SunPower (SPWR) Q3: Trailing Profitability Returns, But Another Quarterly EPS Loss Tests Bull Case

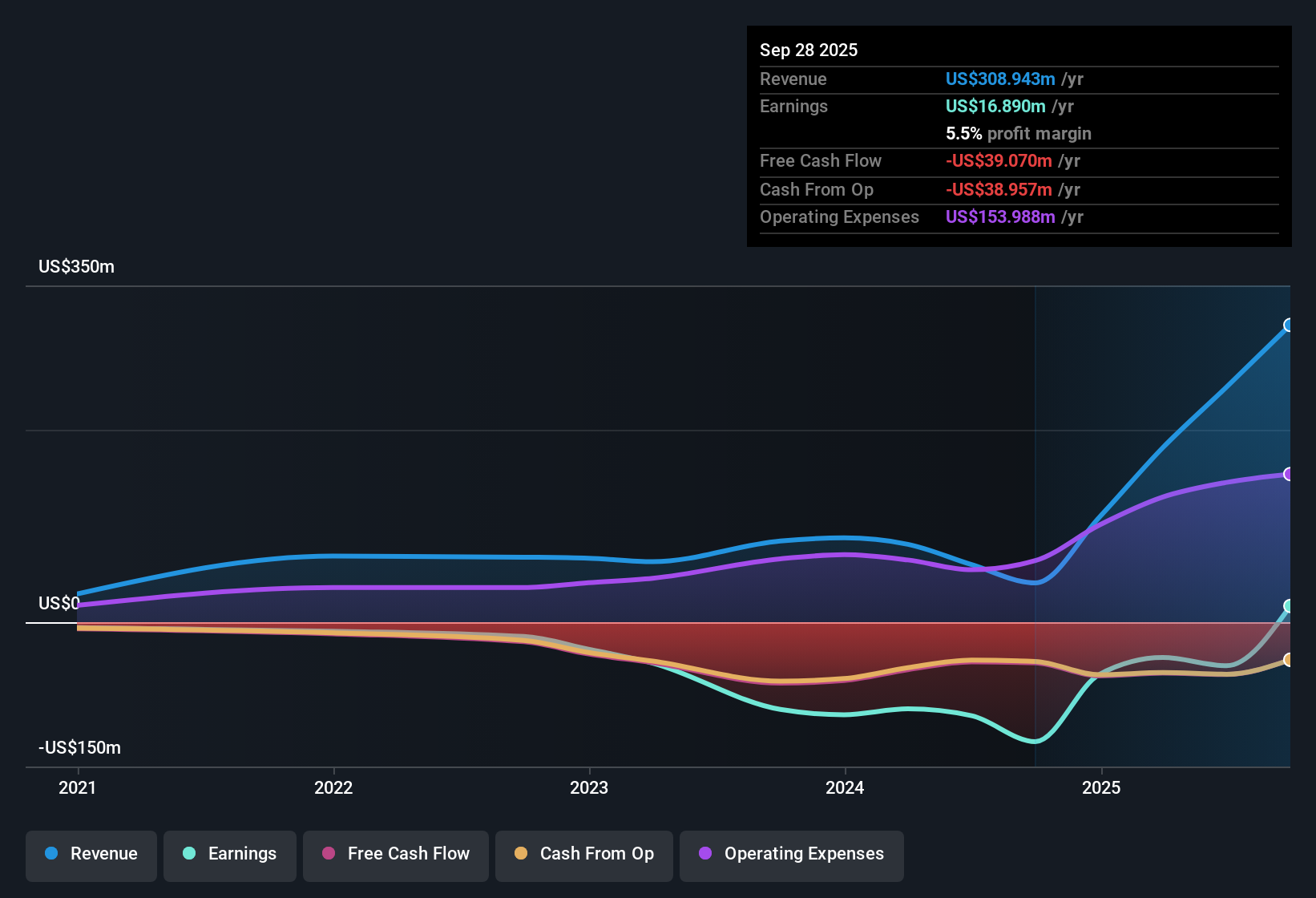

SunPower (SPWR) has just posted its Q3 2025 numbers, with revenue at about $70 million and basic EPS at roughly -$0.19, alongside net income from continuing operations of approximately -$15.8 million and a -$1.1 million hit from discontinued operations setting the tone for the quarter. The company has seen revenue move from about $4.5 million in Q2 2024 to $5.5 million in Q3 2024, then to $88.7 million in Q4 2024, before landing at $82.7 million in Q1 2025, $67.5 million in Q2 2025 and $70.0 million this quarter. EPS swung from around -$2.53 in Q2 2024 to -$1.03 in Q3 2024, then up to $0.58 in Q4 2024 and $0.10 in Q1 2025 before slipping back into the red over the last two quarters, leaving investors to weigh whether recent margin pressure is a temporary reset or a more durable feature of the business.

See our full analysis for SunPower.

With the latest quarter on the books, the next step is to line these results up against the big narratives around SunPower to see which stories the numbers support and which ones start to look a bit stretched.

Curious how numbers become stories that shape markets? Explore Community Narratives

Trailing EPS Turns Positive Despite Q3 Loss

- Even though Q3 Basic EPS was about -$0.19, the trailing twelve month Basic EPS has flipped to roughly $0.21, helped by much stronger results in late 2024 and early 2025.

- What stands out for a bullish view is that trailing net income of about $16.9 million sits alongside a forecast for earnings to grow roughly 45.6 percent per year, yet the most recent two quarters both show losses. This means:

- Supporters can point to the move from large losses in 2024 to positive trailing EPS as evidence the business model can generate profits.

- Skeptics can equally note that the Q2 and Q3 2025 net losses of about $22.4 million and $15.8 million show that profitability has not yet been sustained from one quarter to the next.

Revenue Rebuilds From 2024 Lows

- On a trailing twelve month basis, revenue has climbed to about $308.9 million compared with quarterly revenue that was as low as around $4.5 million to $5.5 million in mid 2024, and analysts now expect revenue to grow roughly 20.1 percent per year, ahead of the wider US market.

- Viewed through a more optimistic lens, this rebound heavily supports a bullish argument that the business is regaining scale, yet there is still tension between that growth story and the recent quarterly pattern:

- Support for bulls comes from the step up from single digit millions of revenue in Q2 and Q3 2024 to between about $67.5 million and $88.7 million per quarter since Q4 2024, which aligns with the double digit annual growth forecast.

- The counterpoint is that quarterly revenue in 2025 has drifted from about $82.7 million in Q1 to $67.5 million in Q2 and roughly $70.0 million in Q3, so the near term trend is flatter than the longer term 20.1 percent growth projection suggests.

Valuation Low, Balance Sheet Stretched

- At a share price of about $1.74, the trailing P E of roughly 11.1 times sits below the broader US market at around 19 times and well under the US electrical industry at about 31.4 times, while major balance sheet flags include negative shareholders equity and debt that is not well covered by operating cash flow.

- For a more cautious or bearish narrative, these numbers create a clear tension between apparent value and financial risk that investors should not ignore:

- On one hand, critics highlight that negative equity plus substantial dilution over the past year mean existing shareholders now rely heavily on future earnings growth to justify even this discounted multiple.

- On the other, the combination of a below market P E and the move to roughly $16.9 million of trailing net income shows why some investors see potential value if the company can improve debt coverage and avoid further large one off losses such as the recent $4.8 million item.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on SunPower's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

SunPower’s uneven profitability, recent quarterly losses, and stretched balance sheet create meaningful uncertainty around how durable any future earnings recovery will really be.

If you want sturdier financial foundations, use our solid balance sheet and fundamentals stocks screener (1943 results) to quickly focus on companies with stronger balance sheets that are better positioned to handle setbacks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com