KB Home (KBH): Reassessing Valuation After Strong Earnings But Cautious 2026 Outlook

KB Home (KBH) just delivered one of those mixed quarters that gets everyone talking, beating expectations on earnings and revenue while simultaneously dialing back its outlook as affordability pressures and a thinner backlog cloud 2026.

See our latest analysis for KB Home.

The market has quickly repriced that cautious 2026 guidance, with an 8.5% one day share price decline and double digit year to date share price retreat. However, three year total shareholder return remains very strong and signals that longer term momentum is still intact.

If KB Home’s reset has you reassessing housing exposure, this is a good moment to scout other ideas across residential and construction linked names using fast growing stocks with high insider ownership.

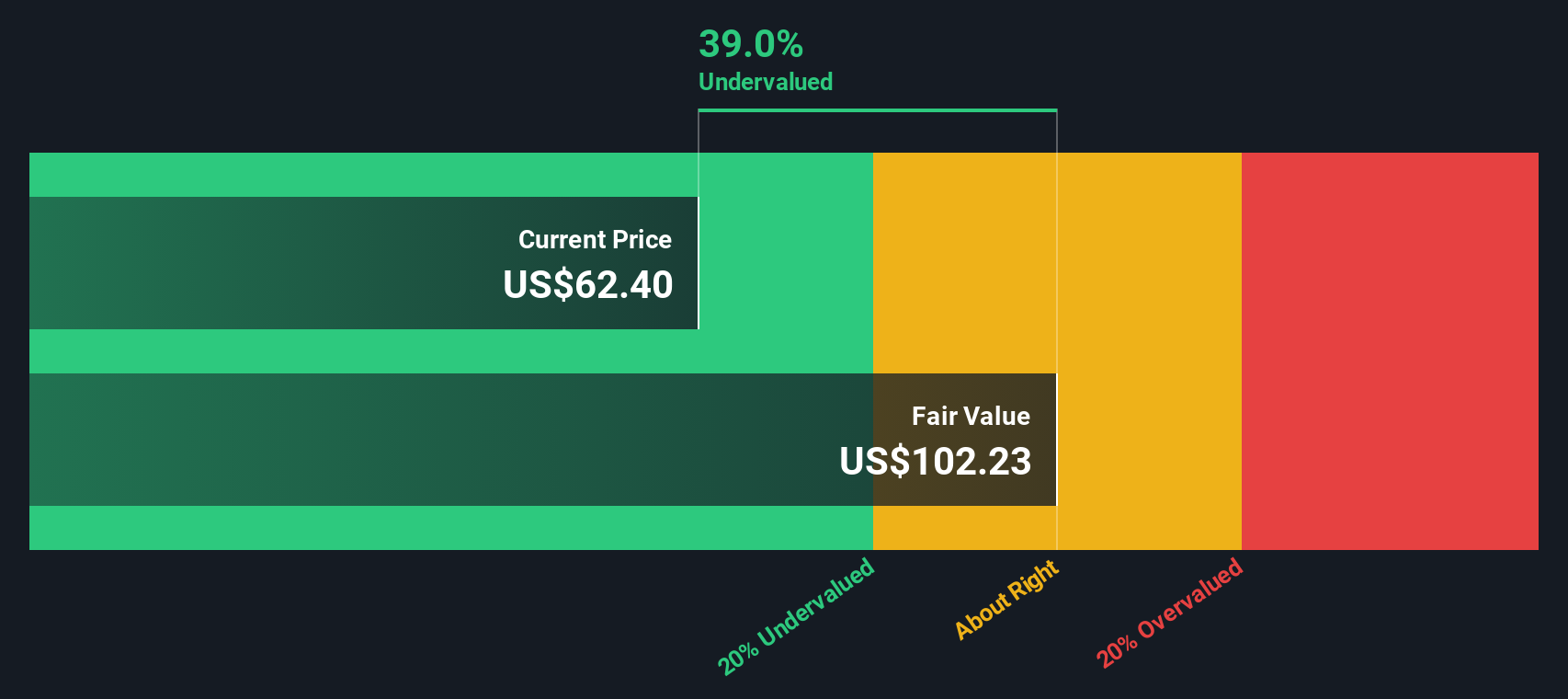

With shares now trading well below recent highs despite solid profitability, investors face a familiar dilemma: is KB Home an undervalued way to play a housing recovery, or is the market correctly pricing in weaker growth ahead?

Most Popular Narrative: 15.6% Undervalued

With KB Home last closing at $57.39 against a narrative fair value of $68, the storyline leans toward upside even as fundamentals cool.

The company is leveraging its national purchasing team to manage costs effectively, such as locking in competitive lumber prices to mitigate future price increases. This could help maintain or improve gross margins by controlling direct costs.

Want to see how flat revenues can still support a higher price tag? This narrative focuses on margin resilience and a richer future earnings multiple. Curious which assumptions really move that fair value line? The details may surprise you.

Result: Fair Value of $68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer demand, regional price cuts, and delivery disruptions could erode margins faster than expected and challenge the case for multiple expansion from here.

Find out about the key risks to this KB Home narrative.

Another Lens on Value

While the fair value narrative points to upside, our SWS DCF model tells a more cautious story, suggesting KB Home is trading well above an intrinsic value of about $23 per share and therefore looks overvalued. Which signal should matter more in a slow growth housing backdrop?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out KB Home for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own KB Home Narrative

If you see the story differently or want to dig into the numbers yourself, you can shape a custom view in just minutes with Do it your way.

A great starting point for your KB Home research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next opportunity?

Do not stop at one housing stock when you can quickly scan focused shortlists on Simply Wall St’s Screener and spot ideas others will miss.

- Capture underpriced potential by targeting companies trading below intrinsic value using these 913 undervalued stocks based on cash flows before the market catches up.

- Capitalize on AI tailwinds by scanning these 24 AI penny stocks packed with businesses building real-world artificial intelligence solutions.

- Lock in reliable cash flows by reviewing these 12 dividend stocks with yields > 3% that may offer steady income on top of capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com