Humana (HUM) Valuation Check as New Amazon-Linked Leader Prepares to Reshape Medicare Advantage

Humana (HUM) just outlined a multi year leadership handoff in its core insurance arm, as long time Insurance Segment President George Renaudin prepares to retire and Amazon veteran Aaron Martin steps in to reshape Medicare Advantage.

See our latest analysis for Humana.

The leadership shake up lands as Humana’s share price has climbed about 13 percent over the past month to 259.40 dollars, even though its three year total shareholder return remains deeply negative. This suggests investors are cautiously warming to the turnaround story rather than fully convinced yet.

If this kind of leadership reset has you rethinking your healthcare exposure, it might be worth exploring other managed care and services names through healthcare stocks to spot fresh ideas.

With earnings rebounding, modest growth, and the stock still trading at a double digit discount to analyst targets and some estimates of intrinsic value, is Humana quietly undervalued, or is the market already pricing in a full recovery?

Most Popular Narrative Narrative: 10.1% Undervalued

Humana's most followed narrative pegs fair value around 288 dollars, a modest premium to the 259.40 dollar last close that implies room for upside.

The analysts have a consensus price target of $298.955 for Humana based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $353.0, and the most bearish reporting a price target of just $250.0.

Curious what kind of revenue climb, margin rebuild, and future earnings multiple would have to align to justify this valuation gap? The blueprint might surprise you.

Result: Fair Value of $288.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering uncertainty around Medicare Advantage star ratings and regulatory shifts could derail margin recovery and challenge the case for sustained undervaluation.

Find out about the key risks to this Humana narrative.

Another Lens on Value

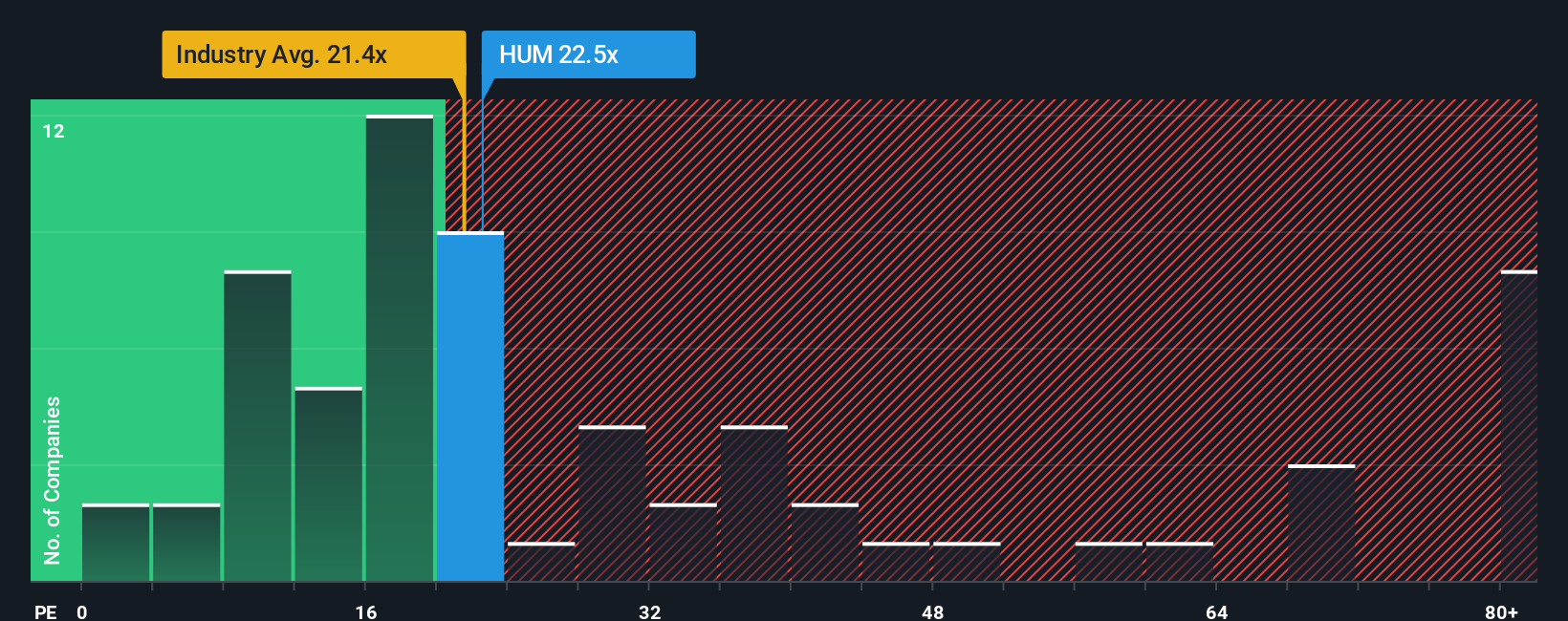

While narratives and fair value models suggest upside, a simple earnings yardstick tells a cooler story. Humana trades on a price to earnings ratio of about 24 times, slightly richer than both peers at roughly 21 times and a fair ratio nearer 41 times. This raises the question of how much near term mispricing really exists.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Humana Narrative

If you would rather weigh the numbers yourself and shape a different storyline, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Humana research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Use the Simply Wall Street Screener to uncover fresh, data backed opportunities and reduce the risk of missing stocks that may be quietly setting up for outperformance.

- Identify potential multibaggers early by scanning these 3625 penny stocks with strong financials that already show stronger balance sheets and earnings power than many speculative names.

- Place your portfolio at the center of an innovation trend by reviewing these 24 AI penny stocks that combine cutting edge technology with real revenue momentum.

- Pursue more attractive entry points by targeting these 913 undervalued stocks based on cash flows where market pessimism has pushed prices below what their cash flows may justify.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com