Assessing Amentum (AMTM) Valuation After Securing Major DTRA and DISA Defense Contracts

Amentum Holdings (AMTM) is back on investors’ radar after landing two meaningful U.S. defense wins, including prime-contractor status on DTRA’s 3.5 billion CTRIC IV program and a separate 120 million DISA computing contract.

See our latest analysis for Amentum Holdings.

Those contract wins appear to be feeding into growing optimism, with the stock now at $29.21 and a strong year to date share price return alongside an even more impressive one year total shareholder return, signaling building momentum rather than a one day pop.

If these defense contracts have you rethinking the sector, it is a good moment to scan other aerospace and defense names using aerospace and defense stocks.

With shares up more than 50 percent over the past year but still trading below analyst targets and our intrinsic value estimate, is Amentum a mispriced defense upstart, or has the market already baked in its next leg of growth?

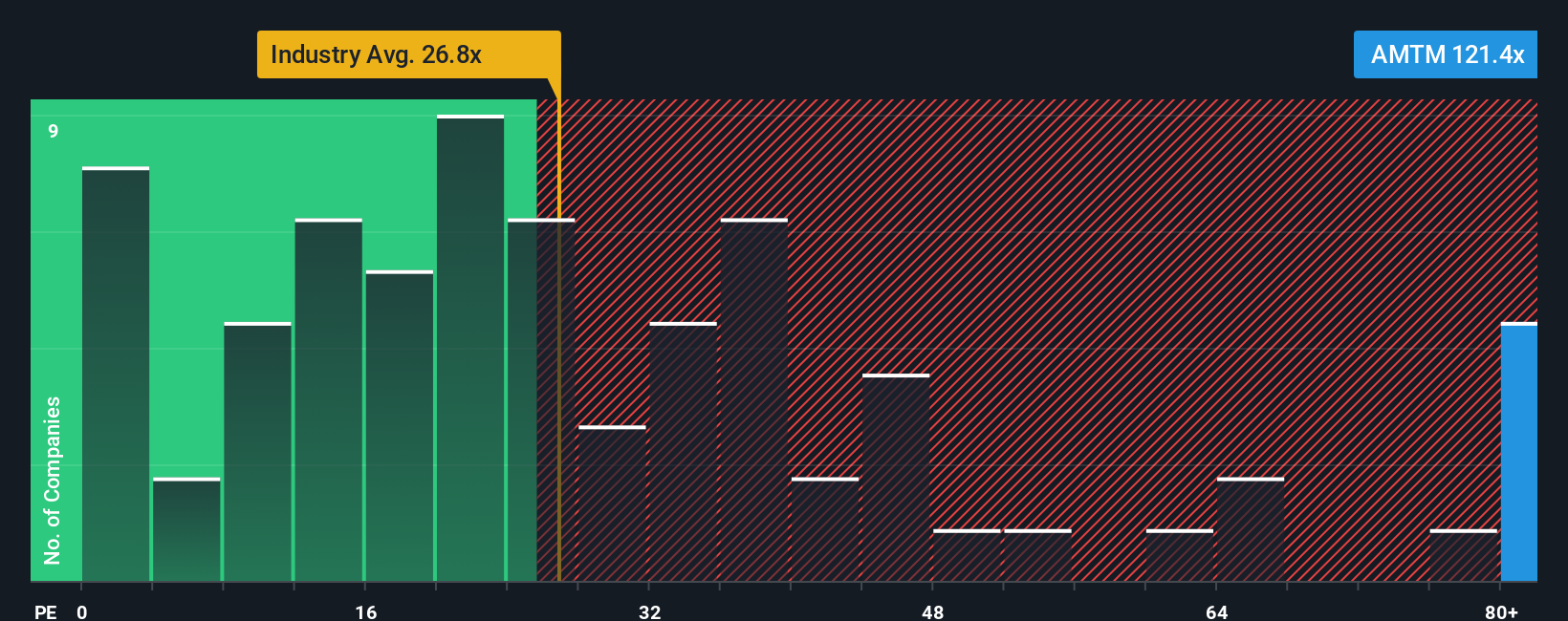

Price-to-Earnings of 107.8x: Is it justified?

The SWS DCF model estimates fair value for Amentum Holdings at $67.38, making the current $29.21 share price look deeply discounted on a cash flow basis.

Our DCF framework projects the company’s future cash flows and then discounts them back to today, aiming to capture the present value of those expected streams.

For Amentum, which has only recently turned profitable but is forecast to grow earnings at over 30 percent annually, that approach places significant weight on improved future profitability rather than today’s slim net income.

Those growth expectations, combined with the company’s role in long duration federal contracts, help explain why intrinsic value can sit far above both near term earnings and headline multiples.

Look into how the SWS DCF model arrives at its fair value.

Result: DCF Fair value of $67.38 (UNDERVALUED)

However, stretched valuation multiples, execution missteps on complex federal contracts, or slower than expected earnings growth could quickly challenge the current optimism around Amentum.

Find out about the key risks to this Amentum Holdings narrative.

Another View on Valuation

Step away from cash flows and the picture flips. At 107.8 times earnings, Amentum trades far above both its industry at 24.2 times and an estimated fair ratio of 33.8 times, suggesting investors are paying up early for growth that still needs to be delivered.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Amentum Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Amentum Holdings Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your Amentum Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop at a single opportunity when you can systematically uncover more. Use the Simply Wall St Screener to find stocks that match your strategy.

- Boost your potential income by reviewing these 13 dividend stocks with yields > 3% that combine attractive payouts with solid underlying businesses.

- Position yourself ahead of structural change by scanning these 24 AI penny stocks shaping the next wave of intelligent automation and data driven products.

- Strengthen your margin of safety by focusing on these 913 undervalued stocks based on cash flows where market prices may not yet reflect long term cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com