Is Coinbase Still Attractive After a 590% Three Year Surge and Recent Pullback?

- If you are wondering whether Coinbase Global at around $245 a share is still a smart way to get exposure to the crypto ecosystem, or if most of the upside is already priced in, this article will walk you through the real valuation story behind the ticker.

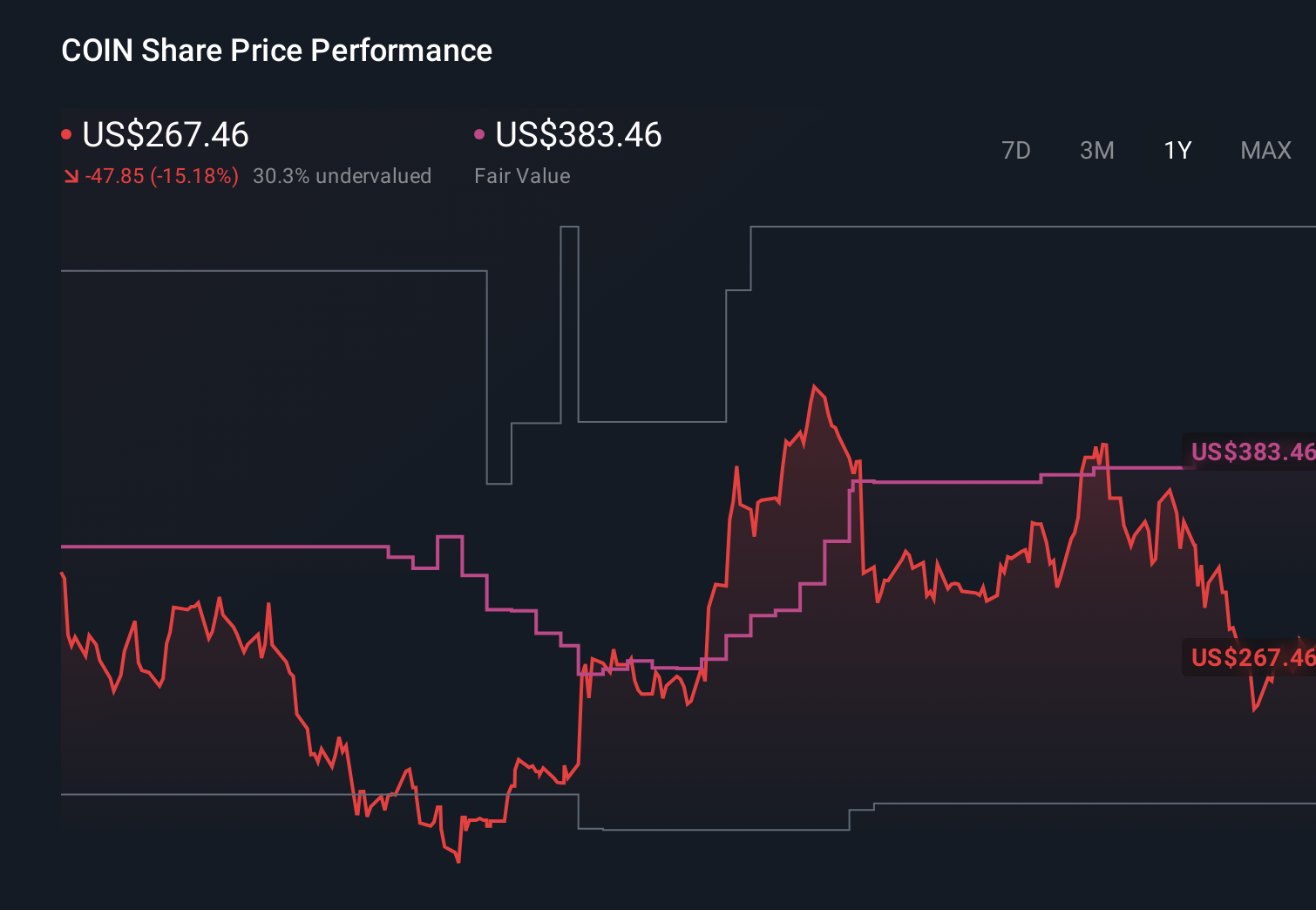

- Despite a rough recent patch, with the stock down 8.4% over the last week, 4.7% over the past month, and 12.1% over the past year, Coinbase is still up an eye-catching 590.7% over three years, which keeps growth-minded investors watching closely.

- Much of the volatility has been driven by shifting sentiment around crypto adoption and regulation, ranging from headline-grabbing discussions about US regulatory clarity for digital assets to renewed institutional interest in crypto infrastructure. At the same time, Coinbase has been expanding its role as a key on-ramp and infrastructure provider for both retail traders and large institutions, which helps explain why the market keeps repricing its future potential.

- On our framework, Coinbase scores a 3/6 on valuation checks, meaning it screens as undervalued on half of the metrics we track. You can dig into this in more detail via our valuation score. Next, we will break down those traditional valuation methods before ending with a more holistic way to think about what the market might really be willing to pay for this business.

Find out why Coinbase Global's -12.1% return over the last year is lagging behind its peers.

Approach 1: Coinbase Global Excess Returns Analysis

The Excess Returns model looks at how much profit a company can generate above the return that shareholders demand, then capitalizes those extra earnings into an intrinsic value per share.

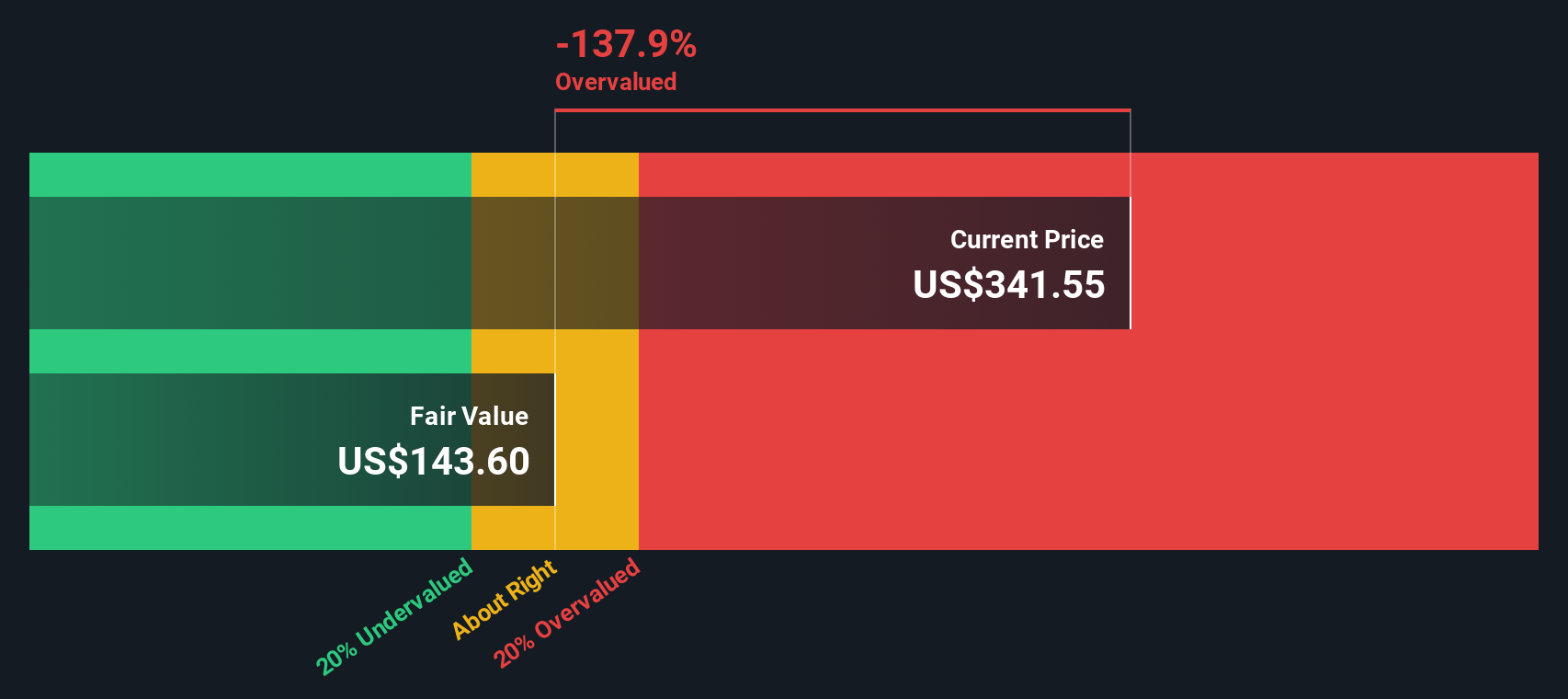

For Coinbase Global, the model starts with a Book Value of $59.62 per share and a Stable EPS of $8.21 per share, based on weighted future Return on Equity estimates from seven analysts. The implied Average Return on Equity is 14.90%, while the Cost of Equity is $4.61 per share, leaving an estimated Excess Return of $3.60 per share. Analysts also project a Stable Book Value of $55.13 per share from two sources, suggesting Coinbase can keep reinvesting at attractive, but not extraordinary, rates.

When these excess returns are projected forward and discounted, the Excess Returns valuation comes out materially below the current share price. Within this framework, the stock appears roughly 95.1% overvalued, indicating that the market price is well above the value implied by the model’s profitability assumptions.

Result: OVERVALUED

Our Excess Returns analysis suggests Coinbase Global may be overvalued by 95.1%. Discover 913 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Coinbase Global Price vs Earnings

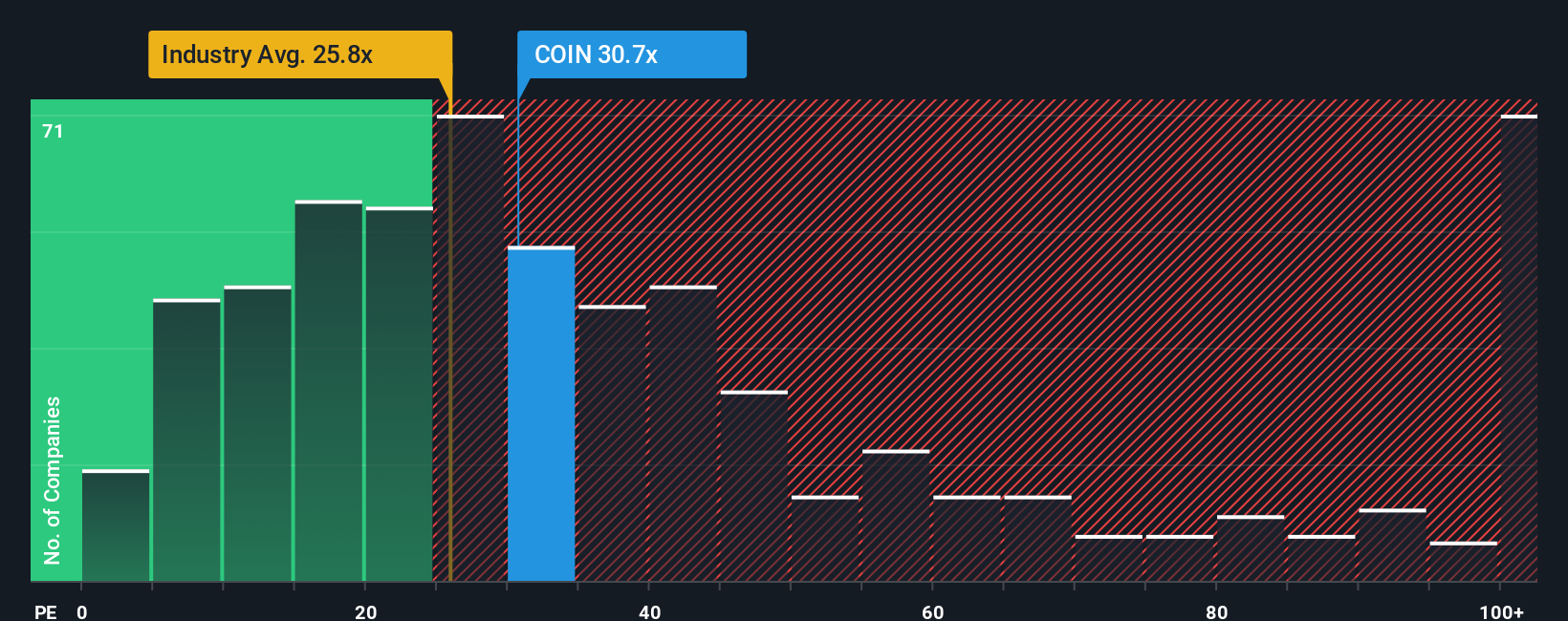

For a profitable company like Coinbase, the price to earnings ratio is a useful way to gauge how much investors are willing to pay today for each dollar of current earnings. In broad terms, faster and more reliable earnings growth, with lower perceived risk, can justify a higher normal or fair PE multiple, while more cyclical or uncertain earnings typically deserve a discount.

Coinbase currently trades at about 20.5x earnings, which sits below both the broader Capital Markets industry average of roughly 25.1x and the peer group average of around 32.1x. Simply Wall St also calculates a Fair Ratio of 22.0x for Coinbase. This is the PE multiple that would be expected once the company’s specific earnings growth outlook, margins, size, industry positioning, and risk profile are taken into account.

This Fair Ratio is more informative than a simple comparison with peers or the industry because it adjusts for Coinbase’s unique fundamentals rather than assuming all Capital Markets stocks deserve the same multiple. With the shares trading modestly below the 22.0x Fair Ratio, the PE lens suggests that Coinbase is slightly undervalued relative to what its earnings profile should warrant.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Coinbase Global Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework that lets you attach a story, your view of Coinbase Global’s future revenue, earnings, and margins, to a financial forecast and then to a fair value estimate you can compare with today’s price. On Simply Wall St’s Community page, used by millions of investors, Narratives make this process accessible by guiding you to express what you believe will drive Coinbase’s business, translating that story into projected financials and a fair value, and then showing whether your view implies the stock is a buy, hold, or sell at its current market price. These Narratives update dynamically as fresh news, earnings, and analyst revisions arrive, so your fair value view can evolve alongside the company rather than staying frozen in time. For example, one Coinbase Narrative might assume strong adoption of new token platforms and blockchain services and see fair value near $510 per share, while a more cautious Narrative focused on ETF competition and fee pressure might land closer to $185, and both perspectives can coexist transparently on the platform.

Do you think there's more to the story for Coinbase Global? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com