Does Generac’s 2025 Valuation Reflect Its Recent Share Price Slide?

- If you have ever looked at Generac Holdings and wondered whether the current share price really reflects its long term potential, you are not alone. This article is designed to unpack exactly that question.

- After a choppy run, the stock is down 13.6% over the last week and 11.1% over the past year, but still sits about 50.7% higher than three years ago. This hints at a story that is more complicated than a simple up or down trend.

- Recently, investors have been weighing Generac's positioning in backup power, energy storage, and distributed energy solutions as extreme weather events and grid reliability concerns keep demand for resilient power in the spotlight. At the same time, the broader clean energy and industrials space has been volatile as the market reassesses growth expectations and risk appetite for anything tied to infrastructure and electrification.

- Despite the mixed share price performance, Generac currently scores a 6/6 valuation check, suggesting it looks undervalued across all our standard measures. Next we will break down what each of those approaches is actually saying about the stock, and then finish with a more holistic way to think about valuation that goes beyond the numbers alone.

Find out why Generac Holdings's -11.1% return over the last year is lagging behind its peers.

Approach 1: Generac Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting how much cash it can generate in the future and then discounting those cash flows back to today in dollar terms.

For Generac Holdings, the latest twelve month free cash flow is about $449.5 million. Analyst and extrapolated estimates, using a 2 Stage Free Cash Flow to Equity model, project this rising to around $1.0 billion in 2035, with interim projections such as $436.6 million in 2026 and $743.2 million in 2029. Simply Wall St extends analyst forecasts beyond the usual five year window by assuming gradually slowing growth over time.

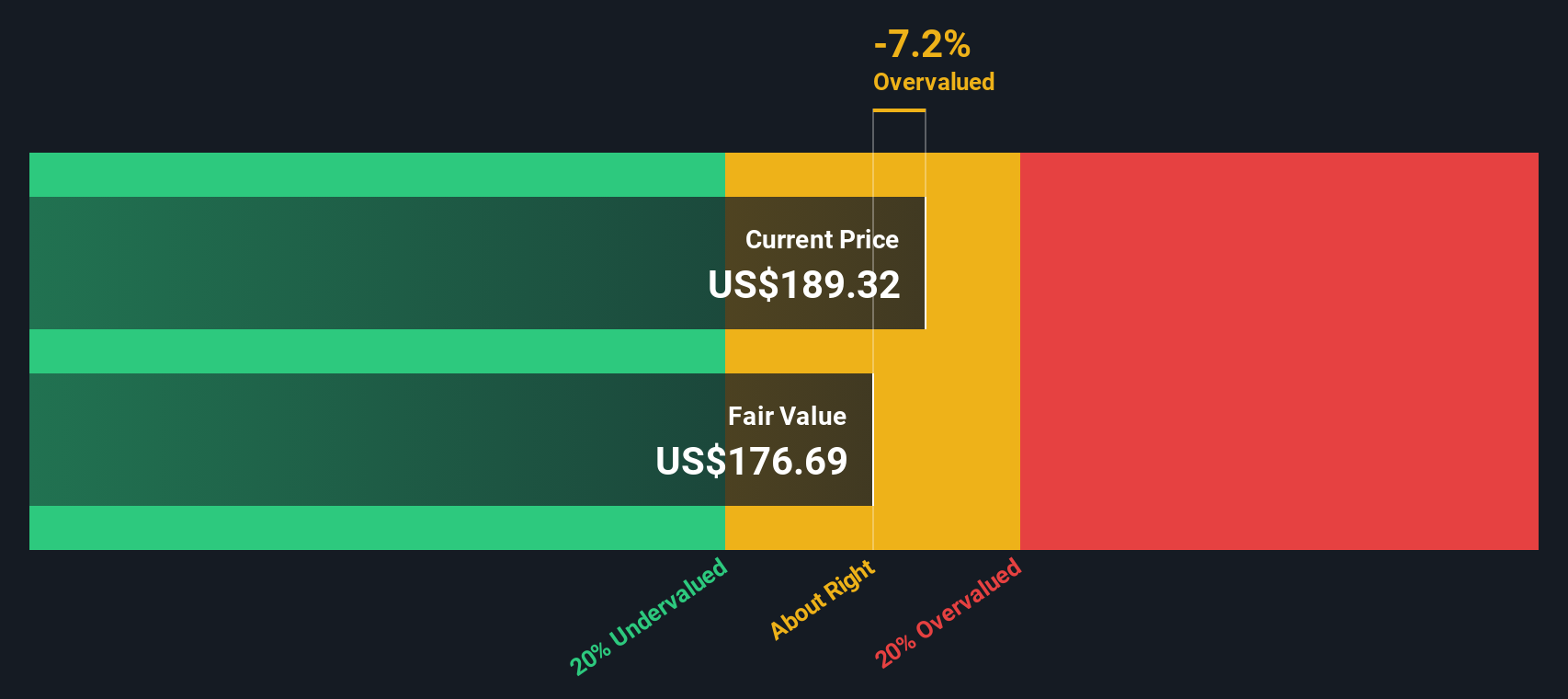

When all those future cash flows are discounted back, the model arrives at an intrinsic value of roughly $192.67 per share. Compared with the current market price, this implies the stock is about 27.9% undervalued based on cash flow fundamentals alone.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Generac Holdings is undervalued by 27.9%. Track this in your watchlist or portfolio, or discover 913 more undervalued stocks based on cash flows.

Approach 2: Generac Holdings Price vs Earnings

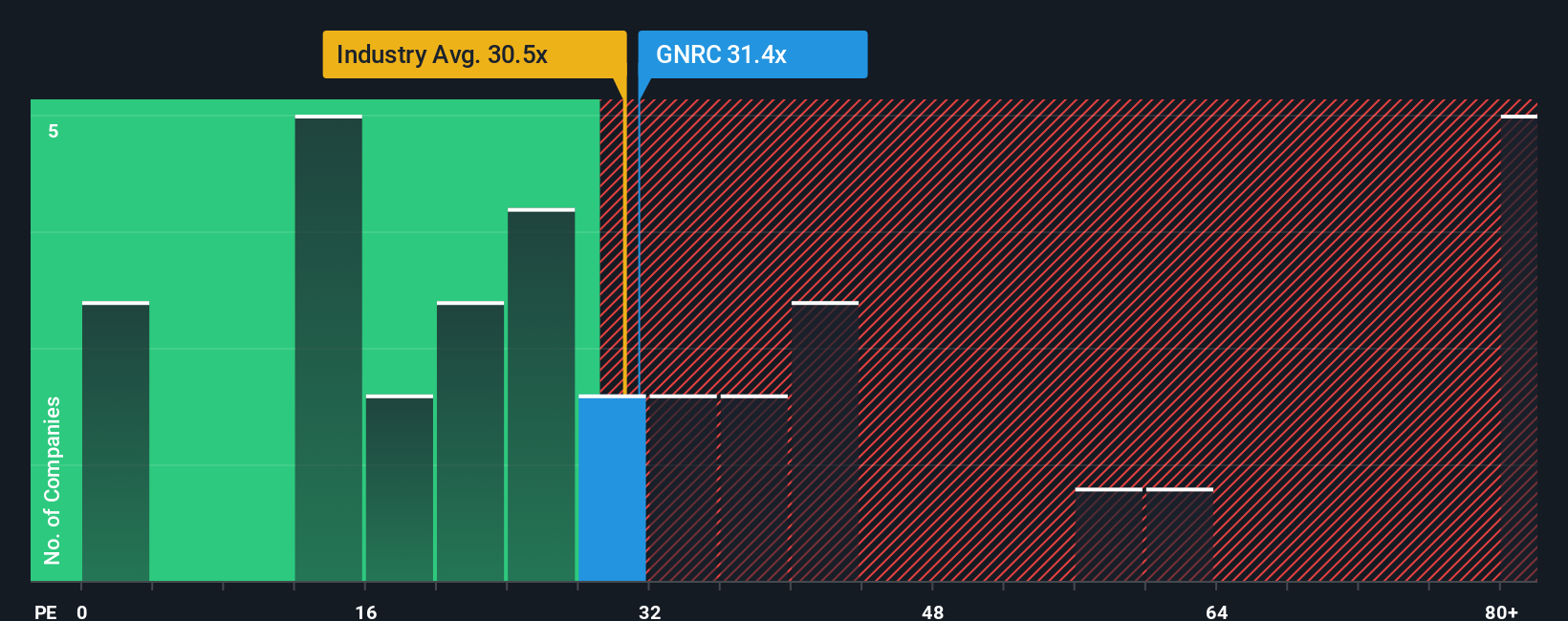

For a consistently profitable business like Generac, the price to earnings multiple is a natural way to judge valuation because it ties the share price directly to the profits shareholders ultimately care about. In general, higher growth and lower risk justify a higher PE ratio, while slower growth or more uncertainty usually mean investors are only willing to pay a lower multiple.

Generac currently trades on a PE of about 26.1x, which is below both the Electrical industry average of roughly 31.4x and the broader peer group at around 34.2x. To go beyond simple comparisons, Simply Wall St uses a proprietary Fair Ratio, which estimates what a normal PE for Generac should be based on its earnings growth outlook, profit margins, risk profile, industry and market cap. Because it blends these company specific factors, the Fair Ratio of 33.5x offers a more tailored benchmark than blunt peer or industry averages.

With Generac trading meaningfully below its 33.5x Fair Ratio, the preferred multiple suggests the market is assigning a discount relative to what its fundamentals might warrant.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Generac Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply your story about a company linked directly to your assumptions for its future revenue, earnings, margins, and fair value.

On Simply Wall St, Narratives live in the Community page and act as an easy, guided way to connect what you believe about a business to a concrete financial forecast and a fair value estimate, used by millions of investors who want their decisions to be driven by more than just headline ratios.

Each Narrative ties together three pieces: the company’s story, the numbers that flow from that story, and the resulting fair value, which you can then compare with the current share price to decide whether the stock looks like a buy, hold, or sell to you.

Because Narratives update dynamically as new data, news, or earnings arrive, your fair value view for Generac adjusts automatically. For example, one investor might see Generac’s data center and grid resiliency tailwinds supporting a fair value closer to $250, while a more cautious investor focused on clean energy and outage risks might land nearer $165 and act differently on the same price.

Do you think there's more to the story for Generac Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com