Nishimatsuya Chain (TSE:7545) Q3 Revenue Growth Tests Bulls as EPS Slips Year on Year

Nishimatsuya Chain (TSE:7545) has posted another data rich quarter, with Q3 2026 revenue of ¥51.2 billion and basic EPS of ¥34.56 alongside net income of ¥2.1 billion, setting the tone for how investors will read the latest numbers. The company has seen revenue move from ¥48.7 billion in Q3 2025 to ¥51.2 billion in Q3 2026, while basic EPS shifted from ¥40.31 to ¥34.56 over the same stretch, giving investors a mixed but nuanced read on headline growth and per share profitability as they parse the update.

See our full analysis for Nishimatsuya Chain.With the latest results on the table, the next step is to compare these numbers with the key narratives around Nishimatsuya Chain to see which storylines hold up and which ones the new data starts to challenge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Ease to 4.2 percent on ¥191,967 million LTM Sales

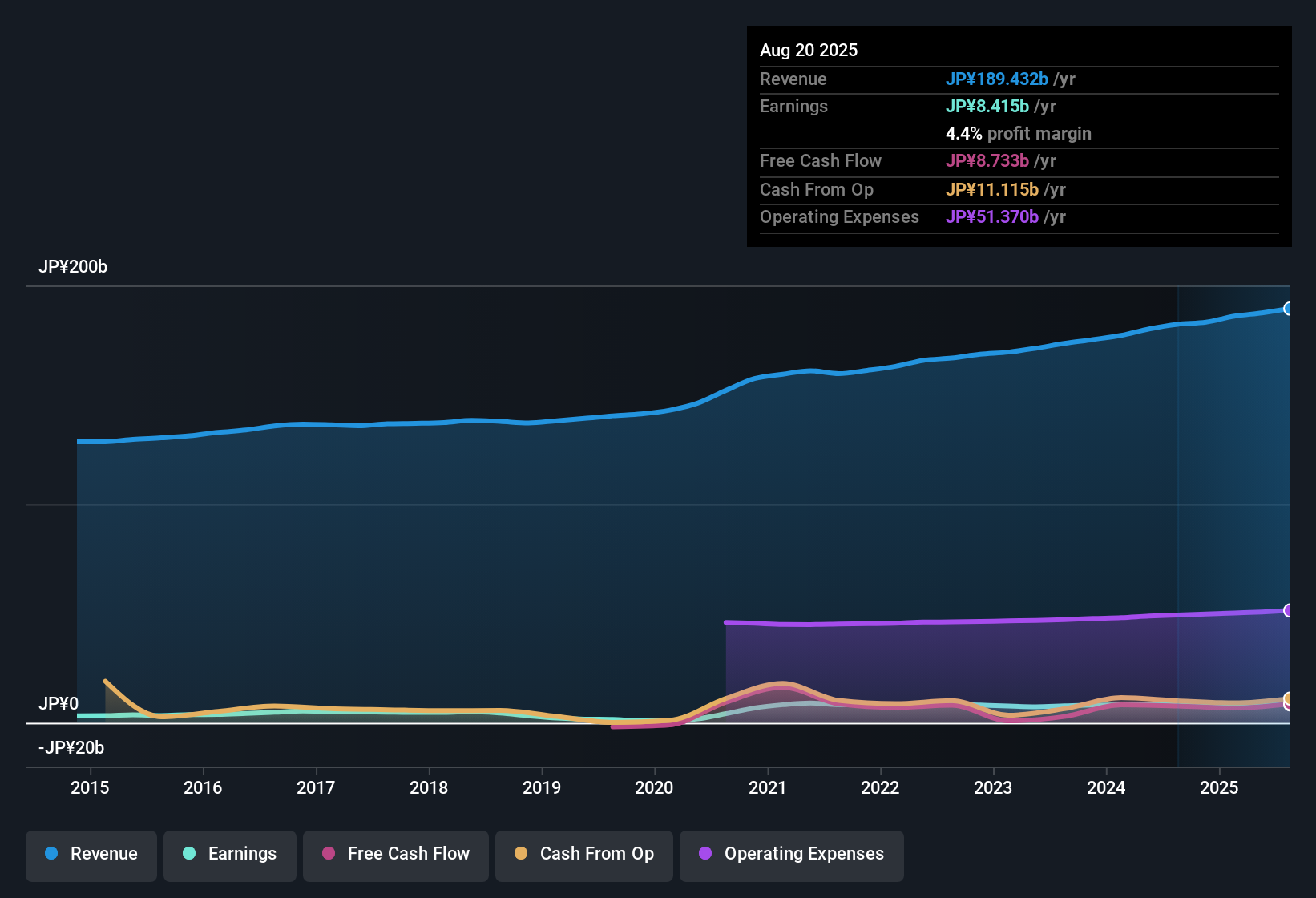

- Over the last twelve months, Nishimatsuya Chain generated ¥191,967 million in revenue with net income of ¥8,066 million, resulting in a 4.2 percent net margin compared with 4.3 percent a year earlier.

- Bulls see the business as a defensive retailer of essential baby and children’s goods, and that view is broadly consistent with relatively stable trailing net income around ¥8,066 to ¥8,415 million and revenue between ¥185,974 and ¥191,967 million over the past year. However, the slight margin dip from 4.3 percent to 4.2 percent reminds investors that even staple driven models still feel cost and competition pressure.

- Supporters can point to steady trailing EPS in the 129.9 to 140.2 yen range and last year’s 3.4 percent earnings growth as evidence that profitability has held up reasonably well for a niche physical retailer.

- At the same time, the essentially flat five year earnings growth rate of 0.02 percent per year keeps the bullish story grounded in stability rather than strong compounding, which may limit how far that defensive angle can stretch.

Forecast Earnings Growth at 8.1 percent per Year

- Forward looking estimates call for earnings to grow about 8.1 percent per year with revenue expected to rise roughly 4.7 percent per year, both in line with or slightly ahead of the broader Japanese market forecasts.

- What stands out for bullish investors is that this 8.1 percent projected earnings pace notably exceeds the 0.02 percent five year historical earnings growth and even last year’s 3.4 percent. This suggests that if the company can translate its ¥191,967 million trailing revenue base into faster profit growth, the stock could shift from a stability story toward a more growth oriented profile.

- Backers of a more optimistic case can argue that steady top line progress from ¥183,217 million to ¥191,967 million over recent trailing periods gives a platform for operational tweaks to flow through to the bottom line.

- However, the recent softening in margin from 4.3 percent to 4.2 percent is a concrete reminder that achieving that faster earnings trajectory will likely require margin management rather than just relying on modest revenue gains.

Premium 16.5x P E with DCF Upside

- The shares trade on a trailing P E of 16.5 times, above the Japanese specialty retail industry on 14.5 times and peers at 13.8 times, yet the current price of ¥2,230 still sits about 9.7 percent below a DCF fair value of roughly ¥2,470.27.

- Critics highlight the valuation premium as a key bearish talking point, and the 16.5 times multiple relative to industry and peer levels backs that concern. However, the gap between the ¥2,230 share price and the DCF fair value of ¥2,470.27 gives valuation focused investors a numerical counterpoint that the market is not pricing in all of the forecast 8.1 percent earnings growth and 4.7 percent revenue growth.

- From a cautious angle, paying above peer multiples for a company whose five year earnings growth has been only 0.02 percent per year could look demanding if the projected acceleration does not show up in future net income figures.

- On the other hand, investors willing to lean on intrinsic value models can point to the roughly 9.7 percent discount to DCF fair value as a margin of safety that partly offsets concerns about the higher P E relative to the 14.5 times industry benchmark.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Nishimatsuya Chain's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Nishimatsuya Chain carries a valuation premium despite only marginal long term earnings growth and slightly softer margins, so future performance needs to improve to justify the price.

If paying up for slow progress feels risky, shift your focus to stable growth stocks screener (2105 results) to target businesses already proving they can compound earnings and revenue more reliably.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com