Magnum Ice Cream (ENXTAM:MICC): Taking Stock of Valuation After a Steady Year-to-Date Share Price Gain

Magnum Ice Cream (ENXTAM:MICC) has quietly outpaced the broader market this year, and with earnings growing faster than revenue, investors are starting to ask whether the current share price still reflects fair value.

See our latest analysis for Magnum Ice Cream.

That modest year to date share price return of 4.78 percent, with the stock now at 13.59 dollars, suggests steady positive momentum is building as investors warm to earnings leverage rather than re rating the story in one big move.

If Magnum’s risk reward profile has you rethinking your watchlist, this is also a good moment to scout fast growing stocks with high insider ownership for other fast moving, high conviction ideas.

With earnings now rising more than three times as fast as revenue and the share price still sitting below analyst targets and intrinsic estimates, is Magnum Ice Cream a quietly undervalued scoop, or has the market already priced in every calorie of its future growth?

Price-to-Earnings of 14.3x: Is it justified?

On a price-to-earnings ratio of 14.3 times, Magnum Ice Cream looks modestly priced next to peers, even after its recent share price gains.

The price to earnings multiple compares what investors are willing to pay today for each unit of current earnings, a key yardstick for established, profitable consumer brands like Magnum.

Here, the market appears to be discounting those earnings conservatively, with MICC trading at a lower multiple than comparable companies despite solid profit growth and improving margins.

Against the peer average of 22 times earnings and the broader European Food industry at 15.9 times, Magnum’s 14.3 times multiple stands out as a clear relative discount, suggesting investors have yet to fully rerate the stock in line with sector norms.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 14.3x.

However, slower top line growth and any disappointment versus analyst targets could quickly puncture sentiment and limit how far this valuation gap can close.

Find out about the key risks to this Magnum Ice Cream narrative.

Another Lens on Value: SWS DCF Model

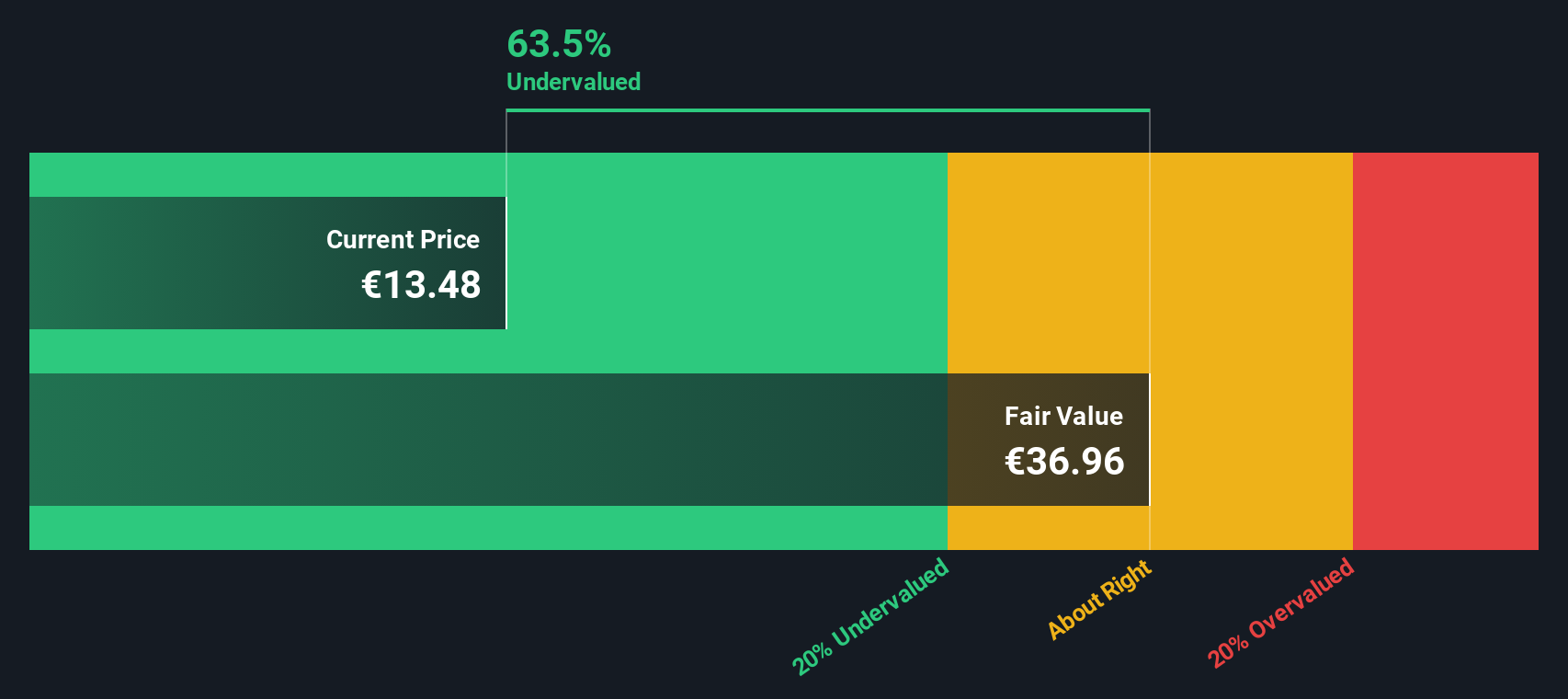

While a 14.3 times earnings multiple hints at modest undervaluation, our DCF model paints a far bolder picture, with fair value at €36.96 versus today’s €13.59. That 63 percent discount looks like a bargain, but is it a mispricing or a mirage built on rosy assumptions?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Magnum Ice Cream for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 912 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Magnum Ice Cream Narrative

If you see the story differently or want to stress test every assumption yourself, you can build a personalised view in just minutes: Do it your way.

A great starting point for your Magnum Ice Cream research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop at Magnum when you can uncover fresh opportunities with the Simply Wall St Screener, tailored to the themes and strategies you care about most.

- Capitalize on underpriced potential by scanning these 912 undervalued stocks based on cash flows that the market has not fully rewarded yet, before sentiment and prices catch up.

- Ride powerful secular trends by zeroing in on these 24 AI penny stocks positioned at the heart of automation, data intelligence, and next generation software.

- Strengthen your income stream by targeting these 12 dividend stocks with yields > 3% that combine attractive yields with sustainable payout profiles and solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com