Bread Financial (BFH): Reassessing Valuation After Fitch’s Rating Moves and Ongoing Earnings Outperformance

Bread Financial Holdings (BFH) just saw Fitch assign a B minus rating to its new perpetual preferred stock, building on an earlier issuer upgrade to BB with a stable outlook that underscores improving credit quality.

See our latest analysis for Bread Financial Holdings.

The latest Fitch actions and a run of earnings beats seem to be feeding into sentiment, with the share price now at $78.0 and a strong 30 day share price return of 20.56 percent helping extend a 26.14 percent 1 year total shareholder return and a powerful 122.13 percent 3 year total shareholder return. This suggests momentum is still building rather than fading.

If this kind of rerating has you wondering what else could be next, it might be a good time to explore fast growing stocks with high insider ownership for other fast moving opportunities.

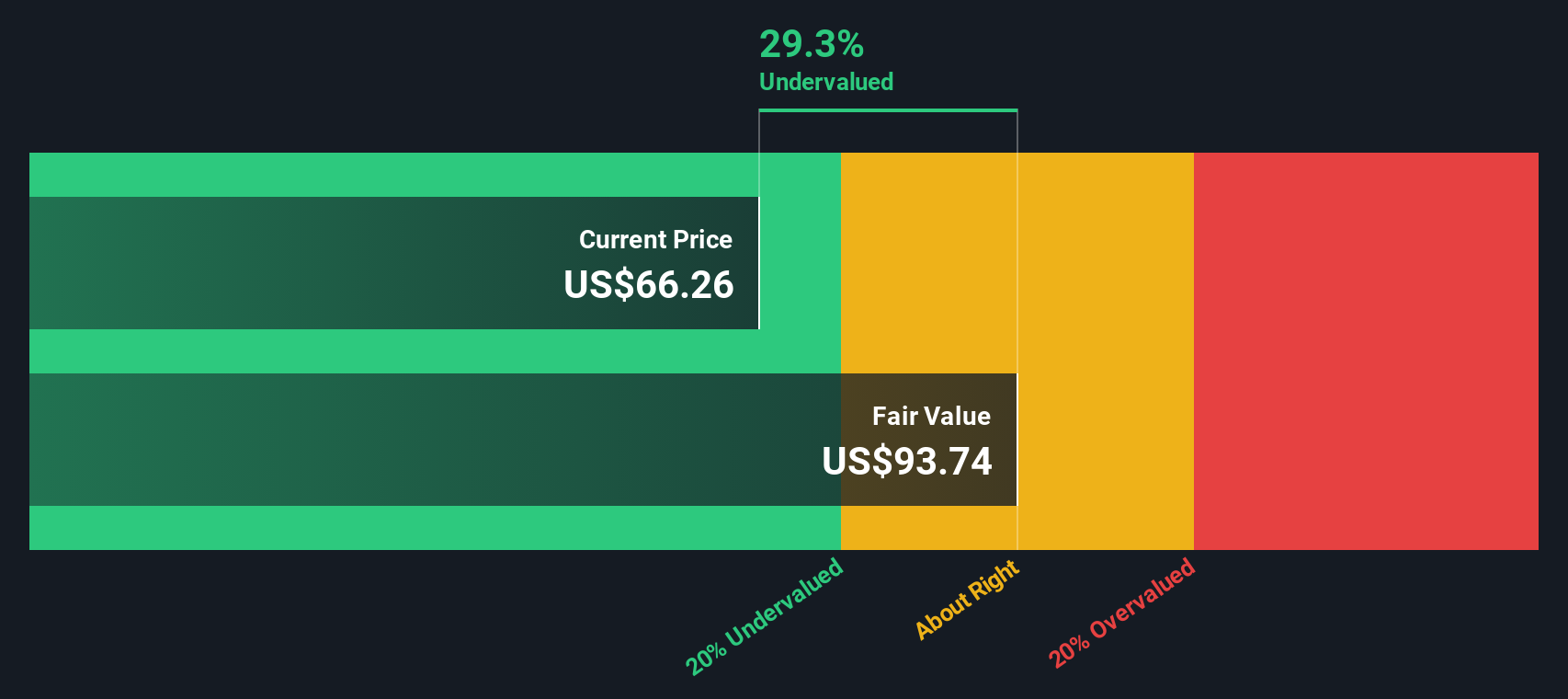

Yet with the stock now above the average analyst price target but still trading at a sizable discount to some intrinsic value estimates, investors must ask: Is Bread Financial still mispriced or already reflecting the next leg of growth?

Most Popular Narrative: 9.6% Overvalued

With Bread Financial closing at $78, the most followed narrative pegs fair value closer to $71.14, framing the recent rally as ahead of fundamentals.

Rolling valuation models forward, including extending explicit forecasts out to 2027, allows bullish analysts to incorporate a longer runway for normalized returns on equity. In their view, this supports incremental upside to intrinsic value estimates.

Curious how steady revenue expansion, leaner margins, and a lower future earnings multiple can still justify a premium to today’s price action? Unlock the full narrative to see which projections really carry the valuation story.

Result: Fair Value of $71.14 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained macro pressure on nonprime customers, or renewed pricing strain in key co brand partnerships, could quickly cap upside and challenge today’s optimistic assumptions.

Find out about the key risks to this Bread Financial Holdings narrative.

Another Lens on Value

While analyst narratives see Bread Financial as roughly 9.6 percent overvalued at $78, our DCF model points the other way. It shows an estimated fair value near $106.42, implying the shares trade at about a 26.7 percent discount. Which set of assumptions do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Bread Financial Holdings Narrative

If this perspective does not fully align with your own, or you would rather dig into the numbers yourself, you can craft a custom view in just a few minutes, Do it your way.

A great starting point for your Bread Financial Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before momentum shifts again, lock in your edge by using the Simply Wall Street Screener to pinpoint fresh, data driven opportunities other investors are still overlooking.

- Capture potential mispricings by targeting companies trading below intrinsic value with these 914 undervalued stocks based on cash flows that still boast solid fundamentals and cash flow strength.

- Position for the next wave of innovation as you assess cutting edge opportunities across these 24 AI penny stocks poised to benefit from accelerating adoption of intelligent automation.

- Lock in reliable cash flow potential by filtering for established businesses among these 12 dividend stocks with yields > 3% that combine income today with room for long term growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com