Weighing PG&E Stock After Wildfire Liability Headlines And Recent 2025 Price Rebound

- Wondering if PG&E at around $15.73 is a beaten down utility bargain or a value trap? You are not alone, and this article is going to unpack that question head on.

- Despite a tough backdrop, the stock is up about 3.8% over the last week and 0.4% over the past month, even though it is still down roughly 21.4% year to date and 20.1% over the last year. A modest 28.0% gain over five years hints at a long, uneven recovery.

- Recent price moves sit against a backdrop of ongoing wildfire liability headlines, regulatory developments in California, and PG&E's continuing infrastructure hardening and safety investments that are reshaping its risk profile. There has also been steady news flow around debt management and system upgrades, which collectively influence how investors weigh the trade off between risk and long term cash flow potential.

- On our framework, PG&E scores a 4/6 valuation score, suggesting it screens as undervalued on most, but not all, of our checks. Next we will walk through the different valuation approaches we use while hinting at a more insightful way to think about its true worth by the end of the article.

Find out why PG&E's -20.1% return over the last year is lagging behind its peers.

Approach 1: PG&E Dividend Discount Model (DDM) Analysis

The Dividend Discount Model estimates what PG&E shares are worth by projecting future dividends per share and discounting them back to today, based on an assumed growth rate and required return.

PG&E currently pays about $0.25 in dividends per share, with an estimated long run dividend growth rate of roughly 3.3%, capped from a higher implied rate of about 8.2% to keep expectations more realistic. The model also factors in an expected earnings growth rate of around 8.2% and a return on equity close to 8.4%. Together, these figures are used to judge how sustainable and growable those dividends might be over time.

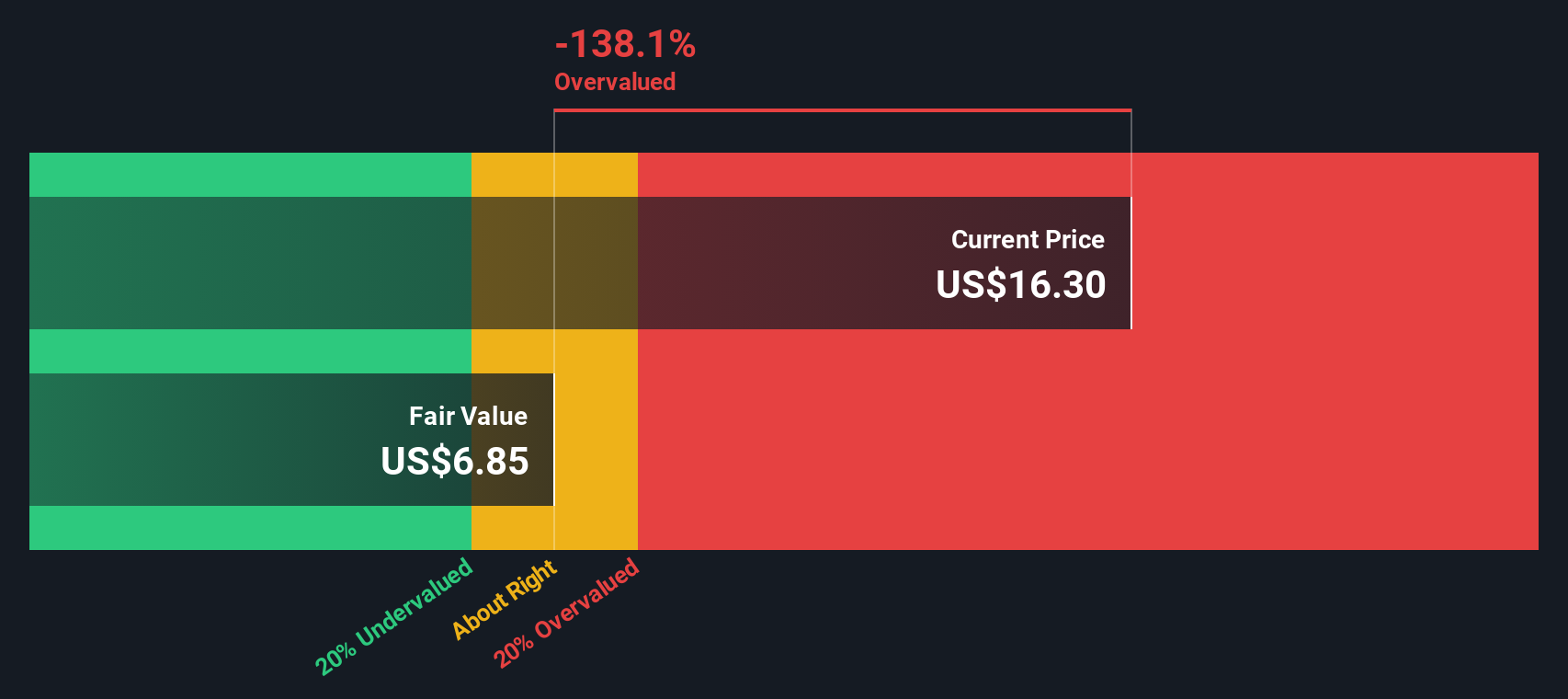

On this basis, the DDM output suggests an intrinsic value of roughly $6.85 per share. Compared with the current price around $15.73, the model implies PG&E is about 129.8% overvalued. This indicates that today’s market price is incorporating far more optimistic dividend growth than the DDM framework supports.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests PG&E may be overvalued by 129.8%. Discover 914 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: PG&E Price vs Earnings

For profitable companies like PG&E, the price to earnings, or PE, ratio is a useful way to gauge whether investors are paying a reasonable price for each dollar of current earnings. In general, faster growth and lower perceived risk justify a higher PE, while slower growth and higher risk should pull that multiple down.

PG&E currently trades on a PE of about 13.3x. That sits below both the broader Electric Utilities industry average of roughly 19.4x and a peer group average near 20.8x, which at face value makes the stock look inexpensive relative to its sector.

However, Simply Wall St’s Fair Ratio framework goes a step further by estimating what multiple PG&E should trade on, given its specific earnings growth outlook, profitability, risk profile, industry positioning and market cap. On this basis, PG&E’s Fair Ratio is estimated at around 26.9x, comfortably above its current 13.3x. That suggests the market is applying a heavier discount than the fundamentals alone would warrant, indicating potential upside if sentiment toward its risk profile improves.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your PG&E Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. This is a simple way to attach your story about PG&E to the numbers by linking what you believe about its future revenues, earnings and margins to a financial forecast and then to a Fair Value. All of this is inside an easy to use tool on Simply Wall St’s Community page, where millions of investors share their views. You can see in real time how different perspectives translate into different buy or sell signals as Fair Value is compared with today’s share price and automatically refreshed when new news or earnings arrive. For example, one PG&E Narrative might lean bullish with a fair value near the top analyst target around 23 dollars based on strong data center driven demand and improving wildfire protections. A more cautious Narrative might anchor closer to 17 dollars, focused on regulatory and affordability risks. You can decide which story, and which Fair Value, you think is more probable.

Do you think there's more to the story for PG&E? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com