Triumph Financial (TFIN): Assessing Valuation as BlueGrace Partnership Expands Freight Payments Footprint

Triumph Financial (TFIN) is back in the spotlight after BlueGrace Logistics joined the Triumph Network, a move that tightens Triumph’s grip on fintech powered freight payments and back office automation.

See our latest analysis for Triumph Financial.

The BlueGrace deal comes as Triumph’s 30 day share price return of 15.91% and 90 day share price return of 12.26% clash with a much weaker year to date share price return of minus 30.07%. However, the three year total shareholder return of 25.55% still points to a longer term story that investors have not completely written off.

If this kind of logistics focused fintech story has your attention, it might be worth scanning fast growing stocks with high insider ownership for other under the radar growth names with committed insiders.

With logistics partners deepening their reliance on Triumph’s platform, yet the share price still lagging its recent momentum, investors now face a pivotal question: is Triumph Financial a mispriced fintech-bank hybrid, or is the market already baking in the next leg of growth?

Most Popular Narrative Narrative: 3.4% Undervalued

With the most popular narrative placing Triumph Financial’s fair value slightly above the last close, the spotlight shifts to how earnings power could catch up.

The continued scaling of TriumphPay and related payment services is driving strong revenue growth and efficiency, as evidenced by rising EBITDA margins (with a stated long term goal of 40%), benefiting from network effects and the digitalization of freight finance, which is expected to further boost net margins and overall profitability.

Curious how a freight focused bank ends up with a valuation more often seen in software, not lenders? The narrative leans on outsized earnings growth, expanding margins, and a richer future earnings multiple than many traditional banks ever achieve. Want to see exactly how those assumptions stack up into that fair value call?

Result: Fair Value of $64.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on freight markets stabilizing, as a deeper trucking downturn or tech investments that fail to reach scale could quickly pressure margins and earnings.

Find out about the key risks to this Triumph Financial narrative.

Another View, Rich Versus Peers

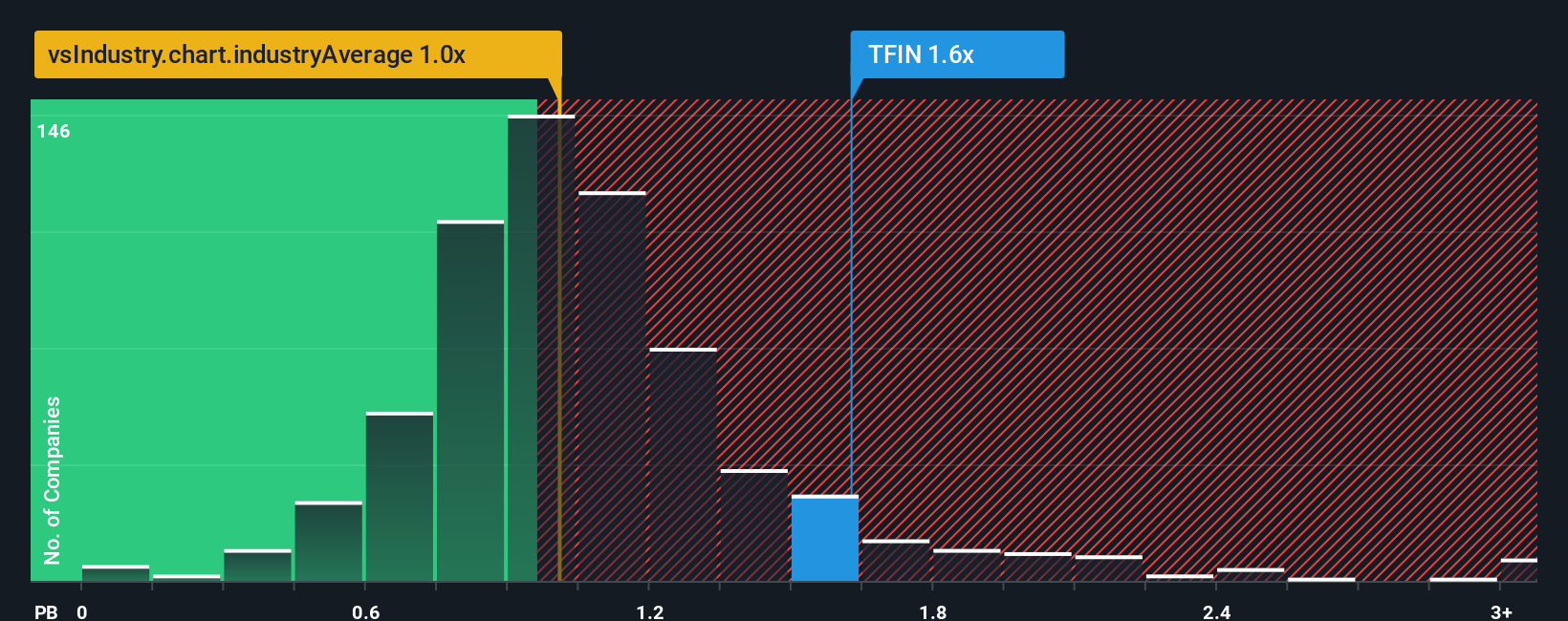

While the narrative pegs Triumph as 3.4% undervalued, a simple price to book lens tells a tougher story. At 1.7 times book versus 1.1 times for US banks and 1.3 times for peers, investors are clearly paying up. How much runway is left if growth stumbles?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Triumph Financial Narrative

If you are skeptical of this view or prefer to dig into the numbers yourself, you can build a tailored thesis in minutes: Do it your way.

A great starting point for your Triumph Financial research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next watchlist upgrade and use the Simply Wall St Screener to pinpoint fresh, high conviction ideas you do not want to overlook.

- Capture powerful secular themes by targeting AI enabled businesses through these 24 AI penny stocks that could reshape entire industries.

- Strengthen your portfolio’s income engine with these 12 dividend stocks with yields > 3% that aim to provide reliable cash flows in changing markets.

- Position ahead of structural shifts in digital finance by focusing on these 79 cryptocurrency and blockchain stocks riding blockchain and tokenization trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com