Assessing Madrigal Pharmaceuticals (MDGL) Valuation After Bullish Rezdiffra Data, FDA Designations and Analyst Upgrades

Madrigal Pharmaceuticals (MDGL) has been climbing after upbeat FDA designations for Rezdiffra and encouraging Phase 3 MAESTRO-NAFLD-1 data, showing improved liver biomarkers in MASH cirrhosis, which is sharpening investor focus on its long term runway.

See our latest analysis for Madrigal Pharmaceuticals.

The latest FDA designations, upbeat MAESTRO-NAFLD-1 data and a stream of bullish research coverage have fed directly into a powerful rerating, with an 8.56% 1 day share price return helping extend Madrigal’s year to date share price return to 88.35% and its 1 year total shareholder return to 91.62%. This reinforces a longer term track record that includes a 392.02% 5 year total shareholder return and signals that momentum is clearly building around Rezdiffra’s commercial story.

If breakthrough liver data has grabbed your attention, this is also a good moment to explore other potential winners across healthcare stocks that could fit a similar high opportunity, higher risk profile.

With shares now near analysts’ targets and long term returns already eye catching, the key question is whether Madrigal still trades at a discount to its Rezdiffra opportunity or if the market has fully priced in future growth.

Most Popular Narrative: 2.1% Undervalued

With Madrigal’s shares last closing at $591.02 against a narrative fair value of $603.47, the story leans only modestly in favor of upside and puts every growth assumption under the microscope.

The analysts have a consensus price target of $461.429 for Madrigal Pharmaceuticals based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $567.0, and the most bearish reporting a price target of just $266.0.

Want to see what justifies a rich, tech like earnings multiple for a still unprofitable liver drug specialist? The narrative hinges on steep revenue acceleration, a sharp swing to profitability and a long runway of protected cash flows. Curious which specific growth and margin inflection points have to land almost perfectly for this valuation to hold together?

Result: Fair Value of $603.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat path could be knocked off course by GLP 1 competition, or by slower than expected cirrhosis uptake and reimbursement progress.

Find out about the key risks to this Madrigal Pharmaceuticals narrative.

Another Lens On Value

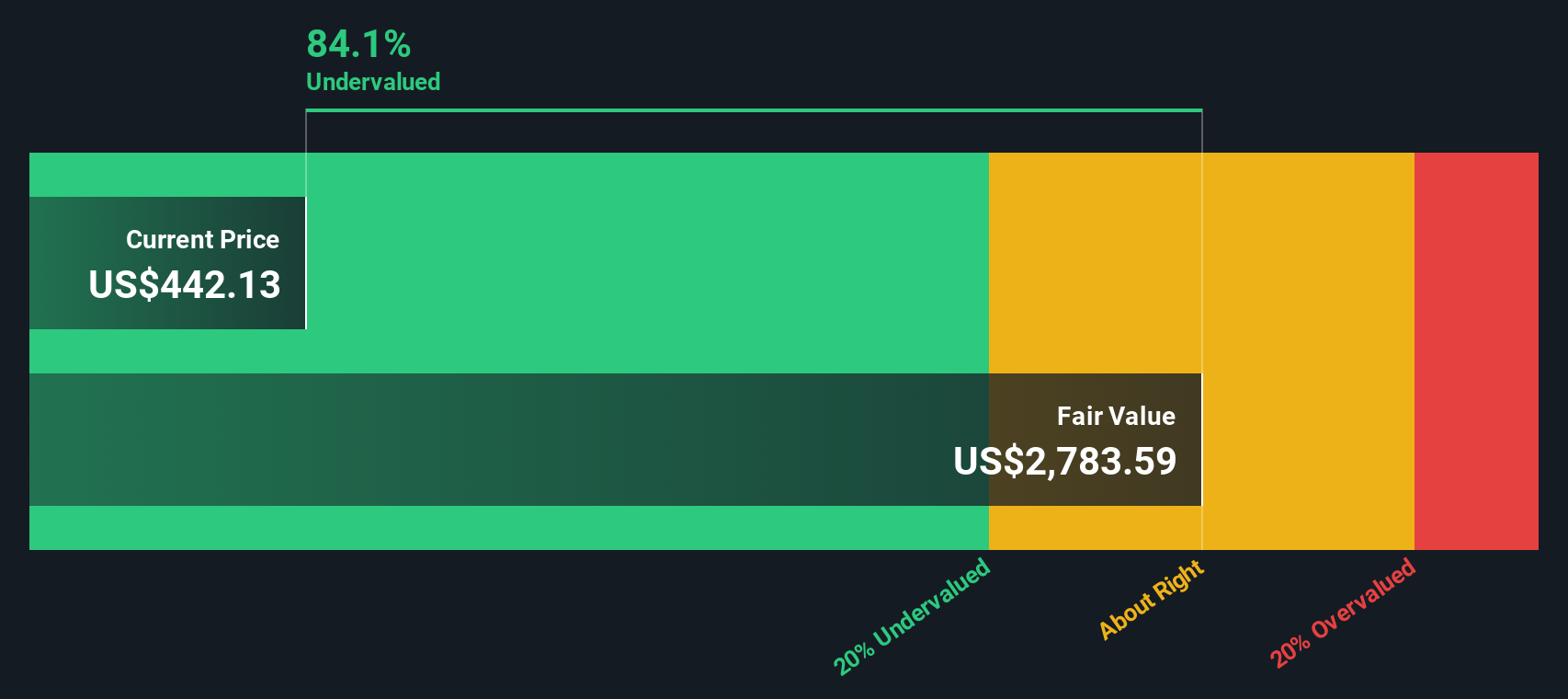

While the narrative suggests only a small 2.1% upside, our SWS DCF model is far more aggressive and implies MDGL is trading about 79.7% below its estimated fair value. That large gap hints at either a rare opportunity or a sign that long term assumptions are too optimistic.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Madrigal Pharmaceuticals Narrative

If you would rather rely on your own analysis or challenge these assumptions, you can build a personalized Madrigal view in just minutes, Do it your way.

A great starting point for your Madrigal Pharmaceuticals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, make sure you are not leaving potential winners on the table. The Simply Wall Street Screener can surface ideas you might otherwise miss.

- Capture early stage growth potential by reviewing these 3634 penny stocks with strong financials that already show strong financial foundations instead of speculative hype.

- Position your portfolio for the next productivity wave by targeting these 24 AI penny stocks that blend cutting edge innovation with improving fundamentals.

- Strengthen your income stream by filtering for these 12 dividend stocks with yields > 3% that can help support long term returns through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com