Tourmaline Oil (TSX:TOU): Assessing Valuation After CEO Mike Rose’s Recent Share Purchase

Tourmaline Oil (TSX:TOU) just saw CEO Mike Rose buy 2,500 shares around CA$60 each, a direct insider purchase that naturally raises questions about how management views the company’s current valuation and outlook.

See our latest analysis for Tourmaline Oil.

That buy comes after a choppy stretch, with the share price now at about CA$59.80 and a negative year to date share price return, but a strongly positive five year total shareholder return, which suggests longer term momentum remains intact.

If insider conviction has your attention, this could be a good moment to broaden your search and discover fast growing stocks with high insider ownership.

With shares lagging year to date despite solid multi year returns and analyst targets sitting materially higher than today’s price, should investors view Tourmaline as undervalued, or assume the market is already pricing in its future growth?

Most Popular Narrative Narrative: 18.1% Undervalued

With Tourmaline Oil last closing at about CA$59.80 versus a narrative fair value near CA$73, the valuation case leans toward upside potential.

Strategic build-out of low-cost, high-margin inventory in the Northeast BC Montney, with associated infrastructure owned by Tourmaline, positions the company for meaningful production growth to 850,000 BOE/d by early next decade, which, at flat pricing, will more than double annual free cash flow, supporting higher future dividend payments and potential buybacks.

Want to see what powers that growth curve? The narrative focuses on aggressive volume expansion, richer margins, and a punchy future earnings multiple. Curious how those pieces fit?

Result: Fair Value of $73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat LNG driven story could be derailed by persistently weak gas prices or regulatory delays that push back export infrastructure timelines.

Find out about the key risks to this Tourmaline Oil narrative.

Another Angle on Valuation

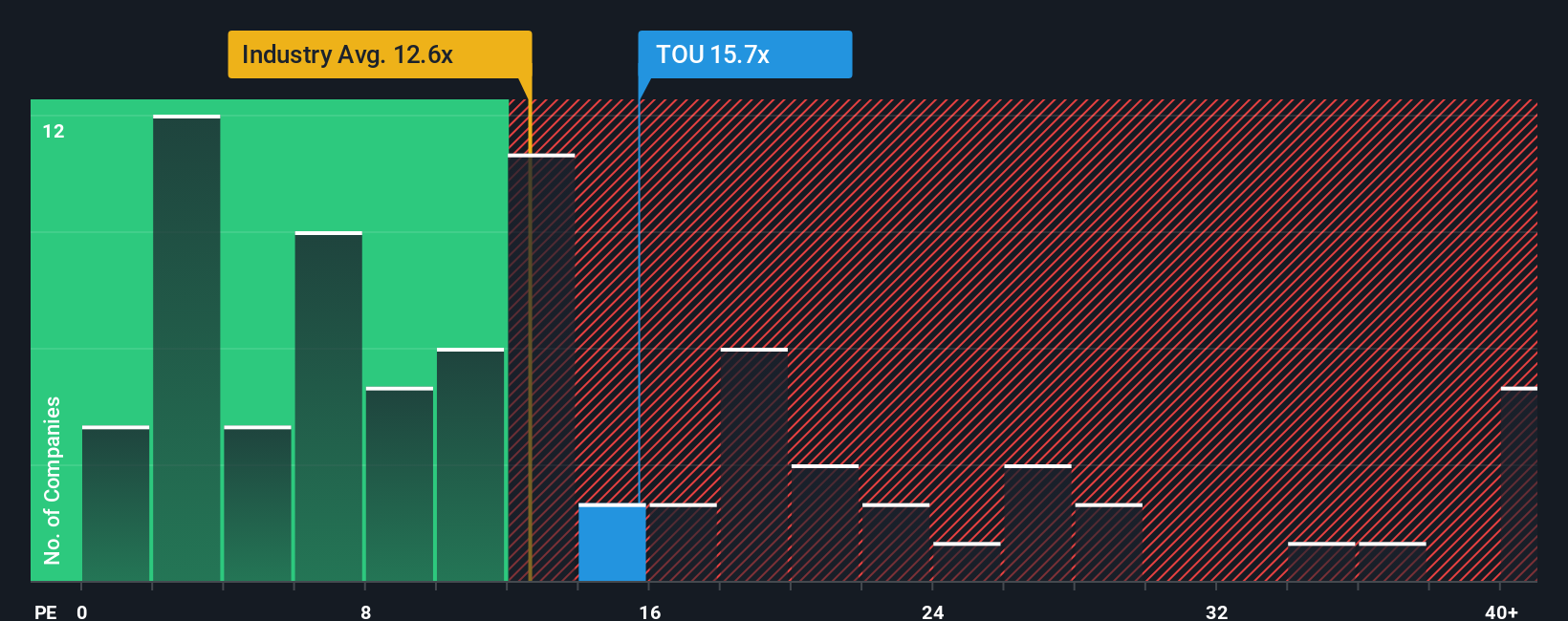

On earnings based measures, the story is less clear cut. Tourmaline trades at about 17.5 times earnings, richer than both the Canadian oil and gas industry on 14.1 times and peer average of 16.4 times, yet still below a 19.3 times fair ratio our model suggests.

In practice, that mix of premium versus peers but discount to the fair ratio points to a mid ground, where execution or gas prices might decide whether today’s level looks like a bargain or a value trap in hindsight.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tourmaline Oil Narrative

If you see the numbers differently or want to stress test the thesis with your own assumptions, you can build a custom view in minutes: Do it your way.

A great starting point for your Tourmaline Oil research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing edge?

Do not stop at one opportunity. Use the Simply Wall St Screener to quickly uncover fresh ideas that could reshape your portfolio before everyone else notices.

- Explore potential income streams by targeting companies with reliable payouts using these 12 dividend stocks with yields > 3% as your starting point.

- Focus on structural growth trends by zeroing in on innovators at the heart of automation and machine learning through these 24 AI penny stocks.

- Identify overlooked names by filtering for quality businesses trading below intrinsic value with these 913 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com