Fujitsu (TSE:6702) Valuation Check After Launch of Its Sports-Focused Technology Accelerator Program

Fujitsu (TSE:6702) just kicked off its "Fujitsu Accelerator Program for Sports," a push to blend sports and technology in ways that could open fresh revenue streams and reinforce its broader digital services strategy.

See our latest analysis for Fujitsu.

That push into sports tech lands against a backdrop of strong momentum, with a roughly 55% year to date share price return and a near 55% one year total shareholder return, signalling investors are steadily warming to Fujitsu’s growth story.

If this kind of digital transformation theme appeals to you, it is worth exploring high growth tech and AI stocks for more tech names that could be riding similar structural trends.

With shares already up more than 50 percent over the past year and trading only modestly below analyst targets, is Fujitsu still an underappreciated digital transformation play, or has the market already priced in its next leg of growth?

Most Popular Narrative Narrative: 4% Undervalued

With Fujitsu last closing at ¥4,307 against a most popular narrative fair value near ¥4,477 per share, the story assumes further upside from here.

Substantial growth in modernization and Uvance businesses (modernization revenue up 44% YoY, Uvance revenue up 52% YoY, Uvance now 29% of segment sales), reflects successful transition away from legacy hardware toward high margin, recurring cloud, consulting, and advanced IT services, which should structurally lift net margins.

Curious how steady, not spectacular, growth can still justify a richer profit multiple than the wider market, even with rising discount rate assumptions? Read on.

Result: Fair Value of ¥4,477.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent international weakness and execution risks in large scale transformation projects could derail margin expansion and challenge the current undervaluation thesis.

Find out about the key risks to this Fujitsu narrative.

Another Lens on Value

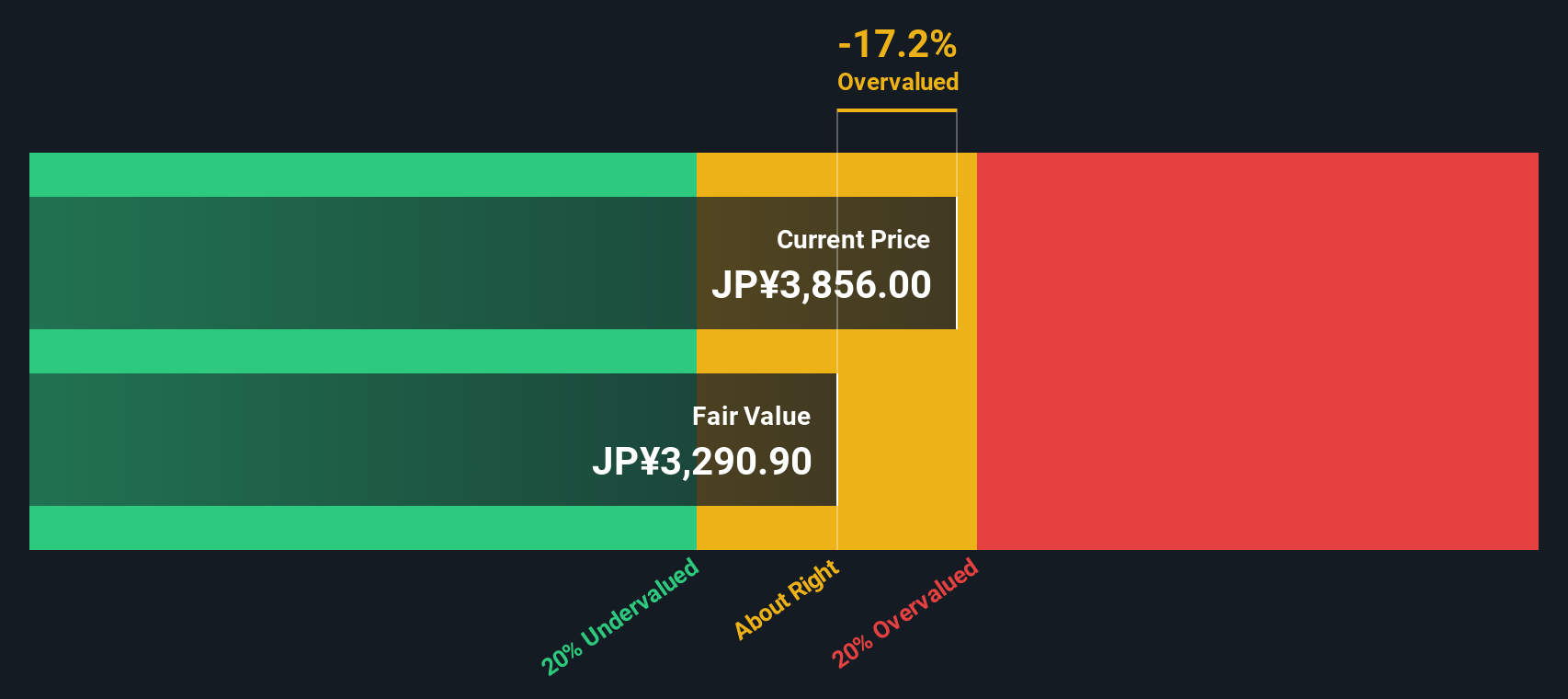

Our SWS DCF model tells a less generous story, putting fair value closer to ¥3,746 versus the current ¥4,307 share price. This implies Fujitsu may be trading ahead of its long run cash flow potential. Is the market leaning too hard into the AI and services narrative?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Fujitsu for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Fujitsu Narrative

If you see the story differently or want to stress test these assumptions yourself, you can build a complete view in just a few minutes using Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Fujitsu.

Ready for your next investing move?

Do not stop with one stock. Use the Simply Wall Street Screener to uncover focused opportunities that could sharpen your portfolio and keep you ahead of the crowd.

- Capture potential mispricings by scanning these 913 undervalued stocks based on cash flows that may still be trading below their long term cash flow potential.

- Position for the next wave of innovation with these 24 AI penny stocks that could benefit as artificial intelligence adoption accelerates globally.

- Lock in steadier portfolio income by reviewing these 12 dividend stocks with yields > 3% offering yields above 3 percent with the backing of listed businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com