Hyakujushi Bank (TSE:8386) Valuation After Nomura Alliance Reshapes Its Asset Management and Intermediary Business

Hyakujushi Bank (TSE:8386) just finalized a sweeping business alliance with Nomura Securities, reshaping how both firms handle asset management and intermediary services. This represents a structural shift investors will want to factor into long term expectations.

See our latest analysis for Hyakujushi Bank.

That backdrop helps explain why momentum has been so strong, with Hyakujushi Bank’s share price nearly doubling year to date and its five year total shareholder return above 400 percent, suggesting investors are steadily repricing its long term prospects.

If this kind of structural change has you thinking more broadly about financials, it could be a good moment to explore fast growing stocks with high insider ownership as potential next opportunities.

With the shares already trading at a premium to some valuation models, the key question now is whether the market is overly exuberant about this alliance driven growth, or if there is still a genuine buying opportunity left.

Price-to-Earnings of 11.5x: Is it justified?

Hyakujushi Bank trades on a price to earnings multiple of 11.5 times at a last close of ¥6,460, sitting modestly below broader market and peer benchmarks.

The price to earnings ratio compares today’s share price with the company’s earnings per share, making it a straightforward way to gauge how much investors are paying for current profits. For a mature, regulated sector like Japanese banking, it is a primary yardstick for how the market prices earnings power and balance sheet strength.

On this measure, Hyakujushi Bank screens as reasonable value, with its 11.5 times multiple below the wider Japanese market’s 14.3 times and slightly under the Japanese banks sector at 11.9 times. That gap suggests investors are not paying a premium despite stronger recent earnings growth and improved profit margins, implying expectations may still be conservative rather than exuberant.

Given the lack of a calculated fair ratio to act as a longer term anchor, the current discount to market and peers stands out as a key reference point for valuation debates.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 11.5x (ABOUT RIGHT)

However, Hyakujushi Bank still faces execution risk around the Nomura alliance, as well as potential margin pressure if Japan’s interest rate environment shifts unexpectedly.

Find out about the key risks to this Hyakujushi Bank narrative.

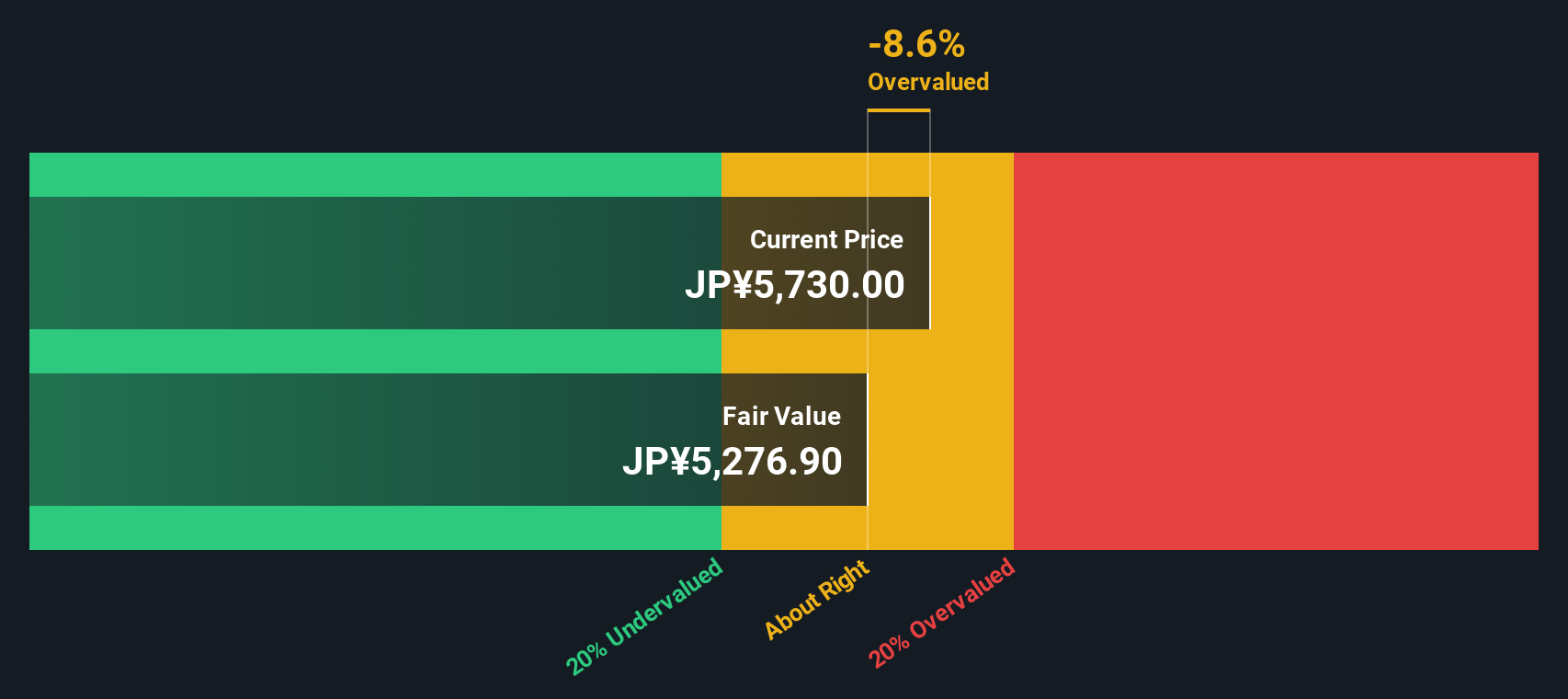

Another View: Our DCF Signals Caution

Our DCF model paints a cooler picture, with Hyakujushi Bank’s fair value estimated around ¥5,286 versus the current ¥6,460 share price. That implies the stock may be overvalued and raises the question: are investors paying too much for recent momentum?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hyakujushi Bank for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hyakujushi Bank Narrative

If you see the story differently or want to dig into the numbers yourself, you can easily build a personalized view in just minutes: Do it your way.

A great starting point for your Hyakujushi Bank research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one compelling story. Lock in your edge by scanning fresh opportunities other investors may be overlooking with targeted stock ideas tailored to your strategy.

- Capture potential multi baggers early by focusing on these 3634 penny stocks with strong financials that already back their small size with robust financial footing.

- Ride powerful structural trends by targeting these 29 healthcare AI stocks bringing automation and smarter diagnostics to one of the world’s most resilient industries.

- Strengthen your portfolio’s income engine by pinpointing these 12 dividend stocks with yields > 3% that combine attractive yields with room for long term payout growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com