Indivior (NasdaqGS:INDV): Reassessing Valuation After Positive SUBLOCADE and INDV-2000 Clinical Trial Results

Indivior (NasdaqGS:INDV) just gave investors fresh reasons to revisit the stock, with new clinical data on SUBLOCADE and Phase II results for INDV-2000 underscoring progress in treating high risk opioid use disorder.

See our latest analysis for Indivior.

Those encouraging readouts help explain why Indivior’s 90 day share price return sits at 51.31 percent and its 1 year total shareholder return is 201.97 percent, suggesting momentum is building around the story.

If this kind of clinical progress has caught your attention, it could be worth exploring other potential opportunities across healthcare stocks to see how Indivior compares in a broader healthcare context.

With shares already up sharply and trading only modestly below analyst targets, the key question now is whether Indivior’s clinical wins still leave upside on the table or if the market has fully priced in its future growth.

Price to Earnings of 35.5x, Is it justified?

Indivior looks richly priced on a headline basis, with a 35.5x price to earnings ratio at a last close of $35.21, even after its strong recent run.

The price to earnings multiple compares what investors pay today with the company’s current earnings, a key yardstick for profitable pharmaceutical and biotech names where cash flows have turned positive.

In Indivior’s case, the market appears to be paying up for a sharp inflection in profitability, with earnings expected to grow 39 percent per year, significantly faster than the broader US market. At the same time, our fair value framework suggests a lower fair price to earnings ratio of 27.8x that the market could eventually gravitate toward if expectations cool.

That premium becomes clearer against peers, as Indivior trades on 35.5x price to earnings versus the US pharmaceuticals industry average of 19.8x. This underscores how far sentiment has moved and how much future earnings strength investors are already baking in.

Explore the SWS fair ratio for Indivior

Result: Price-to-Earnings of 35.5x (OVERVALUED)

However, downside risks remain if SUBLOCADE growth slows, competitive OUD treatments gain share, or key pipeline assets like INDV-2000 underwhelm in later stage trials.

Find out about the key risks to this Indivior narrative.

Another View on Indivior's Value

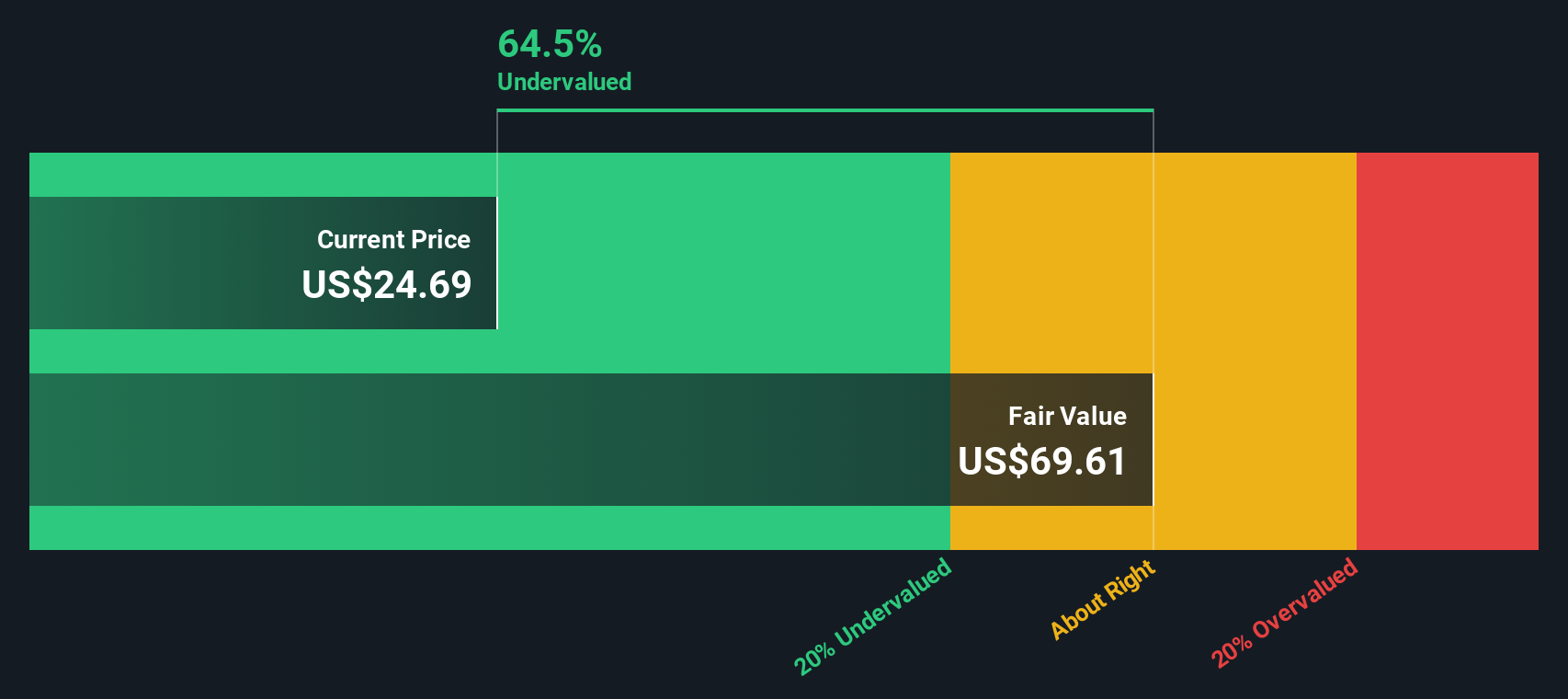

While the 35.5x price to earnings ratio makes Indivior look expensive, our DCF model presents a different perspective. It indicates the shares trade around 66.8 percent below an estimated fair value of $106.15 per share, suggesting potential upside if cash flows materialize as expected.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Indivior for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Indivior Narrative

If you would rather rely on your own analysis and dive into the numbers yourself, you can build a complete narrative in just a few minutes: Do it your way.

A great starting point for your Indivior research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before momentum shifts again, put Simply Wall Street’s Screener to work and line up your next opportunities so you are not scrambling later.

- Explore long term wealth-building potential by reviewing steady income candidates through these 12 dividend stocks with yields > 3% and see which payouts might complement your portfolio.

- Review companies working on innovative technologies by scanning these 24 AI penny stocks and identify those engaged in artificial intelligence.

- Assess early stage opportunities within these 3634 penny stocks with strong financials and consider how they might fit into a diversified portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com