IPO News | Daotong Technology (688208.SH) lists the Hong Kong Stock Exchange as the world's number one digital intelligent vehicle diagnostic solution provider

The Zhitong Finance App learned that according to the Hong Kong Stock Exchange's disclosure on December 19, Shenzhen Daotong Technology Co., Ltd. (688208.SH)) submitted a listing application to the main board of the Hong Kong Stock Exchange, and CICC is its sole sponsor.

Company profile

According to the prospectus, Daotong Technology is a leading provider of digital intelligent vehicle diagnosis and smart charging solutions. According to Frost & Sullivan, based on revenue in 2022, 2023 and 2024, the company is the world's number one digital intelligent vehicle diagnostic solution provider, and its market share increased from 9.1% in 2022 to 11.1% in 2024; in terms of overseas revenue in 2024, the company is the largest smart charging solution provider in China, and in terms of 2024 revenue, the company is the fourth largest smart charging solution provider in North America and the largest Chinese smart charging solution provider in North America.

With more than 20 years of industry experience, the company has developed a comprehensive solution portfolio with strong synergies and based on strong technical capabilities. During the track record period, the company generated revenue by providing digital intelligent vehicle diagnosis and smart charging solutions. At the same time, the company continues to break through the boundaries of its AI applications and technical capabilities in fields with huge potential for commercial growth. The company has launched a personalized intelligent cluster solution. The solution can help users collaborate with multiple embodied agents through the company's self-developed AI application platform to enable facility management with monitoring and operation and maintenance capabilities.

The company has established a global sales network covering about 100 countries or regions around the world. The company's sales channels include distribution networks and direct sales channels. The company has cooperated with more than 800 dealers around the world to continuously expand market coverage and increase market penetration. At the same time, the company directly cooperates with end customers to provide services to the world's top energy companies, mainstream charging facility operators, automotive diagnostic equipment dealers, and Fortune 500 companies.

With customer needs as the core, the company uses industry expertise and AI technology to provide comprehensive software and hardware integration solutions, combining one-time hardware revenue with continuous software revenue to create a scalable and sustainable business model. The company uses intelligent hardware as a business entry point to reach customers, and continues to create value for customers through software services. This business model helps companies replicate successful experiences into various solution businesses.

Financial data

revenue

The company recorded revenue of approximately 2,266 billion yuan, 3.251 billion yuan, 3,932 billion yuan, and 2,345 billion yuan in 2022, 2023, 2024, and 2025 respectively for the six months ended June 30.

Profit during the year/period

The company recorded annual profits of approximately RMB 81.609 million, RMB 140 million, RMB 560 million and RMB 455 million in 2022, 2023, 2024, and 2025 respectively for the six months ended June 30.

Mōri

The company recorded gross profit of approximately 1,264 billion yuan, 1,703 billion yuan, 2,082 billion yuan, and 1,260 billion yuan in 2022, 2023, 2024, and 2025 respectively for the six months ended June 30.

Industry Overview

Digital intelligent vehicle diagnosis is a software and hardware integrated solution designed to provide vehicle condition assessment, fault detection and performance analysis. It covers diagnostic tablets, TPMS products, ADAS calibration products, software update subscription services, cloud services and related products. As a core hub connecting vehicles, technicians, diagnostic data and cloud services, digital intelligent vehicle diagnosis has become the cornerstone of ensuring the safe, reliable and environmentally friendly operation of vehicles. Under the trend of electrification and intelligence, its importance is increasing.

The traditional vehicle diagnosis industry generally has problems such as poor product compatibility, limited inspection coverage, high dependence on technicians' professional experience, and slow repetitive calculation of equipment updates, making it difficult to balance diagnostic efficiency and accuracy. In this context, leading digital intelligent vehicle diagnostic solution providers are integrating AI voice assistants, smart detection, and cloud collaboration functions into solutions by using the synergy between vertical models and smart terminals. In the future, the deep integration of AI technology will become the core of improving the efficiency of the industry, further promoting the evolution of the field of digital intelligent vehicle diagnosis towards intelligence and efficiency.

The market size of the global digital intelligent vehicle diagnostic industry increased from about US$2,809 million in 2020 to US$3.832 billion in 2024, with a compound annual growth rate of 8.1%. The market size is expected to increase further to approximately US$8.04 billion by 2030, and the compound annual growth rate from 2024 to 2030 is expected to reach 13.1%. In 2024, North America, Europe, China and other regions accounted for 36.5%, 39.3%, 12.1%, and 12.2%, respectively. By 2030, North America will continue to lead, with a share of 37.9%.

In the future, with the increase in the penetration rate of AI agents in the field of vehicle diagnosis, the popularity of remote diagnosis services, and the accelerated deployment of enterprise cloud platforms, the share of software solutions is expected to rise sharply, from 16.8% in 2024 to 26.7% in 2030. This change reflects the continuous evolution of the industry from hardware-centric systems to comprehensive solutions that deeply integrate hardware, software, and services.

Board of Directors and Executive Information

The board of directors of the company will be composed of seven directors, including four executive directors and three independent non-executive directors.

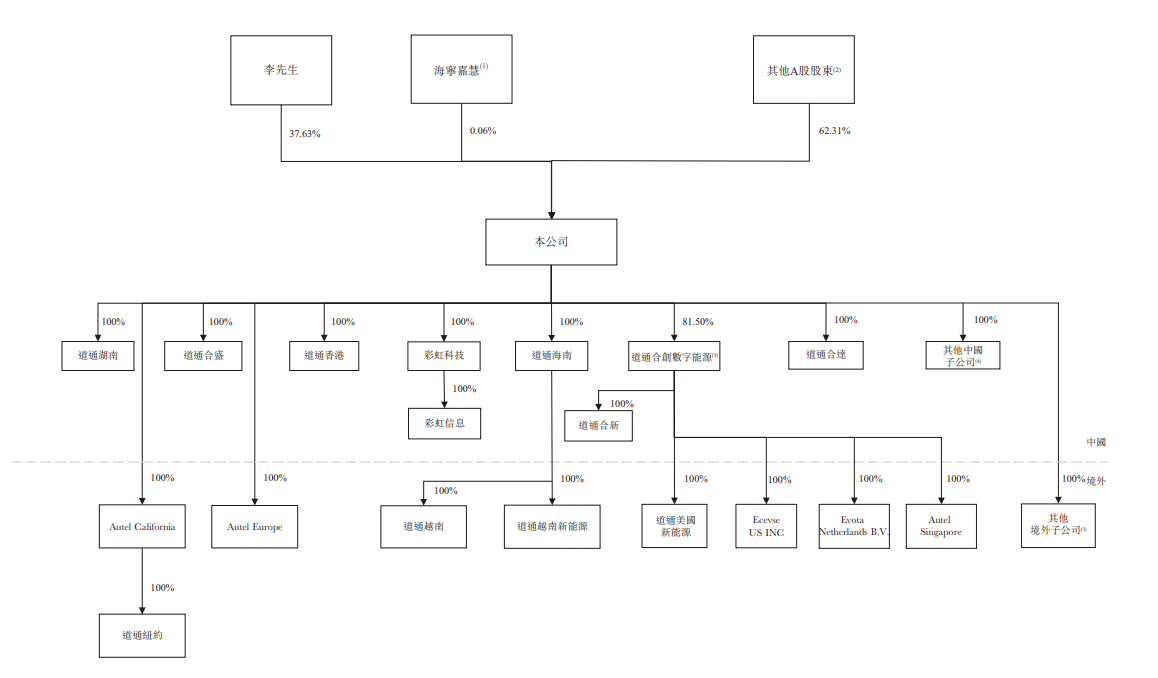

Shareholding structure

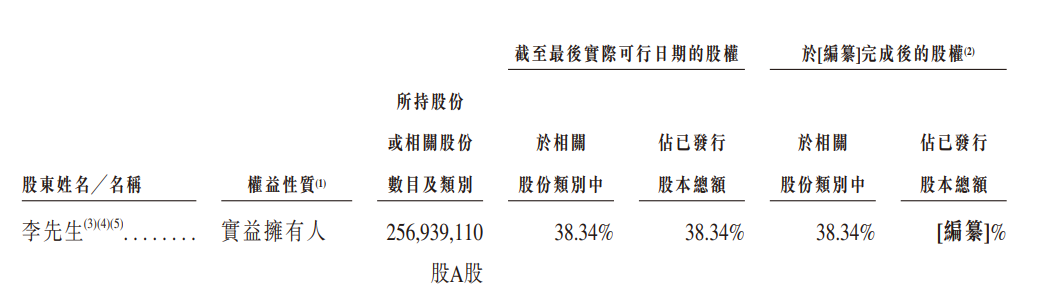

Mr. Li, the company's executive director, chairman and general manager, directly holds 252,169,993 A shares, accounting for about 37.63% of the company's total issued share capital and 37.83% of the voting rights at the company's shareholders' meeting (excluding 3,651,617 A shares held by the company as treasury shares until the last practical date).

As soon as [compilation] is completed, Mr. Lee will be the controlling shareholder of the company.

Intermediary team

Sole sponsor: China International Finance Hong Kong Securities Limited

Industry Advisor: Frost & Sullivan (Beijing) Consulting Co., Ltd. Shanghai Branch

Company Legal Adviser: Regarding Hong Kong Law and US Law: Pu Heng Law Firm (Hong Kong) Limited Liability Partnership; Related to Chinese Law: Zhong Lun Law Firm

Auditor and reporting accountant: Tianjian International Certified Public Accountants Limited