Assessing Federal Agricultural Mortgage (AGM) Valuation After Recent Pullback and 3‑Year Outperformance

Federal Agricultural Mortgage (AGM) has quietly outperformed many financial peers over the past 3 years, even as the stock has slipped about 8% this year, inviting a closer look at its setup.

See our latest analysis for Federal Agricultural Mortgage.

At around $177 per share, the recent pullback, including a modest year to date share price decline, sits against a much stronger backdrop: a three year total shareholder return of about 70 percent, suggesting longer term momentum has not fully broken even as near term sentiment cools.

If Federal Agricultural Mortgage has you thinking about where else steady compounding might be hiding, it is worth exploring fast growing stocks with high insider ownership as a fresh hunting ground for ideas.

With earnings still growing and the share price trading at a hefty discount to analyst targets, investors now face a pivotal question: is Federal Agricultural Mortgage undervalued, or is the market already pricing in its future growth?

Most Popular Narrative Narrative: 22% Undervalued

With Federal Agricultural Mortgage last closing at $177.07 against a narrative fair value of $226, the valuation story hinges on how far growth can stretch.

Expansion into renewable energy, broadband, and infrastructure finance is driving significant new business volume and higher spreads, positioning Farmer Mac to benefit from increasing demand for financing related to sustainability and rural connectivity initiatives, which should support revenue and earnings growth going forward.

Curious what kind of revenue climb, margin resilience, and future profit multiple are needed to back this target? The full narrative unpacks every assumption in detail.

Result: Fair Value of $226 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising credit losses in newer segments and potential shifts in government support could undercut growth expectations and challenge the case for undervaluation.

Find out about the key risks to this Federal Agricultural Mortgage narrative.

Another Lens on Value

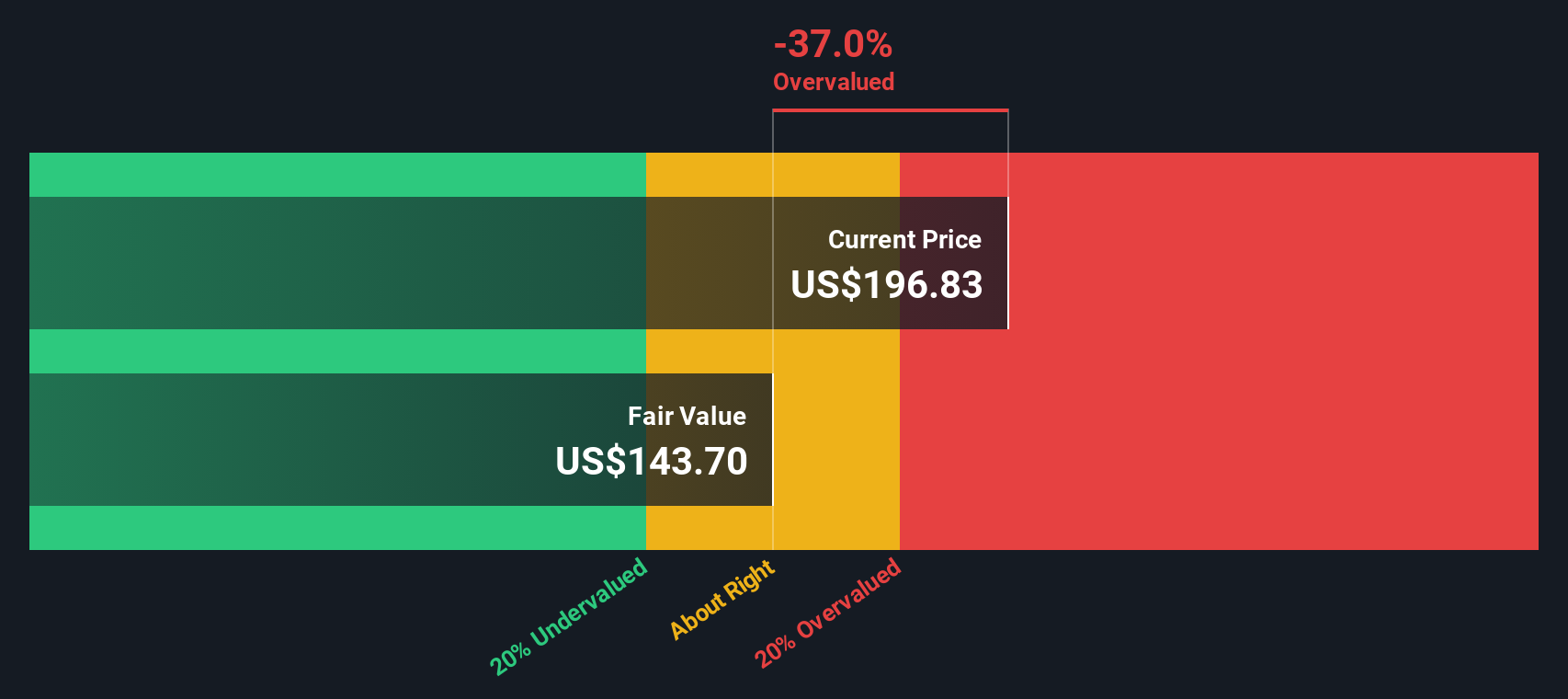

While the narrative fair value suggests upside, our DCF model comes out cooler, putting fair value nearer $135.90. At today’s $177 price, that implies Federal Agricultural Mortgage might actually be overvalued. This raises the question: which story do you trust more, the cash flows or the growth narrative?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Federal Agricultural Mortgage for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Federal Agricultural Mortgage Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can quickly build a personalized thesis in under three minutes: Do it your way.

A great starting point for your Federal Agricultural Mortgage research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before you move on, lock in an edge by scanning fresh opportunities on Simply Wall Street, where data backed screeners can sharpen your next investing move.

- Seize potential mispricings by hunting through these 914 undervalued stocks based on cash flows that may offer stronger upside than well known names like Federal Agricultural Mortgage.

- Ride powerful secular trends by targeting innovation focused plays across these 24 AI penny stocks shaping everything from automation to next generation analytics.

- Boost your income game by reviewing these 12 dividend stocks with yields > 3% that aim to deliver consistent cash returns alongside long term capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com