A look at Public Service Enterprise Group’s valuation after fresh J.D. Power win and sustainability milestones

Public Service Enterprise Group (PEG) just picked up its fourth straight J.D. Power customer satisfaction win in the East Region, alongside recycling over 86% of utility materials. This combination quietly sharpens the stock’s long term appeal.

See our latest analysis for Public Service Enterprise Group.

Even with that steady stream of customer wins and sustainability milestones, PEG’s recent 1 year total shareholder return of around negative 3 percent and a softer year to date share price return near negative 6 percent suggest momentum is consolidating rather than breaking out, following a strong three year total shareholder return close to 45 percent.

If PEG’s mix of reliability and resilience has you rethinking your utilities exposure, it might also be worth exploring healthcare stocks as another pocket of potentially durable, fundamentals driven opportunities.

With PEG trading roughly 6 percent below consensus targets despite solid revenue and earnings growth, investors face a key question: Is this a quiet value opportunity, or has the market already priced in the next leg of growth?

Most Popular Narrative: 10.6% Undervalued

With the most followed fair value sitting near $89.50 against PEG’s recent $80.01 close, the narrative frames a measured upside built on steady expansion.

Analysts are assuming Public Service Enterprise Group's revenue will grow by 3.5% annually over the next 3 years.

Analysts assume that profit margins will increase from 17.8% today to 19.9% in 3 years time.

Curious how modest growth rates and a higher future earnings multiple can still justify a premium valuation for a regulated utility heavyweight? Unlock the full blueprint behind that upside case and see which earnings and margin assumptions do the heavy lifting in this fair value view.

Result: Fair Value of $89.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower data center conversions or tougher New Jersey regulatory decisions on cost recovery could quickly weaken the earnings and valuation case behind that upside.

Find out about the key risks to this Public Service Enterprise Group narrative.

Another Lens on Value

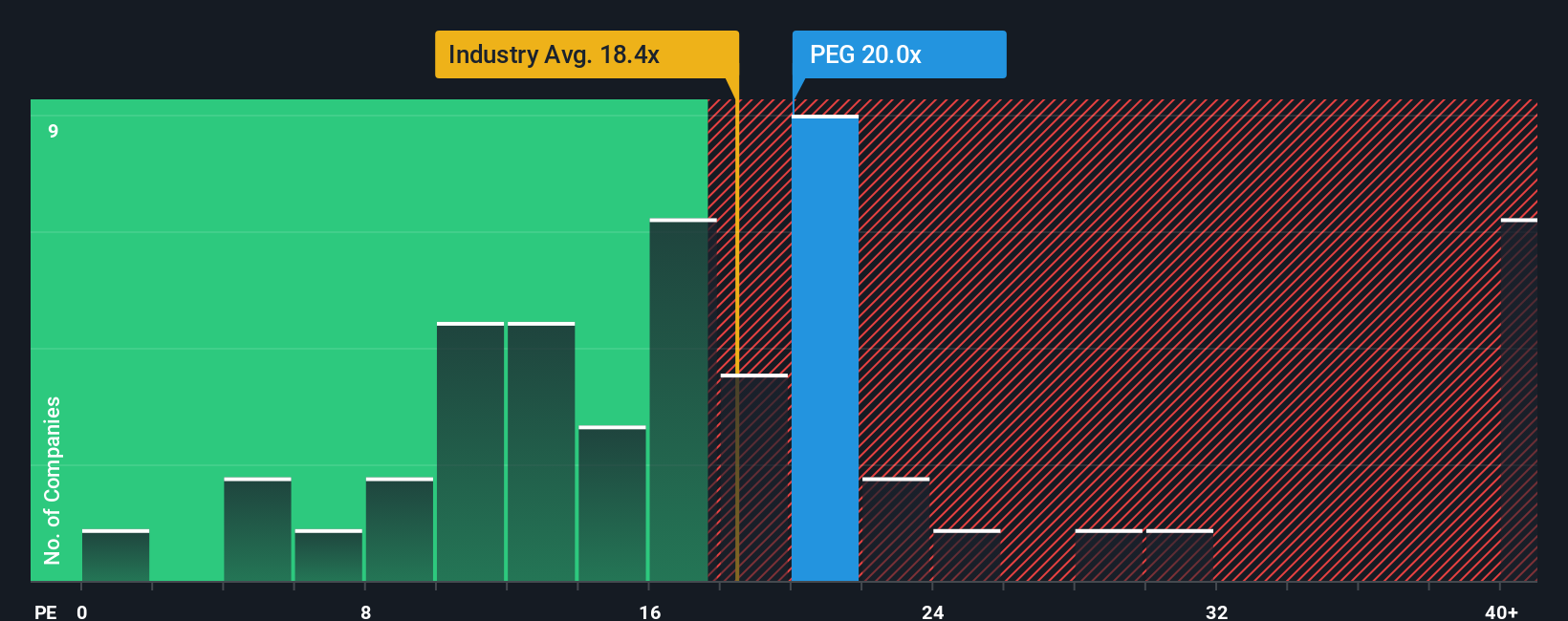

On earnings, PEG looks slightly pricey at 19.2 times compared with US peers at 18.9 times and the global integrated utilities average at 17.9 times. Yet our fair ratio of 23.1 times implies the market might be underestimating its earning power, leaving a narrow but intriguing window, or a value trap in the making?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Public Service Enterprise Group Narrative

If this perspective does not quite fit your view, or you would rather dig into the numbers yourself, you can craft a custom narrative in just a few minutes, Do it your way.

A great starting point for your Public Service Enterprise Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about strengthening your portfolio, use the Simply Wall St Screener now to uncover opportunities other investors may overlook until it is too late.

- Capture potential bargain entries by targeting companies trading below intrinsic value using these 914 undervalued stocks based on cash flows grounded in cash flow strength, not market hype.

- Position yourself at the intersection of medicine and machine learning with these 29 healthcare AI stocks, where innovation and long term demand can support resilient growth.

- Lock in potential income streams by focusing on these 12 dividend stocks with yields > 3% that combine attractive yields with robust underlying fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com