Assessing Ascentage Pharma (SEHK:6855) Valuation After New ASH 2025 Hematology Data on Olverembatinib and Lisaftoclax

Ascentage Pharma Group International (SEHK:6855) just used the 67th ASH Annual Meeting as a showcase, rolling out fresh long term data on Olverembatinib and Lisaftoclax that further clarifies the story behind the stock.

See our latest analysis for Ascentage Pharma Group International.

The latest ASH data land after a bumpy stretch, with a 30 day share price return of minus 11.8 percent and a 90 day share price return of minus 25.1 percent. However, a much stronger year to date share price return and robust multiyear total shareholder returns suggest longer term momentum is still intact rather than fading.

If Ascentage’s hematology pipeline has caught your eye, this could be a good moment to see what else is shaping the sector through healthcare stocks.

With the shares still trading at a steep discount to analyst estimates despite double digit revenue growth, investors now have to ask: is Ascentage an underappreciated growth story, or is the market already pricing in the next leg of upside?

Most Popular Narrative Narrative: 39.3% Undervalued

With Ascentage Pharma Group International last closing at HK$56.35 against a narrative fair value of HK$92.81, the valuation gap hinges on aggressive growth and margin shifts.

Analysts expect earnings to reach CN¥50.7 million (and earnings per share of CN¥0.12) by about August 2028, up from CN¥-405.4 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting CN¥905 million in earnings, and the most bearish expecting CN¥-528.9 million.

Want to see what kind of revenue surge, margin turnaround, and future earnings multiple are reflected in that valuation gap? The full narrative sets out the projections underpinning this fair value, including assumptions more commonly seen in hyper growth sectors. Curious which levers would need to perform strongly to support those numbers? Explore how this roadmap outlines a path for Ascentage from deep losses to meaningful profits.

Result: Fair Value of $92.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained heavy R&D spending and dependence on China-focused Olverembatinib revenues could quickly test the market’s confidence in this growth script.

Find out about the key risks to this Ascentage Pharma Group International narrative.

Another Angle on Valuation

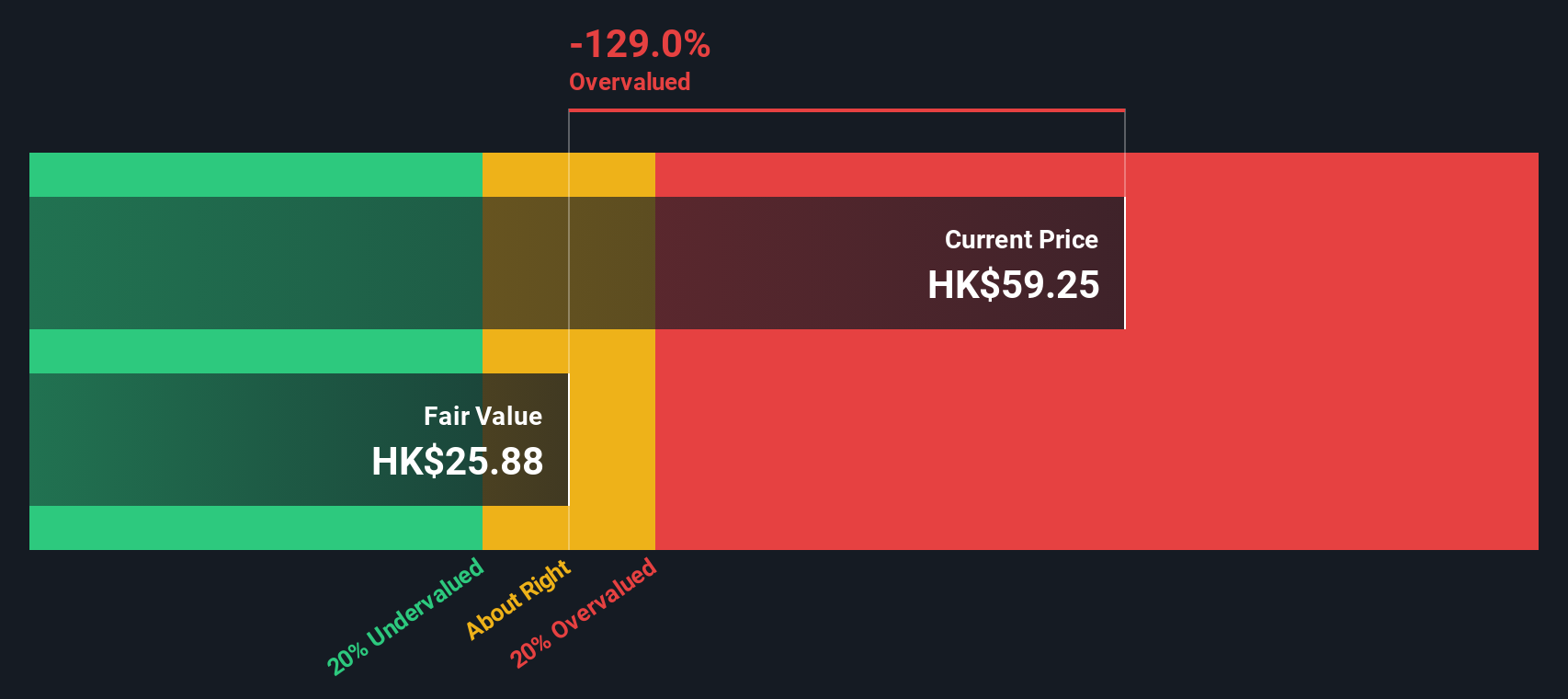

While the narrative fair value points to upside, our SWS DCF model actually suggests Ascentage Pharma Group International is trading above intrinsic value, at around HK$26.11 versus the current HK$56.35. If cash flows do not ramp as hoped, is today’s price already baking in too much optimism?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Ascentage Pharma Group International Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in minutes: Do it your way.

A great starting point for your Ascentage Pharma Group International research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Act now and put Simply Wall Street’s screener to work so you do not miss compelling opportunities across different themes, growth profiles, and income strategies.

- Capture potential breakout names by scanning these 3634 penny stocks with strong financials, which combine higher risk with surprisingly resilient fundamentals.

- Position yourself at the heart of the automation boom through these 24 AI penny stocks that power advances in machine learning, data infrastructure, and intelligent software.

- Lock in steadier cash returns by reviewing these 12 dividend stocks with yields > 3% that can add reliable income alongside your growth holdings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com