Hawaiian Electric (HE) valuation check as S&P SmallCap 600 entry and wildfire litigation shape its outlook

Hawaiian Electric Industries (HE) is back in focus as it prepares to join the S&P SmallCap 600 on December 22, 2025, even while Maui wildfire litigation and clean energy investments shape its longer term risk profile.

See our latest analysis for Hawaiian Electric Industries.

The stock has been choppy lately, with a 1 day share price return of minus 6.24 percent, but a year to date share price return of 20.85 percent suggests tentative momentum as investors weigh wildfire liabilities against the clean energy and index inclusion story.

With Hawaiian Electric back in the headlines, this could be a useful moment to broaden your watchlist and explore fast growing stocks with high insider ownership.

Given wildfire liabilities, modest growth, and a share price now trading slightly above analyst targets, is Hawaiian Electric quietly undervalued because of its renewables and index tailwinds, or are markets already pricing in future growth?

Most Popular Narrative: 6.2% Overvalued

With Hawaiian Electric closing at $11.42 against a narrative fair value of $10.75, the most followed view sees modest downside baked into today’s price.

Regulatory and legislative support for clean energy procurement, combined with expanded investments in grid resilience and decarbonization, positions the company to capitalize on rising demand for electricity from transportation electrification and policy-driven renewables adoption, providing long-term revenue tailwinds.

Want to see the math behind this cautious stance? The narrative leans on reshaped margins, slower earnings momentum, and a higher future profit multiple than before. Curious which assumptions really move that fair value line?

Result: Fair Value of $10.75 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering wildfire litigation costs and heavy infrastructure spending could still squeeze margins and undermine the clean energy upside that analysts are banking on.

Find out about the key risks to this Hawaiian Electric Industries narrative.

Another Angle on Value

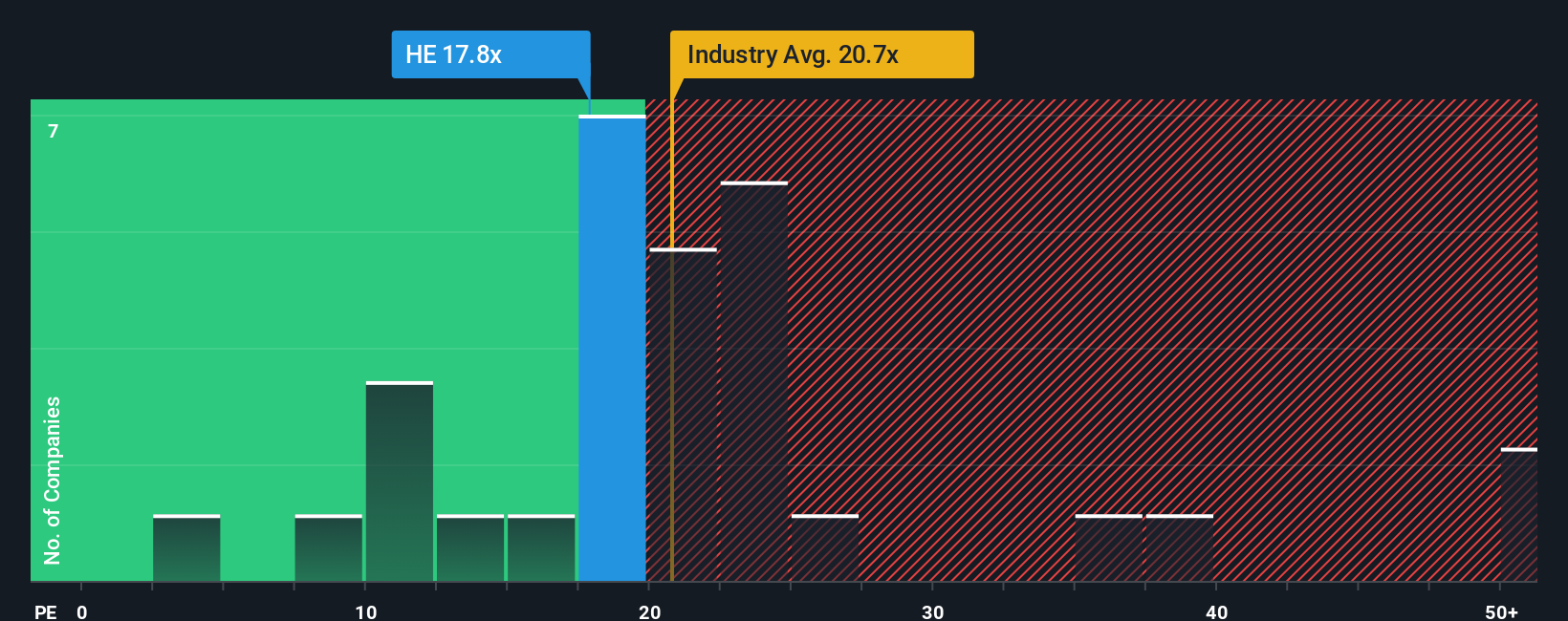

While the narrative fair value suggests modest downside, the price to earnings lens paints a tighter picture. At 17.5x earnings compared with peers at 21.9x and a fair ratio of 17.9x, Hawaiian Electric looks roughly in line, raising the question of how much mispricing really remains.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hawaiian Electric Industries Narrative

If you see the story differently or just want to dig into the numbers yourself, you can build a complete view in minutes, Do it your way.

A great starting point for your Hawaiian Electric Industries research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, use the Simply Wall Street Screener to uncover high conviction opportunities you might overlook and strengthen the core of your portfolio.

- Capture potential multi baggers early by reviewing these 3633 penny stocks with strong financials with solid fundamentals before they appear on everyone else's radar.

- Position your portfolio for the next productivity boom as you evaluate these 24 AI penny stocks transforming how businesses operate worldwide.

- Lock in quality at a discount by scanning these 913 undervalued stocks based on cash flows where market pessimism may already be overdone relative to underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com