New Navy Combatant, Submarine Milestone and Autonomy Wins Could Be A Game Changer For Huntington Ingalls Industries (HII)

- Earlier this month, HII announced that its Ingalls Shipbuilding division was chosen by the U.S. Navy to design and build a future small surface combatant ship based on its Legend-class national security cutter design, while Newport News Shipbuilding hit a key “pressure hull complete” milestone on Virginia-class submarine Oklahoma (SSN 802) and advanced work on its ROMULUS unmanned surface vessel prototype.

- Together, these developments highlight how HII is deepening its role across manned surface combatants, nuclear submarines, and autonomous maritime systems, reinforcing its position as a core supplier to the U.S. Navy.

- Next, we’ll examine how winning the small surface combatant program could influence Huntington Ingalls’ shipbuilding-focused investment narrative and outlook.

We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Huntington Ingalls Industries Investment Narrative Recap

To own Huntington Ingalls, you need to believe in sustained U.S. naval shipbuilding demand and HII’s ability to convert its backlog into steadier earnings despite high fixed costs and labor or supply chain pressures. The small surface combatant win strengthens revenue visibility and slightly eases the near term dependence on timing for major awards like Virginia-class Block VI and Columbia Build II, but political and budget risk around long duration ship programs still looms large.

The Virginia-class submarine Oklahoma reaching “pressure hull complete” is especially relevant here, because it underscores how much of HII’s thesis still rests on flawless execution in nuclear submarines. Progress on Oklahoma, together with the expanded Babcock partnership on future Virginia-class blocks, sits right at the intersection of the key catalyst of higher throughput and the ongoing risk that supply chain or workforce issues could disrupt schedules and margins.

But investors should also weigh how exposed this long term story remains if U.S. defense priorities shift more aggressively toward smaller, unmanned platforms and away from...

Read the full narrative on Huntington Ingalls Industries (it's free!)

Huntington Ingalls Industries' narrative projects $13.6 billion revenue and $785.0 million earnings by 2028. This implies 5.4% yearly revenue growth and about a $260 million earnings increase from $525.0 million today.

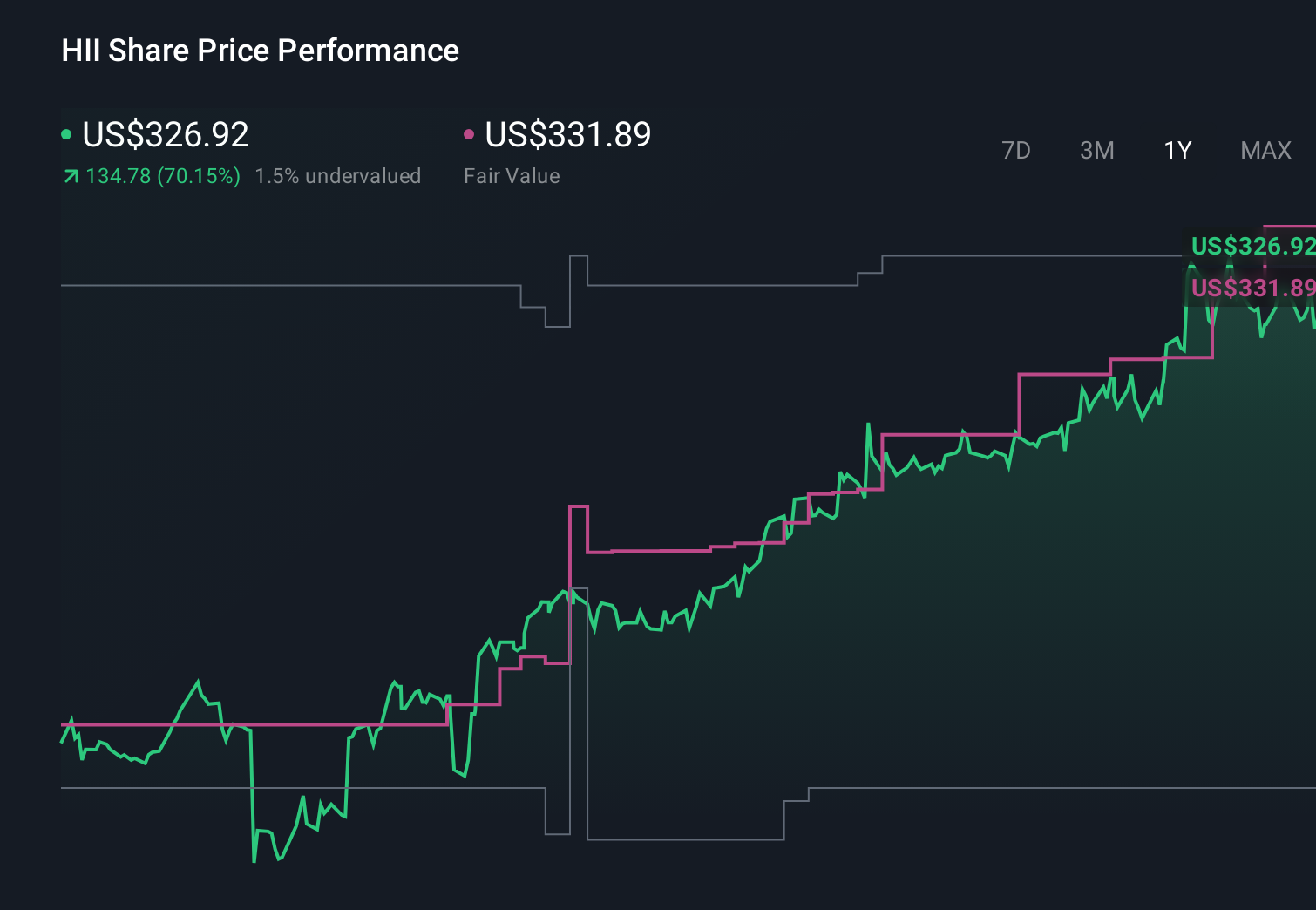

Uncover how Huntington Ingalls Industries' forecasts yield a $331.89 fair value, in line with its current price.

Exploring Other Perspectives

Eight fair value estimates from the Simply Wall St Community span roughly US$180 to about US$451 per share, so opinions on HII’s upside vary widely. Set against that, HII’s growing role in both traditional shipbuilding and autonomous systems could matter a lot if defense spending and program timing stay supportive of the current backlog-driven story.

Explore 8 other fair value estimates on Huntington Ingalls Industries - why the stock might be worth 47% less than the current price!

Build Your Own Huntington Ingalls Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Huntington Ingalls Industries research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Huntington Ingalls Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Huntington Ingalls Industries' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 34 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com