Toyo Seikan Group Holdings (TSE:5901) Valuation After New Restricted Share Incentive Plan Announcement

Toyo Seikan Group Holdings (TSE:5901) has kicked off a new chapter in its equity story by launching a restricted share incentive plan, allotting up to 738,300 treasury shares to its employee shareholding association.

See our latest analysis for Toyo Seikan Group Holdings.

The plan lands at a time when momentum is clearly building, with a roughly 11 to 12 percent 3 month share price return and a powerful long term total shareholder return profile that suggests growing confidence in Toyo Seikan’s prospects.

If this kind of alignment between employees and shareholders interests you, it could also be worth exploring fast growing stocks with high insider ownership as a way to uncover other compelling ideas.

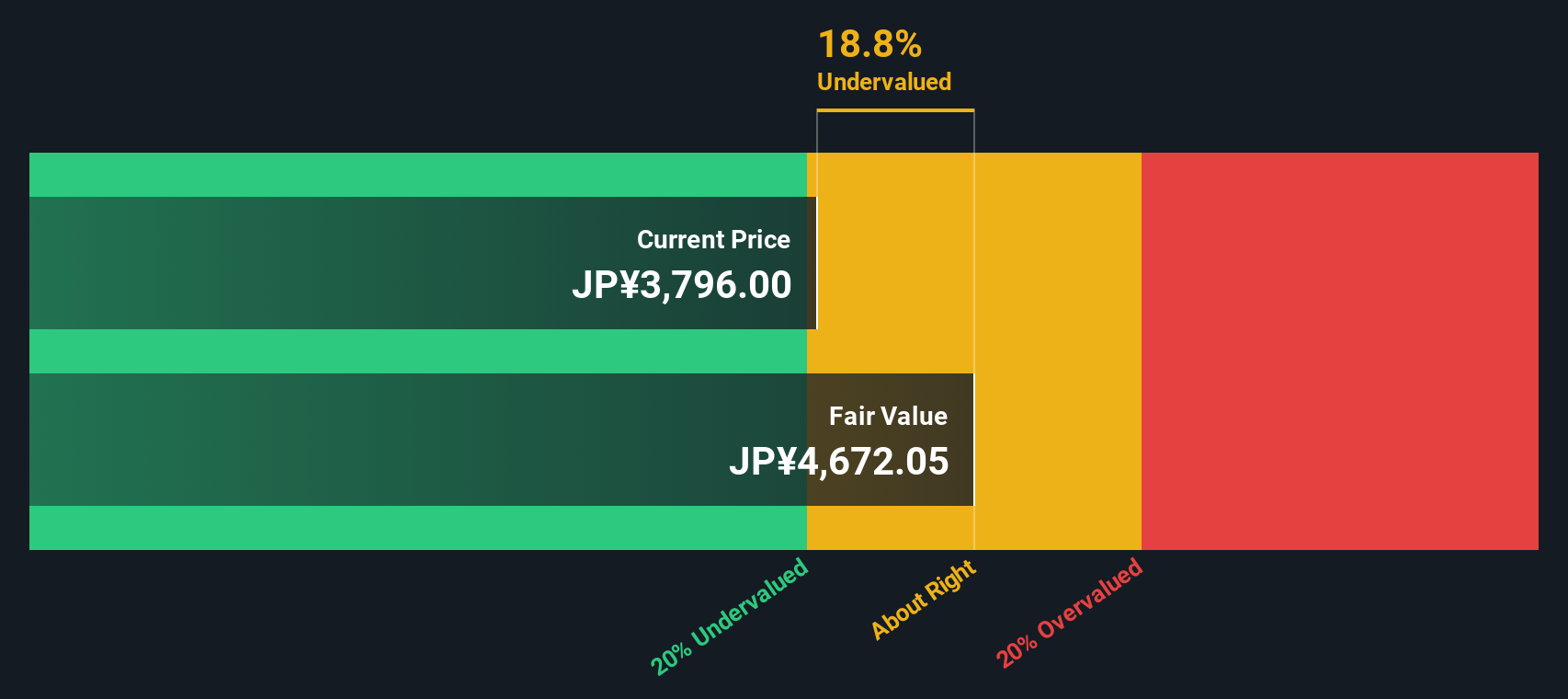

But with the shares already up strongly this year and trading at what appears to be around a 17 percent discount to estimated intrinsic value, is there still a buying opportunity here, or is the market already pricing in future growth?

Price-to-Earnings of 13.1x: Is it justified?

Toyo Seikan Group Holdings last closed at ¥3,863, and on a price-to-earnings ratio of 13.1x it trades at a premium to peers despite a sizable discount to intrinsic value estimates.

The price-to-earnings multiple compares the current share price to earnings per share, making it a direct gauge of how much investors are willing to pay for each unit of current profit. For a mature packaging business, this is a central lens because earnings tend to be more stable than high growth tech style revenue stories.

Here, the 13.1x price-to-earnings ratio sits above both the Japanese packaging industry average of 10.3x and the broader peer group on 10.5x. This implies the market is already paying up for Toyo Seikan’s recent earnings acceleration and higher profit margins. That sits alongside our DCF model suggesting the shares trade at roughly a 17.3% discount to an estimated fair value of around ¥4,669. This indicates the valuation premium on earnings might still be compatible with longer term cash flow potential.

Relative to the industry, the current price-to-earnings premium is clear, with Toyo Seikan valued more richly than the typical Japanese packaging name. The market appears to be assigning the company a higher status than its sector peers, reflecting its strong profit growth and improved margins, while still leaving room for upside if cash flows evolve as expected.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 13.1x (ABOUT RIGHT)

However, risks remain, including potential slowdowns in global packaging demand and margin pressure from raw material costs that could challenge current growth expectations.

Find out about the key risks to this Toyo Seikan Group Holdings narrative.

Another View on Value

While the 13.1x earnings multiple looks full next to peers, our DCF model still points to a fair value of about ¥4,669 per share, roughly 17% above the current price. If the market starts to care more about long term cash flows than near term optics, could that gap close?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Toyo Seikan Group Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Toyo Seikan Group Holdings Narrative

If you see the story differently or would rather dig into the numbers yourself, you can shape a personalised view in minutes: Do it your way.

A great starting point for your Toyo Seikan Group Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not leave your next opportunity to chance. Use the Simply Wall Street Screener to pinpoint stocks that match your strategy before the market catches on.

- Capture early-stage potential by scanning these 3634 penny stocks with strong financials that combine small size with surprisingly resilient fundamentals.

- Position yourself at the frontier of innovation by targeting these 24 AI penny stocks shaping the future of automation and intelligent software.

- Focus on these 12 dividend stocks with yields > 3% that aim to deliver dividend yields above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com