Celcuity (CELC): Reassessing Valuation After New VIKTORIA-1 Breast Cancer Data Boosts Investor Interest

Celcuity (CELC) just gave investors fresh Phase 3 data on its lead drug gedatolisib at the San Antonio Breast Cancer Symposium, highlighting longer progression free survival and manageable side effects across important advanced breast cancer subgroups.

See our latest analysis for Celcuity.

The latest VIKTORIA-1 update comes after a powerful run, with Celcuity’s 90 day share price return of 92.72 percent and a standout year to date share price return of 670.45 percent. Its one year total shareholder return of 711.88 percent shows momentum has been building rather than fading.

If this kind of late stage biotech move has caught your attention, it may be worth scanning other potential treatments and pipelines across healthcare stocks for fresh stock ideas.

Yet with Celcuity still loss making and its share price already near analyst targets, the bigger question now is whether gedatolisib upside is underappreciated or if the market is already pricing in years of future growth.

Price-to-Book of 40x, is it justified?

Celcuity’s latest close at $101.16 lines up with a very rich valuation, with the stock trading at around 40 times its book value versus far lower benchmarks.

The price-to-book ratio compares the company’s market value to its net assets on the balance sheet, a common yardstick for early stage biotechs that lack meaningful revenue and profits. For Celcuity, this elevated multiple suggests investors are paying far more than the accounting value of its assets, effectively front loading expectations that gedatolisib and the pipeline will translate into substantial future cash flows.

That premium becomes even more striking against peers, with Celcuity’s 40x price-to-book multiple far above both its specific peer group average of 9.2x and the broader US biotech industry average of 2.6x. The market is clearly assigning Celcuity a leadership style valuation multiple, one that assumes its science, clinical data and growth runway will outpace typical biotech trajectories.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-book of 40x (OVERVALUED)

However, investors still face meaningful risk if pivotal trial results disappoint or regulators demand additional studies, particularly because Celcuity has yet to generate commercial revenue.

Find out about the key risks to this Celcuity narrative.

Another Way to Look at Value

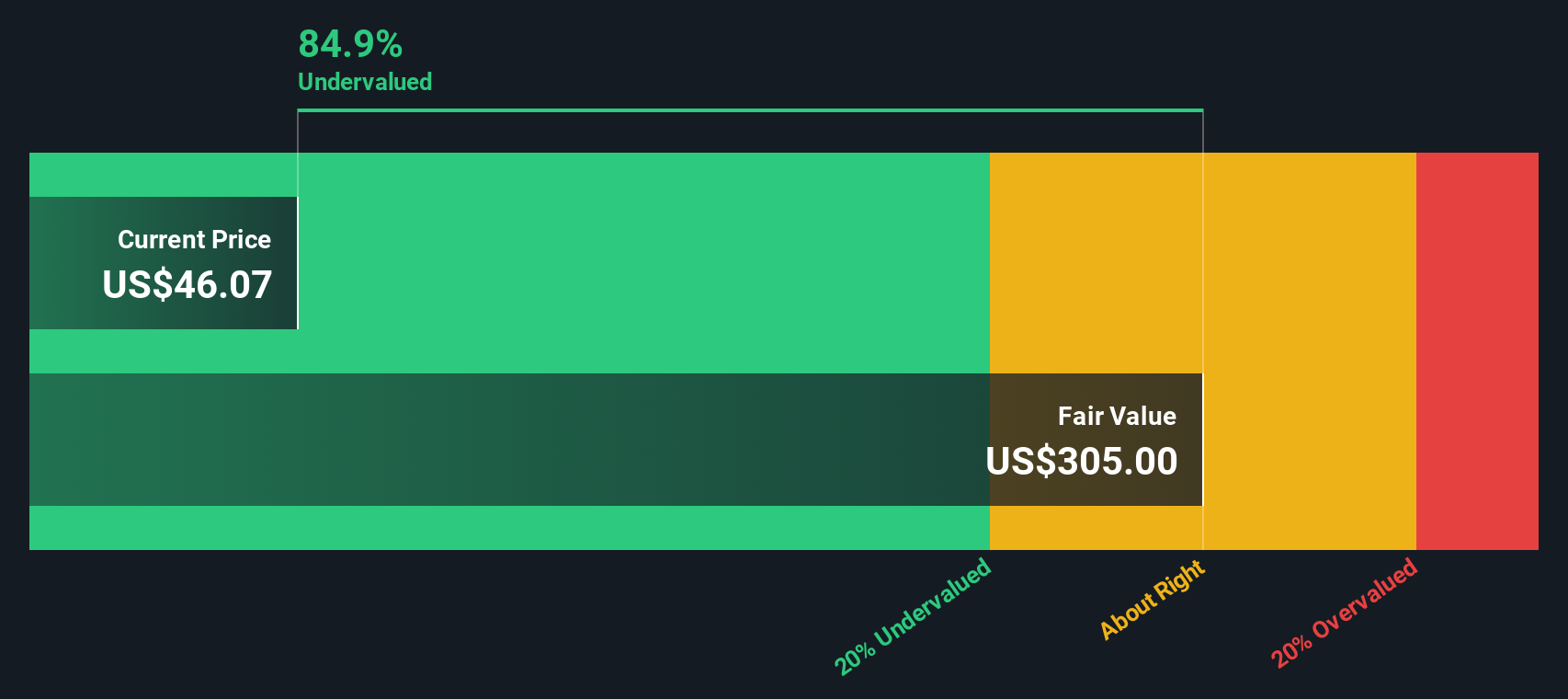

Our DCF model paints a very different picture to the lofty 40x price to book. On that lens, Celcuity screens as deeply undervalued, trading around 79.5 percent below an estimated fair value of $492.54. Is the market underestimating gedatolisib, or is the model too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Celcuity for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Celcuity Narrative

If you would rather rely on your own due diligence and interpret the numbers directly, you can build a tailored thesis in under three minutes: Do it your way.

A great starting point for your Celcuity research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before momentum shifts again, sharpen your watchlist with focused screens on value, income and innovation that spotlight opportunities most investors are still overlooking.

- Target long term wealth building by using these 913 undervalued stocks based on cash flows to spot quality businesses trading at meaningful discounts to their intrinsic value.

- Boost your potential income stream by scanning these 12 dividend stocks with yields > 3% for reliable payers offering attractive yields above 3 percent.

- Ride powerful structural trends by reviewing these 24 AI penny stocks that are harnessing artificial intelligence to reshape entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com