Evaluating SiteOne Landscape Supply (SITE) After Robust Q3 Beat and Fresh Buy-Rated Coverage

SiteOne Landscape Supply (SITE) has been getting extra attention after a solid Q3, with double digit Adjusted EBITDA growth and better operating leverage helping the stock edge higher despite a choppy backdrop.

See our latest analysis for SiteOne Landscape Supply.

That Q3 beat and the integration of Irrigator Tech, plus fresh Buy-rated coverage, have helped stabilize sentiment. Yet the share price return over the past year remains slightly negative while the three year total shareholder return is still positive, suggesting a longer term growth story that the market is reassessing rather than abandoning.

If SiteOne’s setup has you thinking about where else momentum could build, this is a good moment to scan fast growing stocks with high insider ownership and see what other stories are starting to take shape.

With revenue and earnings still growing, a double digit discount to analyst targets, and margins expected to improve, investors now face a key question: Is SiteOne undervalued, or is the market already pricing in that future growth?

Most Popular Narrative: 17.8% Undervalued

With the narrative fair value sitting above SiteOne Landscape Supply's last close, the optimistic case leans on earnings power and margin expansion doing the heavy lifting.

Increased emphasis on high margin private label brands and product mix optimization, with brands such as Pro-Trade, Solstice Stone, and Portfolio growing over 30%, is supporting gross margin improvement and boosting overall profitability. Secular demand for environmentally conscious and sustainable landscaping solutions creates premium product growth opportunities, positioning SiteOne to benefit from long term shifts in customer preferences, supporting robust revenue and margin expansion over time.

Want to see why steady revenue growth plus a rising profit margin could still justify a premium earnings multiple? The narrative reveals the exact profit trajectory and valuation math behind that higher fair value, including how long it expects elevated growth to last and what kind of earnings power SiteOne must deliver to make the numbers work.

Result: Fair Value of $156.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macro headwinds in construction and execution risks around integrating smaller acquisitions could still derail the margin expansion and earnings trajectory that underpin this narrative.

Find out about the key risks to this SiteOne Landscape Supply narrative.

Another View on Valuation

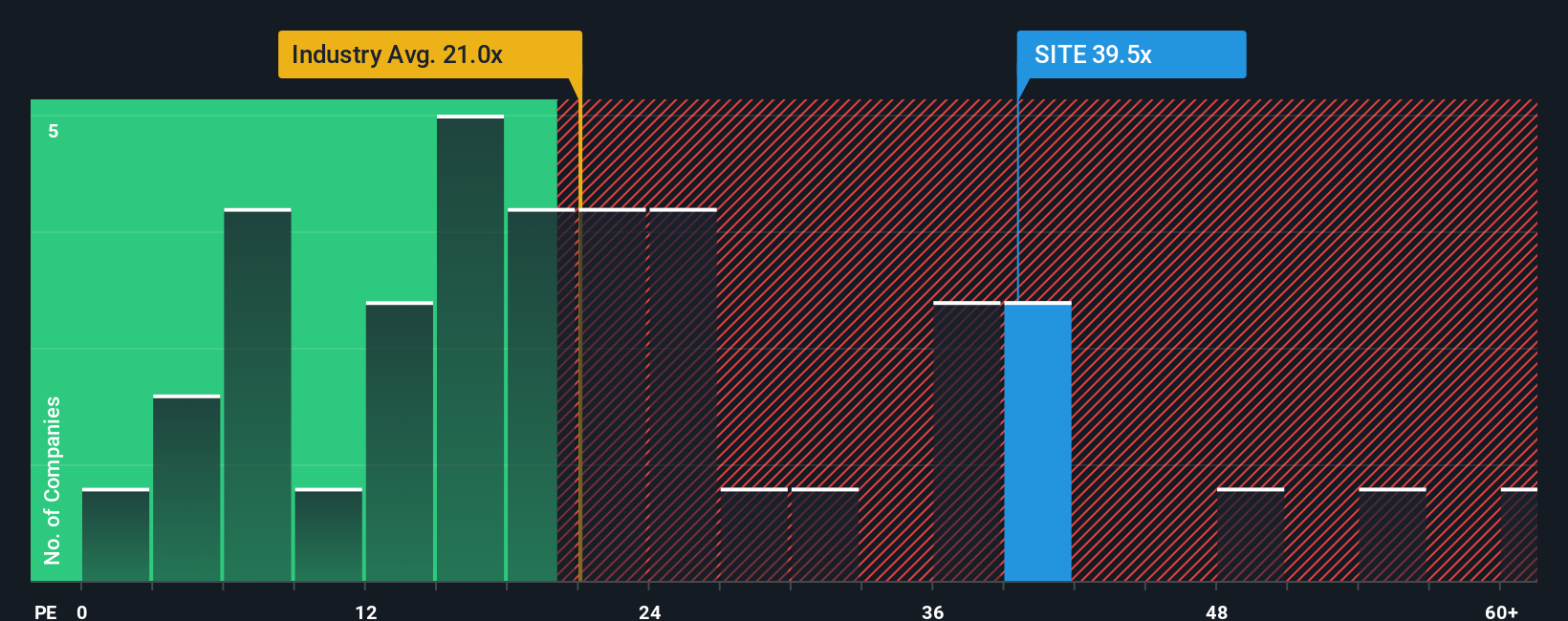

While the narrative points to upside, our ratio checks paint a tougher picture. SiteOne trades on a 40.9x price to earnings multiple, roughly double the US Trade Distributors industry at 20.2x and well above a 29.2x fair ratio, raising the risk that expectations are already stretched.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SiteOne Landscape Supply Narrative

If you want to dig into the numbers yourself and reach a different conclusion, you can build a custom narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding SiteOne Landscape Supply.

Looking for more investment ideas?

Ready for your next smart move? Use the Simply Wall St Screener to spot opportunities you might be overlooking and stay a step ahead of other investors.

- Capture potential bargains by scanning these 914 undervalued stocks based on cash flows that the market may be mispricing based on their future cash flows.

- Position yourself at the frontier of innovation with these 24 AI penny stocks that are harnessing artificial intelligence to transform entire industries.

- Strengthen your income strategy by reviewing these 12 dividend stocks with yields > 3% that can help support reliable, long term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com