How Investors Are Reacting To Li Auto (LI) First Quarterly Loss And Recall Amid Global Expansion

- In recent weeks, Li Auto has faced its first quarterly loss after 11 profitable quarters, hit by a recall of its MEGA model, weaker sales and margins, and analyst downgrades, even as it gained approval to test Level 3 autonomous driving in Beijing.

- At the same time, Li Auto has accelerated its overseas push into Egypt, Kazakhstan, and Azerbaijan and opened new global AI R&D hubs, signaling a bid to offset domestic pressure with international growth and smarter driving technology.

- We’ll now examine how Li Auto’s first quarterly loss amid recall and sales setbacks reshapes the company’s previously optimistic investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Li Auto Investment Narrative Recap

To own Li Auto today, you need to believe it can convert heavy AI and BEV investment into sustainable profitability despite a sharp Q3 loss and softer guidance. The key short term catalyst is execution on its upgraded product lineup, while the biggest risk is that rising R&D and recall costs outpace any recovery in sales and margins, which this quarter’s loss and analyst downgrades suggest is a material near term concern.

Among the recent announcements, Li Auto’s approval to test Level 3 autonomous driving in Beijing stands out because it directly relates to the company’s heavy AI spending and smart driving focus. If these trials translate into reliable, user valued features at scale, they could support pricing power and help justify the elevated cost base that is currently weighing on profitability.

Yet for investors, the real concern is whether Li Auto’s growing AI and R&D bill can be supported if sales keep...

Read the full narrative on Li Auto (it's free!)

Li Auto's narrative projects CN¥232.1 billion revenue and CN¥15.2 billion earnings by 2028. This requires 17.4% yearly revenue growth and an earnings increase of about CN¥7.1 billion from CN¥8.1 billion today.

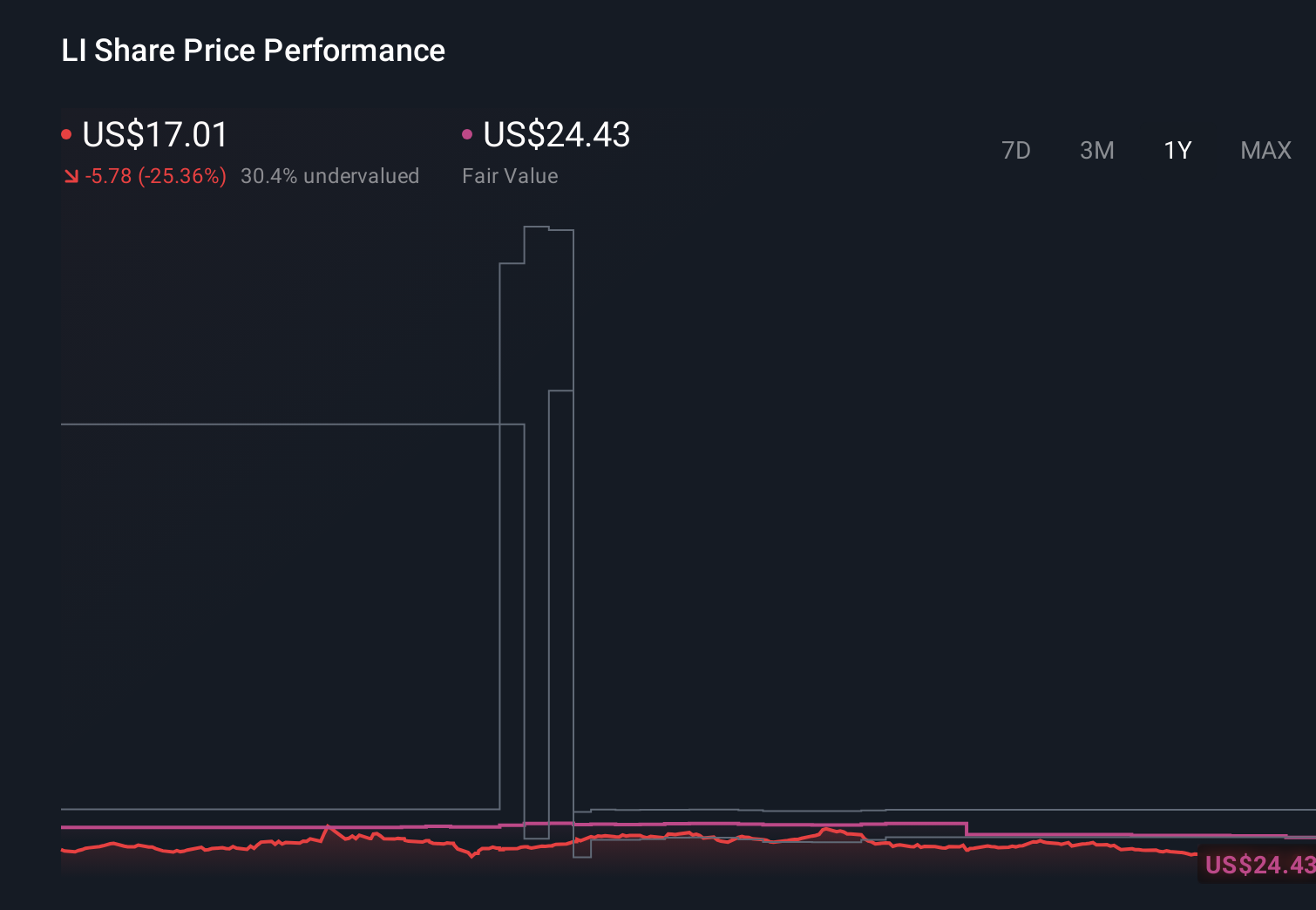

Uncover how Li Auto's forecasts yield a $24.43 fair value, a 44% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community see Li Auto’s fair value between US$24.43 and US$36.73, underscoring how far opinions can spread. Against that backdrop, the recent loss and rising AI and recall spending raise important questions about how quickly profitability can catch up, so it makes sense to weigh several viewpoints before forming your own.

Explore 5 other fair value estimates on Li Auto - why the stock might be worth over 2x more than the current price!

Build Your Own Li Auto Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Li Auto research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Li Auto research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Li Auto's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com