New Oriental (NYSE:EDU) Valuation After Serenity Capital’s Big Bet on Its Post‑Crackdown Transformation

Serenity Capital’s decision to lift New Oriental Education & Technology Group (NYSE:EDU) into its top holdings is a clear vote of confidence in the company’s post crack down transformation and earnings trajectory.

See our latest analysis for New Oriental Education & Technology Group.

That conviction lines up with the market’s tone, with a 30 day share price return of 7.42 percent and a three year total shareholder return of 47.27 percent suggesting momentum is rebuilding after a tougher year.

If Serenity Capital’s move has you rethinking the education theme, it could be worth scanning adjacent opportunities through high growth tech and AI stocks for other growth stories shaping the future of learning and services.

With earnings rebounding and shares still trading below analyst targets and intrinsic value estimates, the key question now is whether New Oriental remains mispriced or if the market is already baking in the next leg of growth.

Most Popular Narrative: 14% Undervalued

With the narrative fair value sitting above the last close of $55.48, the story frames New Oriental as a rebuilding compounder with expanding earnings power.

Analysts expect earnings to reach $628.5 million (and earnings per share of $4.18) by about September 2028, up from $371.7 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $790 million in earnings, and the most bearish expecting $420.9 million.

Want to see how steady revenue expansion, rising margins, and shrinking share count combine into that upside view? The growth math under this narrative might surprise you.

Result: Fair Value of $64.49 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and lingering regulatory uncertainty could still pressure margins and overseas demand, which may challenge the smooth compounding path implied in this narrative.

Find out about the key risks to this New Oriental Education & Technology Group narrative.

Another View: Valuation Through Earnings

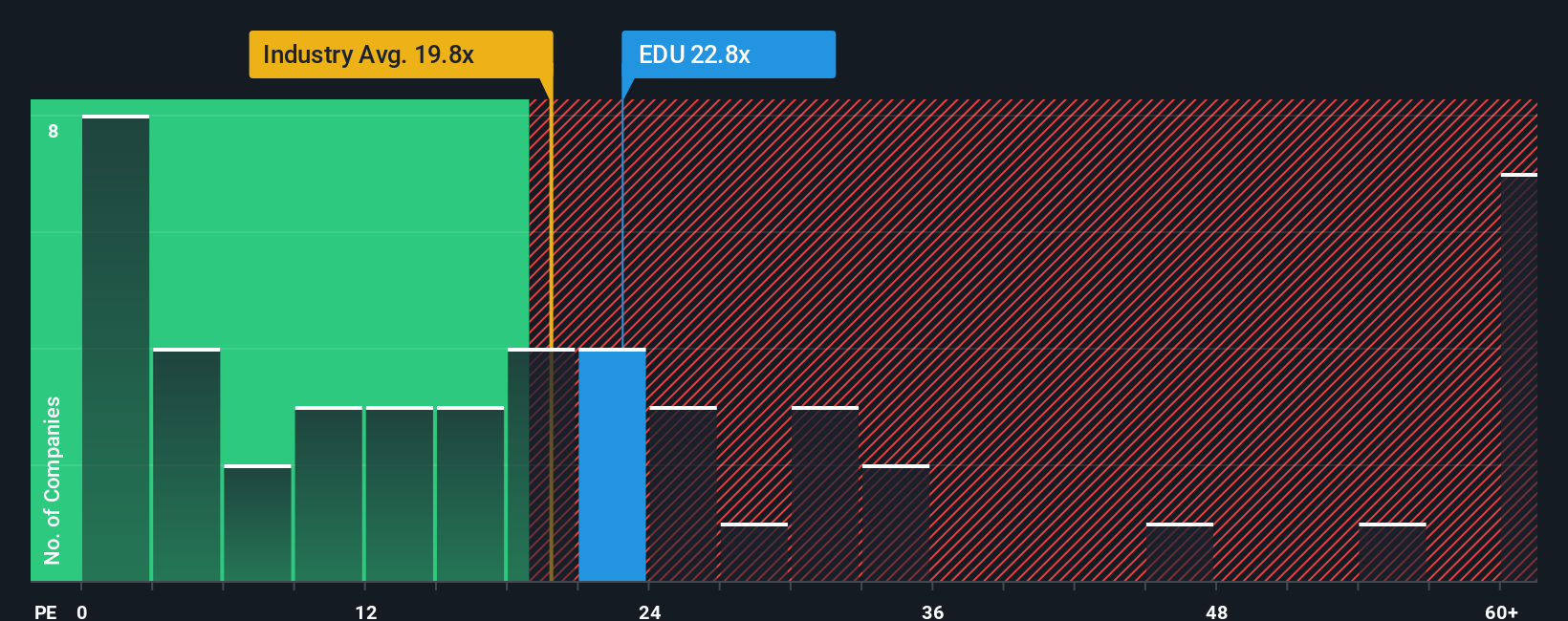

Looked at through an earnings lens, New Oriental trades on 24.1 times, above the US Consumer Services average of 16.8 times and slightly above its 23.7 times fair ratio, but below peer average at 28.5 times. Is that a quality premium or hidden downside risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own New Oriental Education & Technology Group Narrative

If you are not fully aligned with this perspective, or simply enjoy digging into the numbers yourself, you can build a custom view in just a few minutes, all starting with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding New Oriental Education & Technology Group.

Looking for more investment ideas?

Before you move on, lock in your next potential winners by scanning focused stock ideas that match your style, so you are not chasing yesterday’s trades.

- Capitalize on mispriced quality by reviewing these 913 undervalued stocks based on cash flows that pair solid fundamentals with attractive valuations before the crowd catches on.

- Position for the next wave of innovation by targeting these 24 AI penny stocks at the heart of intelligent automation and data driven disruption.

- Strengthen your income stream by zeroing in on these 12 dividend stocks with yields > 3% that can support steady payouts alongside long term compounding.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com