Aluminum Corp of China (SEHK:2600) Valuation After New Energy High-Precision Foil Expansion Moves

Aluminum Corporation of China (SEHK:2600) just shook things up with a completed capital contribution to Yunnan Aluminum Foil, backing a new energy high precision sheet, strip, and foil project that sharpens its high end growth trajectory.

See our latest analysis for Aluminum Corporation of China.

The move into high precision new energy materials comes after a strong run, with Aluminum Corporation of China’s share price returning around 51% over 90 days and a 1 year total shareholder return above 170%. This suggests momentum is still building as recent index inclusion and incentive plan unlocks reset expectations.

If this kind of repositioning toward higher value products interests you, it might be worth scanning fast growing stocks with high insider ownership as your next stop for potential fast movers.

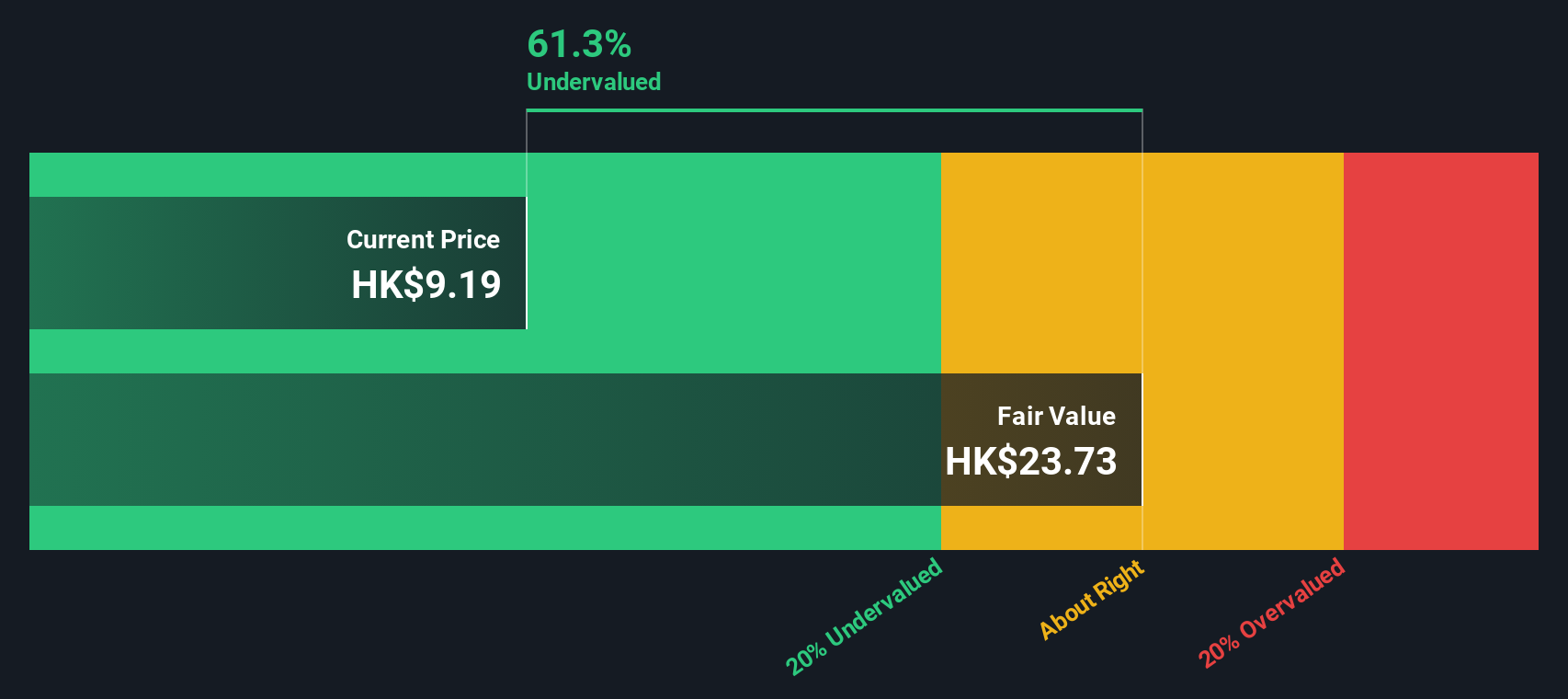

Yet with the shares already up sharply and now trading only slightly below analyst targets but far beneath some intrinsic value estimates, investors have to ask: is this still a buy, or is future growth already priced in?

Price-to-Earnings of 12.4x: Is it justified?

On a price-to-earnings basis, Aluminum Corporation of China looks undervalued, with its 12.4x multiple sitting below both peers and the broader industry.

The price-to-earnings ratio compares the current share price with annual earnings per share, making it a useful yardstick for a mature, profitable producer like Aluminum Corporation of China.

Here, the company trades at 12.4x earnings, while similar peers sit closer to 23.4x, and the Hong Kong Metals and Mining industry averages around 17.1x. Against an estimated fair price-to-earnings of 16.3x, the current discount hints that the market could still re rate the stock if the company continues to deliver on its earnings track record.

Explore the SWS fair ratio for Aluminum Corporation of China

Result: Price-to-Earnings of 12.4x (UNDERVALUED)

However, slower revenue growth and only modest upside to consensus price targets could limit near term gains if execution or commodity conditions disappoint.

Find out about the key risks to this Aluminum Corporation of China narrative.

Another View: Big Gap on Our DCF

Our DCF model paints a very different picture, suggesting fair value around HK$25.30, roughly 55% above the current HK$11.33 price. That implies the stock may be undervalued, but it also assumes earnings and cash flows hold up over time. Is the market missing something, or simply being more cautious?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aluminum Corporation of China for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aluminum Corporation of China Narrative

If you see the numbers differently or want to stress test your own assumptions, build a fresh narrative in just a few minutes, Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Aluminum Corporation of China.

Ready for your next investing move?

Before you stop here, use the Simply Wall St Screener to pinpoint fresh, high potential ideas other investors may overlook, and keep your watchlist one step ahead.

- Explore early stage opportunities with these 3634 penny stocks with strong financials that already show strong financial foundations, not just hype.

- Identify future facing opportunities by scanning these 24 AI penny stocks shaping automation, machine learning, and real world AI adoption.

- Find value focused ideas using these 914 undervalued stocks based on cash flows that appear mispriced based on their underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com