Novavax (NVAX): Weighing Undervaluation Claims Against Fading Momentum and DCF Signals

Novavax (NVAX) has been grinding through a tough stretch, with the stock sliding over the past 3 years even as it works to reposition its vaccine pipeline and stabilize revenue trends.

See our latest analysis for Novavax.

At a share price of $6.66, Novavax’s modest 1 month share price return of 2.94 percent has not yet reversed the 1 year total shareholder return of negative 23.45 percent. This signals that long term momentum is still fading despite recent stabilisation.

If you are weighing where to allocate risk in healthcare after watching Novavax’s swings, it could be worth scanning healthcare stocks for other potential opportunities.

With Novavax trading at a steep discount to analyst targets yet facing sharp revenue and profit declines, investors are left to decide: Is pessimism overdone here, or is the market already bracing for limited future growth?

Most Popular Narrative Narrative: 49.2% Undervalued

With Novavax closing at $6.66 and the most followed narrative pointing to a fair value near double that level, the gap in expectations is striking.

The analysts have a consensus price target of $12.5 for Novavax based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $25.0, and the most bearish reporting a price target of just $6.0.

Curious how shrinking revenues, thinner margins and a much richer future earnings multiple can still add up to a higher value than today? Want the full playbook?

Result: Fair Value of $13.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps on the licensing pivot, or weaker than expected COVID vaccine demand, could quickly undermine the undervalued thesis and pressure earnings.

Find out about the key risks to this Novavax narrative.

Another View On Value

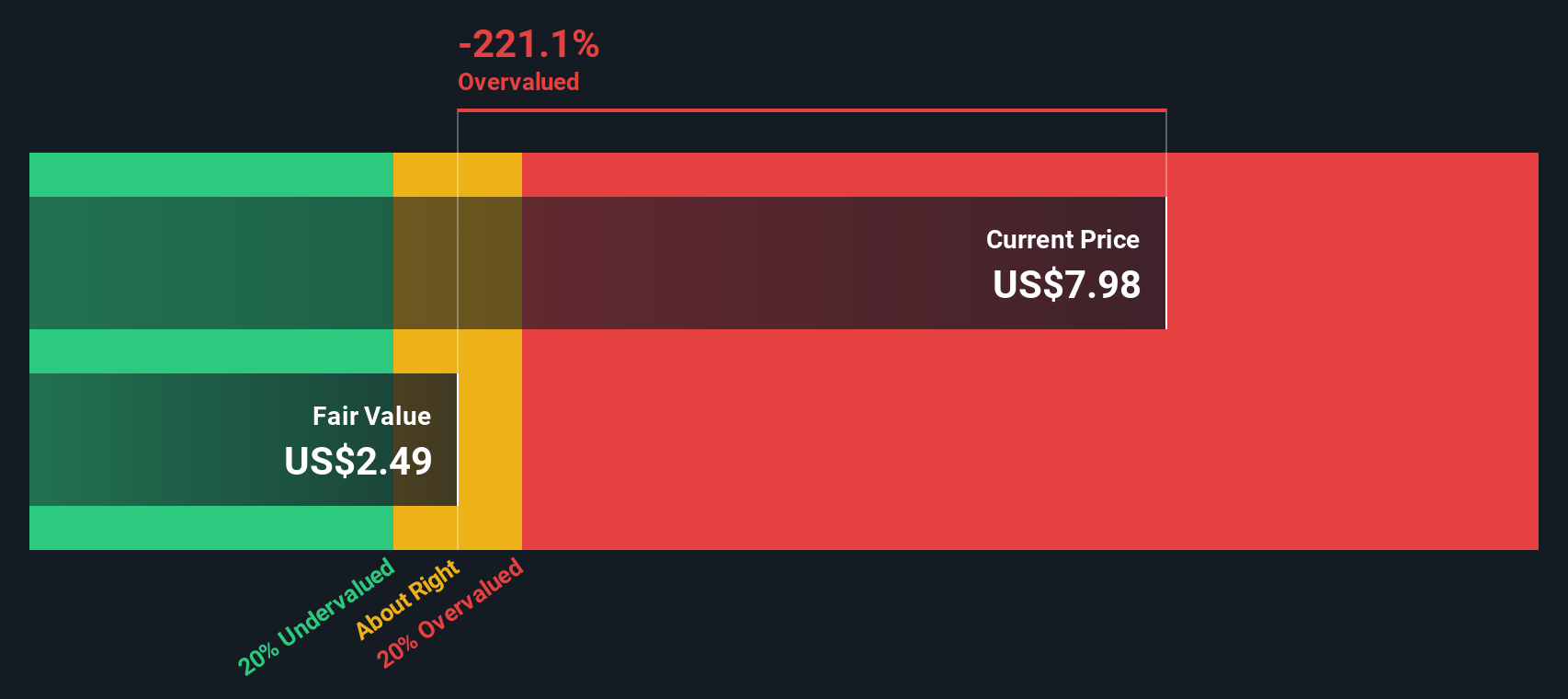

While the analyst narrative sees upside, our DCF model paints a cooler picture, suggesting Novavax is trading above its estimated fair value. In other words, the cash flows implied by today’s business outlook do not fully back up the bullish price targets. What, then, might drive a re rating?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Novavax for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Novavax Narrative

If you would rather dig into the numbers yourself and shape your own view, you can build a personalised narrative in minutes: Do it your way.

A great starting point for your Novavax research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put Simply Wall St to work and uncover fresh opportunities that could outpace Novavax and reshape your portfolio’s return potential.

- Capitalize on mispriced opportunities by reviewing these 913 undervalued stocks based on cash flows that may offer stronger upside than headline names.

- Ride structural growth trends by targeting these 29 healthcare AI stocks transforming how medicine is delivered and decisions are made.

- Position yourself early in a fast evolving space with these 79 cryptocurrency and blockchain stocks participating in the shift toward digital assets and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com