Danaher (DHR): Revisiting Valuation as Earnings Grow While the Share Price Stalls

Danaher (DHR) has been treading water lately, with the stock roughly flat over the past year even as fundamentals quietly improve. That gap between steady earnings growth and muted price action is what makes the setup interesting.

See our latest analysis for Danaher.

At around $224.84 per share, Danaher’s 90 day share price return of 18.05 percent stands out against a softer year long total shareholder return of roughly flat. This suggests momentum is starting to rebuild as investors reassess its growth and risk profile.

If Danaher’s steadier footing has you thinking about what else might be setting up for a sustained run, this is a good moment to explore healthcare stocks as potential next ideas.

With earnings still compounding and the share price lagging longer term returns, the key question now is whether Danaher is quietly undervalued or if today’s rebound already reflects the next leg of its growth. Is there a buying opportunity, or is the market simply pricing in the future?

Most Popular Narrative: 12.9% Undervalued

Compared with Danaher’s last close, the most followed narrative points to a higher fair value, framing the current price as a potential discount rather than a peak.

The sustained advancement of precision medicine and personalized therapies, including new AI assisted diagnostic solutions and groundbreaking launches in genomics (like support for in vivo CRISPR therapies), positions Danaher's technology portfolio to capture higher margin growth and drive long term EBITDA expansion.

Curious how recurring, high margin consumables, expanding diagnostics demand, and an elevated future earnings multiple can still add up to upside from here? The narrative’s fair value leans heavily on compounding profitability, a richer margin mix, and a premium valuation usually reserved for faster growing sectors. Want to see exactly which growth and margin paths have to materialize to justify that target, and how much optimism is already baked in? Read on to unpack the full set of assumptions behind this call.

Result: Fair Value of $258.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent trade tensions with China and prolonged weakness in early stage biotech funding could derail the expected recovery and pressure Danaher’s premium multiple.

Find out about the key risks to this Danaher narrative.

Another Angle on Valuation

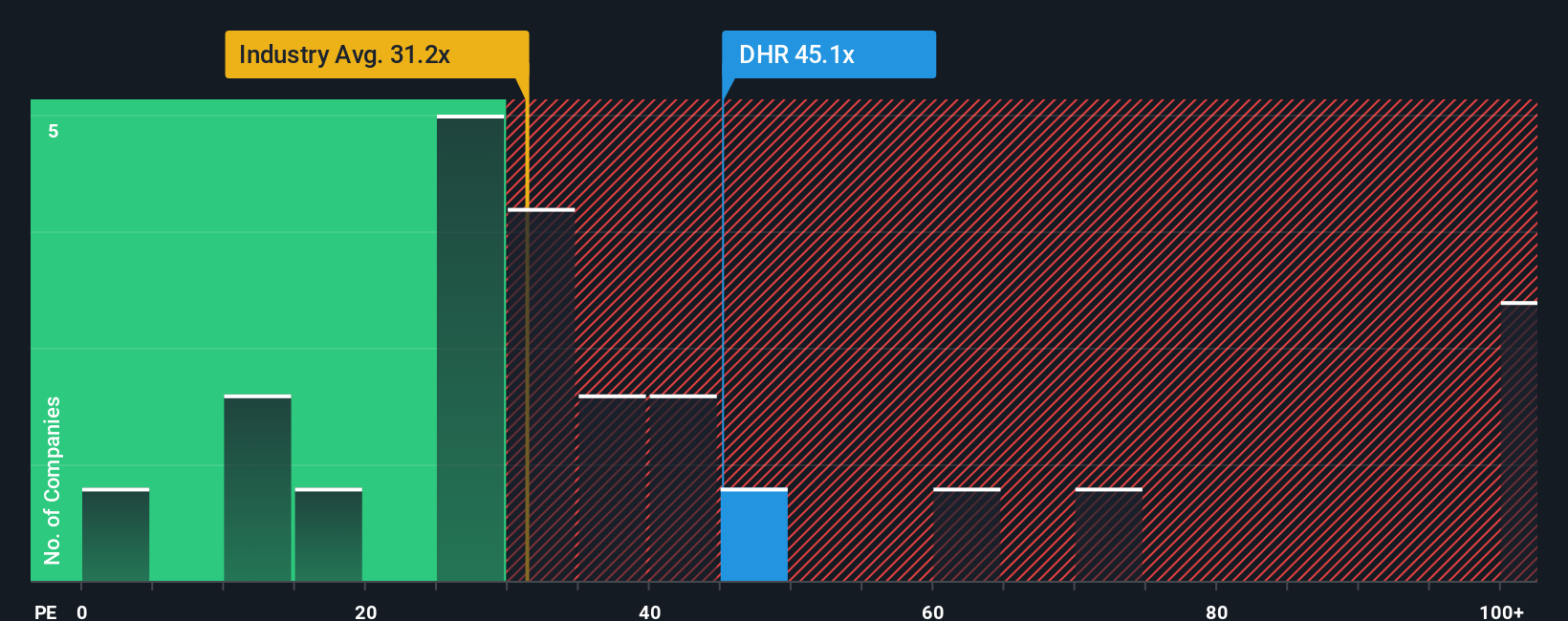

While the narrative points to about 12.9 percent upside, the earnings multiple tells a tougher story. Danaher trades at a 45.3 times price to earnings ratio versus a 34.4 times industry average and a 32.1 times fair ratio, which tilts the balance toward overvaluation. If sentiment cools, how much multiple risk are you really carrying?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Danaher Narrative

If this perspective does not quite match your own view, or you prefer to dig into the numbers yourself, you can assemble a personalized thesis in just a few minutes: Do it your way.

A great starting point for your Danaher research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Put your Danaher insights to work and move confidently to your next opportunity, or you risk watching others capture the upside that could have been yours.

- Target powerful cash flow potential with these 914 undervalued stocks based on cash flows that trade below what their fundamentals suggest, before the market fully catches on.

- Capitalize on the next wave of innovation by scanning these 24 AI penny stocks poised to benefit from real world adoption of artificial intelligence solutions.

- Strengthen your income strategy by reviewing these 12 dividend stocks with yields > 3% that combine attractive yields with the financials to keep paying through different market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com