Stryker (SYK): Reassessing Valuation After Dividend Hike and Parnassus Endorsement

Stryker (SYK) just paired a 5% dividend hike with a fresh vote of confidence from Parnassus Investments, and together those signals are encouraging investors to revisit the stock after a soft stretch.

See our latest analysis for Stryker.

That message lands at a time when momentum has cooled a bit, with the latest share price at $355.2 and a slightly negative year to date share price return, but a markedly stronger three and five year total shareholder return suggesting the longer term compounding story is still intact.

If Stryker’s mix of resilience and growth has your attention, this could be a good moment to explore other quality names across healthcare stocks and see what else fits your watchlist.

With earnings growing faster than revenue and shares still trading at a discount to analyst targets, investors now face a key question: Is Stryker mispriced for its next leg of growth, or is the market already there?

Most Popular Narrative: 16.9% Undervalued

With Stryker last closing at $355.20 versus a narrative fair value near $427.66, the gap in expectations puts the growth assumptions under the spotlight.

The ongoing industry shift to outpatient and minimally invasive procedures, where Stryker is a leading supplier of ASC infrastructure and advanced surgical solutions, positions the company to benefit from increased procedure volumes and deeper customer penetration, bolstering both revenue and operating leverage.

Curious how this narrative turns operating leverage, expanding margins and steady top line growth into a premium future earnings multiple, yet still calls the shares undervalued? The detailed blueprint behind that gap between current price and projected value is where the story really gets interesting.

Result: Fair Value of $427.66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, extended regulatory delays or persistent supply chain disruptions could cap international growth and margins and challenge the notion that Stryker’s premium multiple is fully justified.

Find out about the key risks to this Stryker narrative.

Another Angle on Valuation

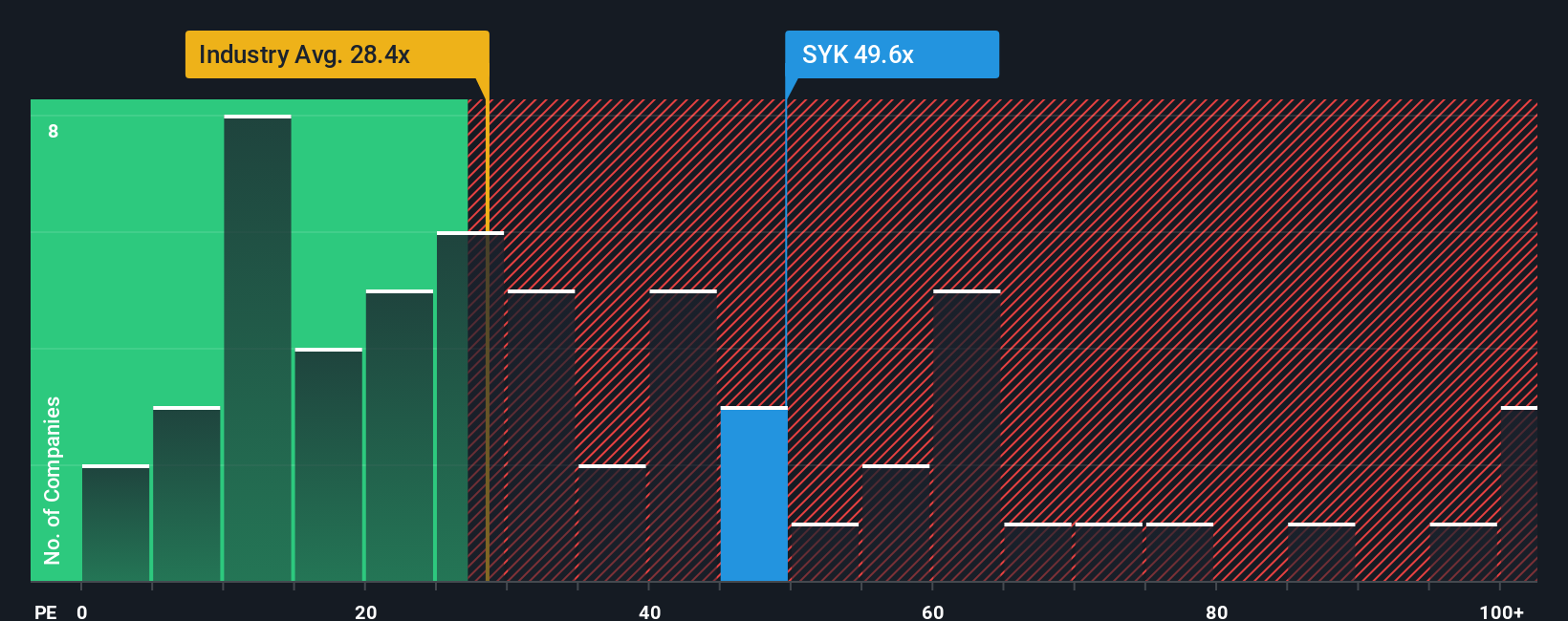

On simple earnings metrics, Stryker looks stretched, with a price to earnings ratio of 46.2 times versus the US Medical Equipment industry at 29.7 times and a fair ratio of 37.1 times, suggesting meaningful downside risk if sentiment cools or growth underwhelms.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Stryker Narrative

If you see the story differently or want to dig into the numbers yourself, you can shape a custom view in just minutes with Do it your way.

A great starting point for your Stryker research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing edge?

Before you move on, lock in an information advantage by using the Simply Wall St Screener to surface fresh opportunities that fit your strategy and risk profile.

- Capture potential mispricings by targeting companies trading below their estimated worth through these 914 undervalued stocks based on cash flows. This can give you a clear starting point for value ideas.

- Scan for innovators accelerating artificial intelligence breakthroughs with these 24 AI penny stocks to find businesses that may be influencing how industries operate.

- Focus on companies that generate cash and consistently return it to shareholders via these 12 dividend stocks with yields > 3% to identify firms with meaningful dividend payouts today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com