Is Morgan Stanley’s Rally Justified After Wealth Management Pivot and Strong 2025 Share Gains?

- If you are wondering whether Morgan Stanley remains attractive after its huge run, or if the smart money has already moved on, you are in the right place to unpack what the current price really implies.

- The stock now trades around $176.98. Despite a modest 0.8% slip over the last week, it is up 11.9% in the last month, 41.8% year to date, 47.4% over 1 year, 127.5% over 3 years, and 204.9% over 5 years. This naturally raises questions about how much upside is left versus the risk on the table.

- Recent headlines have focused on Morgan Stanley sharpening its wealth management focus and leaning further into fee based, capital light businesses, a strategic pivot that markets often reward with a higher valuation multiple. At the same time, ongoing commentary around interest rate paths, capital requirements for big banks, and shifting trading volumes has added some volatility to sentiment without derailing the broader uptrend.

- Our valuation framework currently gives Morgan Stanley a 3/6 score on undervaluation checks, suggesting that the story is more nuanced than a simple cheap or expensive label. We will walk through traditional valuation methods next, then finish with a more holistic way of thinking about value that ties them all together.

Approach 1: Morgan Stanley Excess Returns Analysis

The Excess Returns model looks at how effectively Morgan Stanley turns shareholder equity into profits above its cost of capital, then capitalizes those surplus returns into an implied share value.

On this view, Morgan Stanley starts from a Book Value of $62.98 per share and is expected to generate Stable EPS of $11.24 per share, based on weighted future Return on Equity estimates from 12 analysts. With an Average Return on Equity of 16.46% and a Cost of Equity of $6.65 per share, the model estimates an Excess Return of $4.59 per share. This indicates the bank is projected to earn meaningfully more than investors require for taking on its risk.

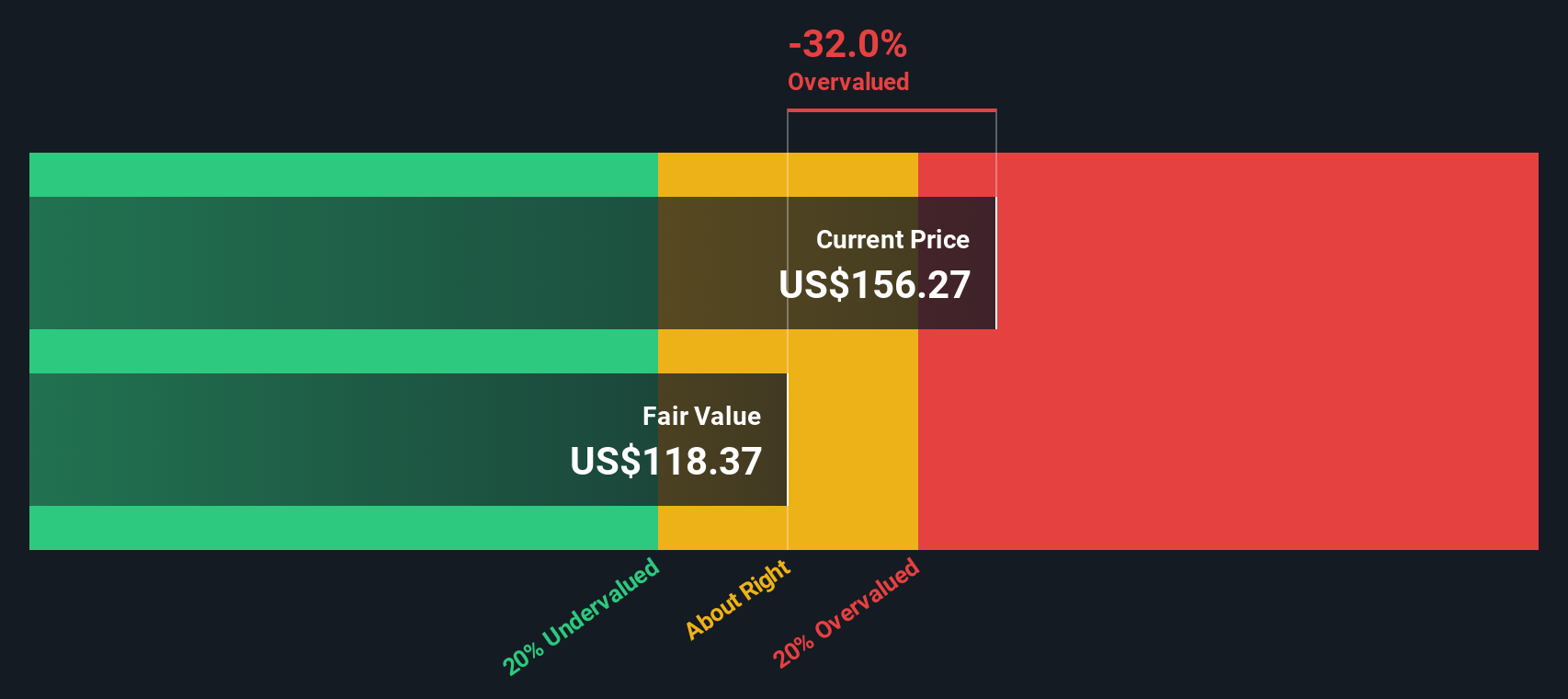

As that earning power compounds into a Stable Book Value of $68.29 per share, the Excess Returns framework implies an intrinsic value of about $139.04 per share. Compared with the current price around $176.98, the model suggests the stock is roughly 27.3% overvalued. Under this approach, the recent rally appears to be running ahead of fundamentals.

Result: OVERVALUED

Our Excess Returns analysis suggests Morgan Stanley may be overvalued by 27.3%. Discover 912 undervalued stocks or create your own screener to find better value opportunities.

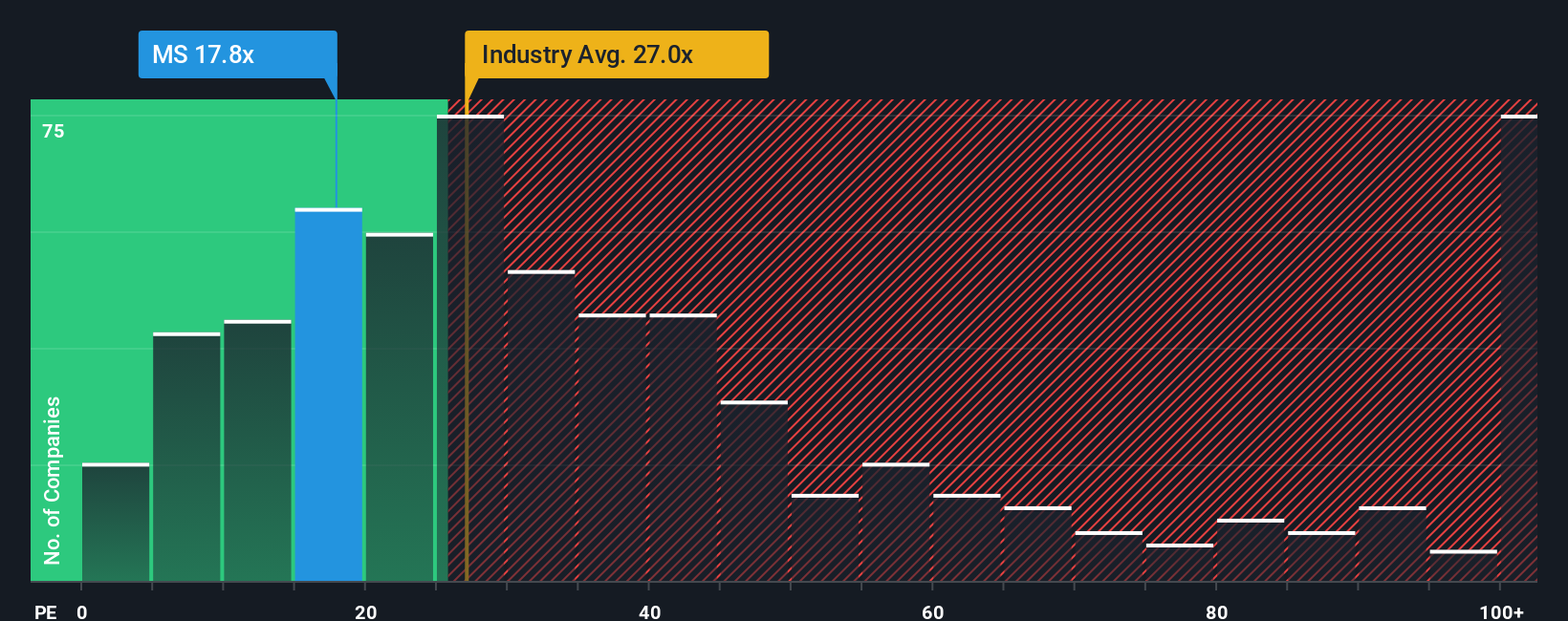

Approach 2: Morgan Stanley Price vs Earnings

For a consistently profitable bank like Morgan Stanley, the price to earnings, or PE, ratio is a practical way to gauge how much investors are paying for each dollar of current earnings. In general, faster earnings growth and lower perceived risk justify a higher PE, while slower growth or higher risk pull that multiple down.

Morgan Stanley currently trades on about 18.1x earnings. That is below both the broader Capital Markets industry average of roughly 25.1x and the peer group average near 30.3x, which might initially suggest the shares are on sale. However, simple comparisons like these miss important nuances around growth prospects, profitability and risk.

Simply Wall St tackles this with a Fair Ratio of 19.0x, its proprietary estimate of what Morgan Stanley’s PE should be after accounting for its earnings growth outlook, risk profile, profit margins, size and industry position. Because this metric is tailored to the company, it is more informative than a blunt peer or industry comparison. Against that 19.0x fair level, the current 18.1x multiple points to Morgan Stanley trading at a modest discount rather than an obvious bubble.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Morgan Stanley Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, which are simple, story driven models on Simply Wall St’s Community page that let you connect your view of Morgan Stanley’s future revenues, earnings and margins to a financial forecast, a fair value estimate, and ultimately a buy or sell decision.

You can compare that fair value to the live share price, and all of this then updates dynamically as new news, earnings or guidance is released. One investor might build a bullish Narrative that leans into wealth management growth, technology driven margin expansion and steady buybacks to justify a fair value near the high end of recent targets around 160 dollars. A more cautious investor could emphasize regulatory risk, fee pressure and digital competition to arrive closer to the low end near 122 dollars. Both perspectives can coexist transparently on the platform as clear, testable stories behind the numbers.

Do you think there's more to the story for Morgan Stanley? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com