Assessing American Water Works (AWK) Valuation After Kentucky Rate Approval and New Sustainability Recognition

The latest rate approval for Kentucky American Water, combined with fresh sustainability accolades, gives investors a timely reason to revisit American Water Works Company (AWK) and its long term earnings and dividend potential.

See our latest analysis for American Water Works Company.

Even with the new Kentucky rate approval and fresh sustainability recognition in the mix, American Water Works Company’s 5.16% year to date share price return and modest 5.98% one year total shareholder return suggest steady, not explosive, momentum as investors weigh regulated growth against valuation and interest rate risk.

If this kind of steady utility exposure appeals to you, it is also worth exploring other healthcare stocks where essential services, stable cash flows, and defensive characteristics can create interesting long term ideas.

With steady mid single digit revenue and earnings growth, a premium multiple, and only a single digit discount to analyst targets, the key question now is whether American Water is quietly undervalued or if markets already price in its next leg of growth.

Most Popular Narrative: 9.4% Undervalued

With the latest fair value estimate sitting above American Water Works Company’s last close of $130.25, the prevailing narrative frames AWK as moderately mispriced in investors’ favor.

Heightened regulatory and societal focus on water quality and infrastructure modernization is accelerating rate case approvals and driving significant capital investment (e.g., $3.3 billion capital spend in 2025, requests for $111 million cumulative rate increases in CA by 2029). These factors enable predictable, above inflation rate increases and support sustainable earnings expansion.

Want to see how steady mid single digit growth, rising margins, and a rich future earnings multiple combine into that fair value call, including the exact assumptions behind it? Read on to unpack the full blueprint behind this valuation story and why a relatively low discount rate still points to upside.

Result: Fair Value of $143.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising debt costs and any stumble on key rate approvals could quickly erode that projected margin expansion and pressure AWK’s valuation case.

Find out about the key risks to this American Water Works Company narrative.

Another Angle on Valuation

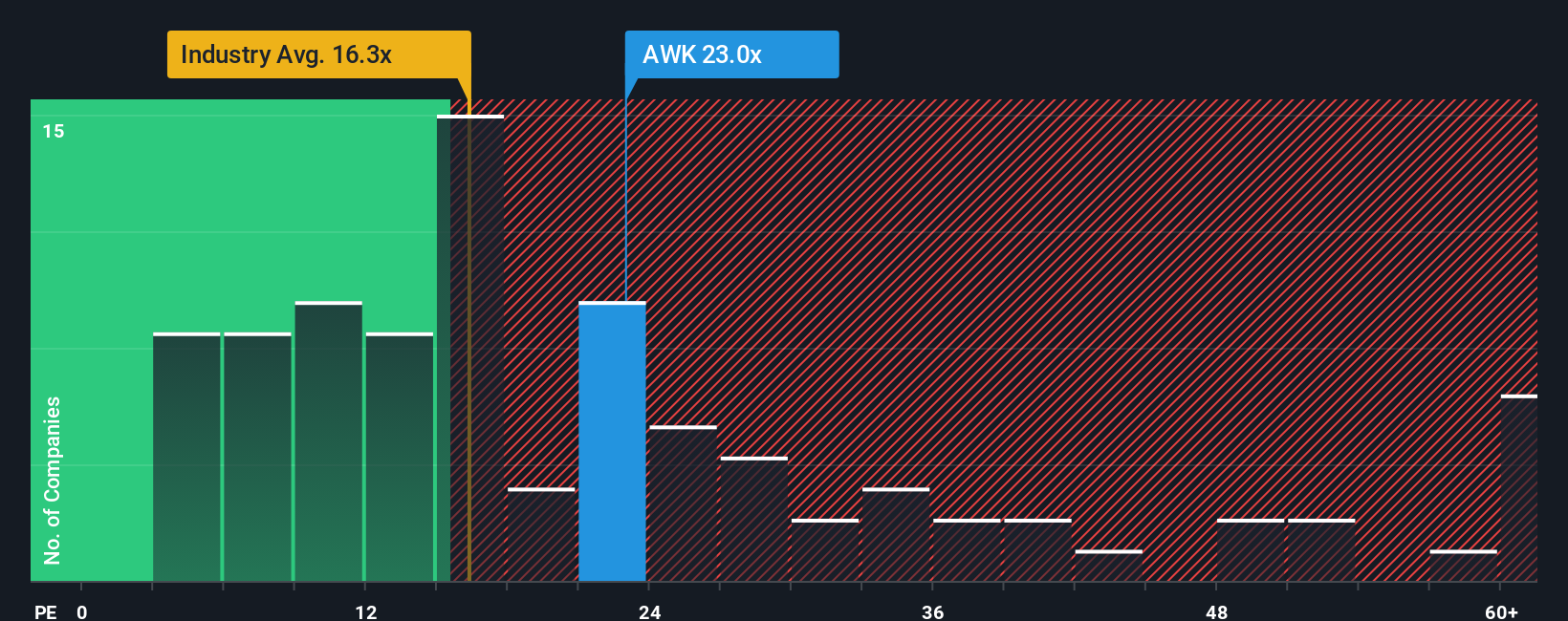

Looked at through its price to earnings ratio, American Water looks far less forgiving. Shares trade at about 22.9 times earnings, versus roughly 16 times for the global water utilities group and 18.2 times for peers, leaving limited room for execution missteps or rate surprises.

That said, the current price is close to our fair ratio of 23.6 times earnings, which suggests the market may already be near where it should be, not wildly stretched or deeply cheap. The question, then, is whether investors are really being paid enough for the regulatory and financing risks ahead.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own American Water Works Company Narrative

If you see the story differently or want to stress test the assumptions with your own inputs, you can build a personalized narrative in just minutes: Do it your way.

A great starting point for your American Water Works Company research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Instead of stopping with American Water, put Simply Wall Street’s Screener to work and uncover focused opportunities you might regret missing when the next leg higher begins.

- Target reliable income streams by scanning these 12 dividend stocks with yields > 3% that can complement steady utility holdings with potentially stronger cash returns.

- Catch early growth stories by reviewing these 3634 penny stocks with strong financials that already show improving fundamentals instead of waiting for the crowd to notice.

- Strengthen your value watchlist by checking these 914 undervalued stocks based on cash flows, where mispriced cash flows may offer more upside than mature, fully priced names.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com