Tingyi (Cayman Islands) Holding (SEHK:322): Valuation Check After Major CEO Transition Announcement

Tingyi (Cayman Islands) Holding (SEHK:322) has kicked off a major leadership transition, with long serving CEO Chen Yinjang set to retire at the end of 2025 and Wei Hong Chen stepping in from January 2026.

See our latest analysis for Tingyi (Cayman Islands) Holding.

The leadership handover comes as Tingyi’s 90 day share price return of 11.55 percent and year to date share price return of 21.22 percent signal improving momentum. A 1 year total shareholder return of 29.75 percent shows the recent gains are already feeding through for longer term investors.

If this reshuffle has you thinking about where the next consumer winner could come from, it might be worth exploring fast growing stocks with high insider ownership for other ideas with punchy growth and committed insiders.

With earnings still growing, the share price well below some valuation estimates, and a modest discount to analyst targets, is Tingyi quietly undervalued ahead of its leadership change, or are markets already pricing in the next leg of growth?

Price-to-Earnings of 15.1x: Is it justified?

At a last close of HK$12.17, Tingyi is trading on a price to earnings ratio of 15.1 times, a premium to both peers and the company’s own fair ratio estimate.

The price to earnings multiple compares today’s share price with the company’s per share earnings. It provides a simple snapshot of how much investors are willing to pay for current profits in the food and beverage sector.

For Tingyi, the premium PE suggests the market is paying up for quality and return on equity, even though forecast profit growth sits in the mid single digit range rather than high growth territory. A fair PE of 14.2 times implies there could be room for the valuation to gravitate lower if sentiment cools.

The gap versus both the Hong Kong food industry average PE of 12.7 times and the peer group average of 12.2 times is striking. This underscores how strongly the market is valuing Tingyi’s earnings relative to sector alternatives and the level that our fair ratio points to as a potential anchor.

Explore the SWS fair ratio for Tingyi (Cayman Islands) Holding

Result: Price-to-Earnings of 15.1x (OVERVALUED)

However, softer mid single digit profit growth and a richer valuation than Hong Kong peers leave Tingyi vulnerable if consumer demand or input costs disappoint.

Find out about the key risks to this Tingyi (Cayman Islands) Holding narrative.

Another View: What Does Our DCF Say?

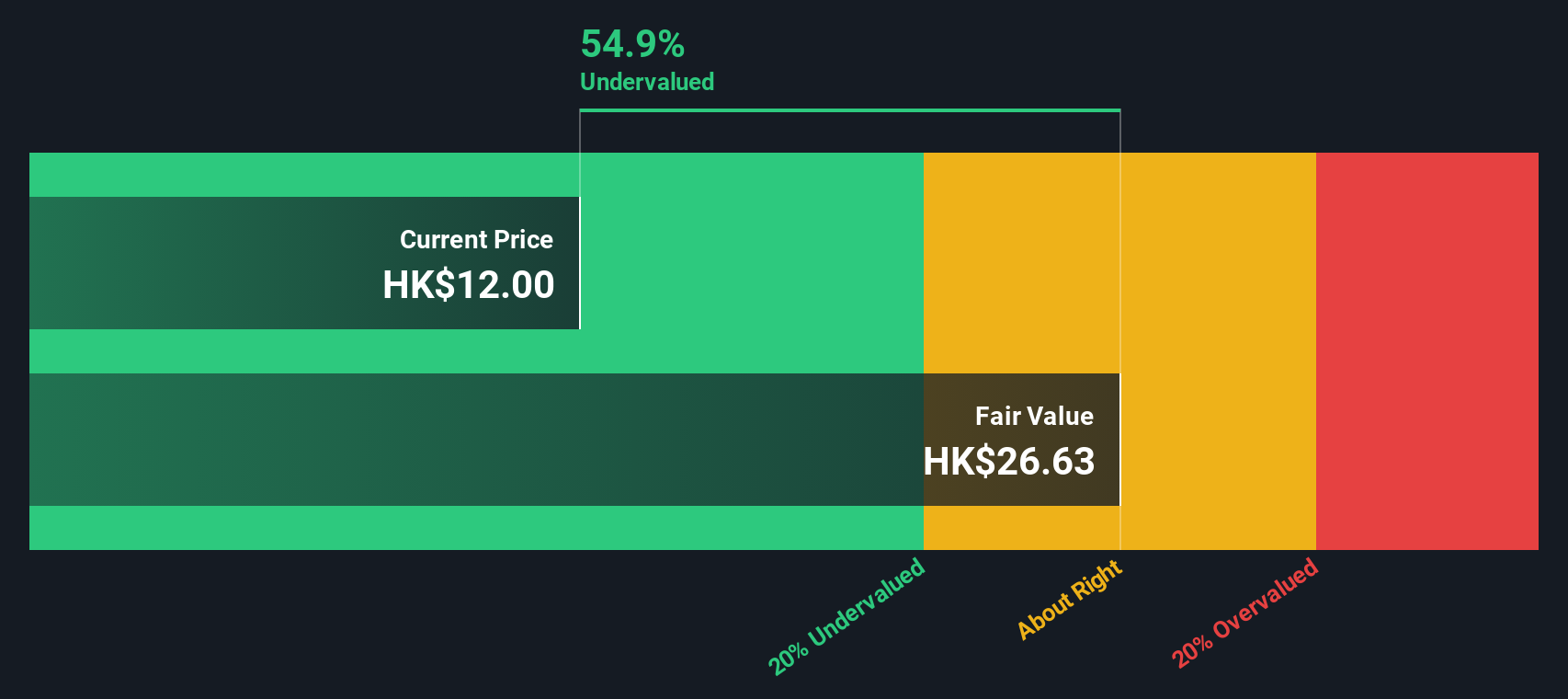

While the 15.1 times earnings multiple suggests Tingyi looks pricey, our DCF model points the other way, with a fair value estimate of HK$26.88 versus the current HK$12.17. That implies the shares trade at roughly a 55 percent discount, so is sentiment too cautious?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tingyi (Cayman Islands) Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tingyi (Cayman Islands) Holding Narrative

If you would rather examine the numbers yourself and challenge these conclusions, you can quickly build a personalised view in just minutes using Do it your way.

A great starting point for your Tingyi (Cayman Islands) Holding research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before markets move on without you, use the Simply Wall St Screener to uncover fresh opportunities that match your strategy and sharpen your next move.

- Capture potential mispricings by targeting companies trading below their estimated worth through these 914 undervalued stocks based on cash flows, and position yourself ahead of a possible rerating.

- Ride powerful income trends by focusing on reliable payers using these 12 dividend stocks with yields > 3%, and build a portfolio that works harder for you every quarter.

- Stay ahead of structural change in digital finance with these 79 cryptocurrency and blockchain stocks, and tap into businesses building real-world uses for blockchain and cryptocurrencies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com