Assessing nVent Electric (NVT) Valuation After Its Confident Quarterly Dividend Increase

nVent Electric (NYSE:NVT) just gave income investors a small raise, boosting its quarterly dividend 5% to 0.21 dollars per share for the first quarter of 2026, a clear nod to management's confidence.

See our latest analysis for nVent Electric.

The market seems to agree with that confidence, with the share price at 101.54 dollars after a strong year to date share price return of 48.32 percent and a standout five year total shareholder return of 376.33 percent. This suggests momentum remains firmly on nVent Electric's side.

If rising dividends have you rethinking your watchlist, this could be a good moment to broaden your search and discover fast growing stocks with high insider ownership.

Yet with the stock already near record highs and trading at a premium to some industrial peers, the real question is whether nVent Electric still offers upside or if the market has already priced in its future growth.

Most Popular Narrative Narrative: 16.5% Undervalued

With the narrative fair value set around 121.54 dollars versus a 101.54 dollars close, the implied upside leans firmly on nVent Electric's structural growth story.

The rapid acceleration in global electrification, digitalization, and the surge in AI-driven data center and power utility infrastructure is leading to record new orders and a backlog more than four times higher than a year ago, with visibility into 2026 and beyond. This sets the stage for sustained revenue growth and increases the likelihood of multi-year topline outperformance.

Want to see what powers that backlog driven outlook? The narrative leans on ambitious revenue growth, rising margins, and a future earnings multiple that rivals sector leaders. Curious which projections have to come true to unlock that upside? Dive in to see the specific profit and cash flow assumptions that underpin this fair value call.

Result: Fair Value of $121.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could falter if AI data center spending cools or if recent acquisitions fail to deliver expected synergies and margin gains.

Find out about the key risks to this nVent Electric narrative.

Another Angle On Valuation

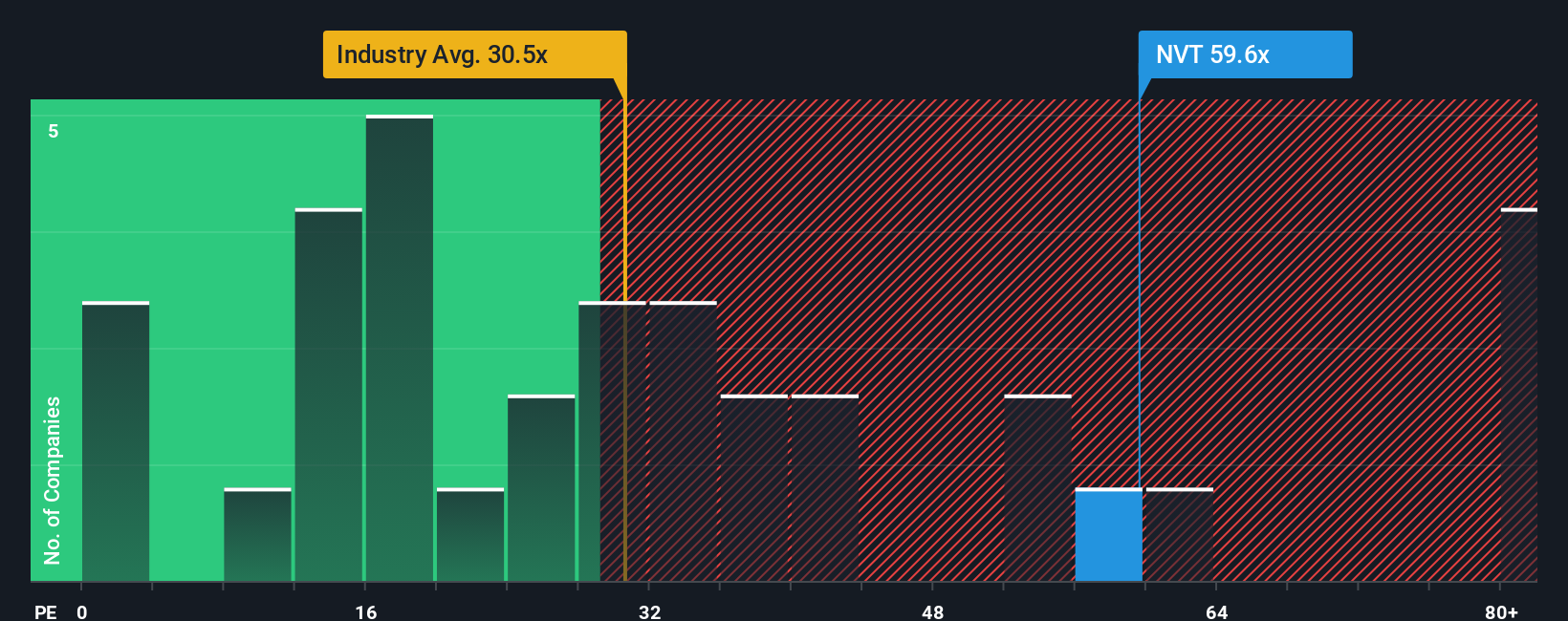

While the narrative points to upside, a simple earnings lens paints a tougher picture. NVT trades on a 55.3x price to earnings ratio versus 31.4x for the US Electrical industry and a fair ratio of 35.2x, which implies investors are paying a steep premium. Is that premium really sustainable?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own nVent Electric Narrative

If this perspective does not fully align with your own, or you would rather test the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your nVent Electric research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, put Simply Wall St to work for you by uncovering fresh stock ideas tailored to different strategies, so your next move is intentional.

- Capture early-stage potential by scanning these 3634 penny stocks with strong financials that already show solid fundamentals and potential room to grow.

- Explore emerging innovation by targeting these 24 AI penny stocks positioned at the intersection of artificial intelligence and earnings growth.

- Focus on quality at a lower price by looking at these 914 undervalued stocks based on cash flows that our models flag as mispriced relative to their cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com