GXO Logistics (GXO): Assessing Valuation After Strategic Leadership Transitions and Post‑Acquisition Realignment

GXO Logistics (GXO) just reshuffled its leadership bench, adding a new Chief Commercial Officer, a new Chief Operating Officer and an incoming Non Executive Chairman, a coordinated move that is catching investors attention.

See our latest analysis for GXO Logistics.

The leadership shake up comes after a strong run, with GXO’s share price returning about 12 percent over the past month and roughly 24 percent year to date, while its one year total shareholder return of about 27 percent suggests that momentum is still building rather than fading.

If strategic changes at GXO have you thinking about where else leadership and growth stories might be taking shape, this could be a good moment to explore fast growing stocks with high insider ownership.

With earnings growing sharply, leadership leaning into transformation, and the stock still trading at a discount to analyst targets and some intrinsic value models, is GXO an overlooked opportunity, or are markets already pricing in the next leg of growth?

Most Popular Narrative: 16.7% Undervalued

With GXO Logistics last closing at $53.29 against a narrative fair value of $63.94, the valuation case leans toward meaningful upside grounded in earnings power.

Enhanced deployment of automation, AI, and proprietary software (with recent launches like GXO IQ) is rapidly improving warehouse productivity, reducing labor costs, and increasing operational efficiency, which is beginning to drive margin expansion and should positively impact net earnings and EBITDA margins. Integration of Wincanton not only delivers near term cost synergies (~$60M by 2026) but also opens new large verticals (defense, industrial, infrastructure) and geographies, which is expected to generate significant revenue synergies over the next 18 to 24 months, further accelerating top line growth and improving operating leverage.

Want to see how steady mid single digit growth assumptions turn into earnings power and a richer future multiple than today suggests? The narrative unpacks a detailed path for expanding margins, shrinking share count, and re rating the stock without relying on overly aggressive revenue forecasts. Curious which specific profitability and valuation levers carry the heaviest weight in that fair value math? Dive in to see the full blueprint behind this case.

Result: Fair Value of $63.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps on the Wincanton integration or leadership transition could delay margin gains, undermine earnings momentum, and challenge the current undervaluation thesis.

Find out about the key risks to this GXO Logistics narrative.

Another Lens on Valuation

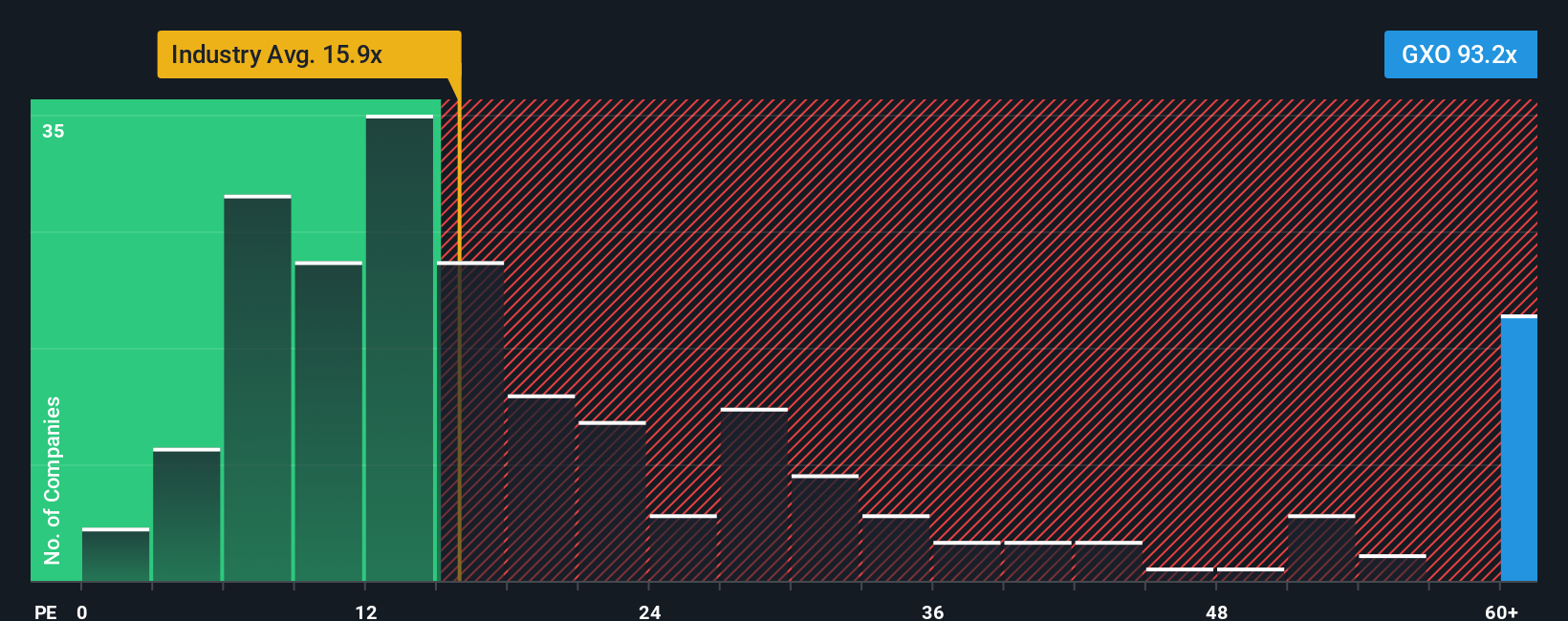

Fair value models suggest GXO is 16.7 percent undervalued, but its price to earnings ratio near 68.6 times looks stretched versus a 41.3 times fair ratio, 24 times for peers, and 15.9 times for the wider logistics group. Is the premium a moat or just margin for error?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GXO Logistics Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a fresh narrative in just minutes: Do it your way.

A great starting point for your GXO Logistics research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas beyond GXO?

Consider exploring additional opportunities that align with your style, risk comfort, and return expectations across different areas of the market.

- Explore trends in automation and software by targeting innovators in technology and digital infrastructure through these 24 AI penny stocks that are reshaping the future.

- Seek potential income and stability by focusing on dependable payers with rising cash flows using these 12 dividend stocks with yields > 3% tailored to yield conscious investors.

- Look for the next potential value rerating by using these 913 undervalued stocks based on cash flows to identify quality companies trading at meaningful discounts to intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com