below their cash flow potential through these 913 undervalued stocks based on cash flows. These could re rate as sentiment shifts.

- Ride structural growth in machine learning and automation by zeroing in on these 24 AI penny stocks that are positioned to benefit from rising enterprise and consumer adoption.

- Strengthen your income stream by pinpointing reliable payers using these 13 dividend stocks with yields > 3%, focusing on those that can support attractive yields without stretching their balance sheets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com