Rongan PropertyLtd And 2 Other Asian Penny Stocks To Consider

As Asian markets navigate a period of mixed economic signals and monetary policy shifts, investors are increasingly exploring diverse avenues for potential growth. Penny stocks, often associated with smaller or newer companies, represent a unique opportunity within this landscape. Despite their somewhat outdated name, these stocks can still offer significant value when they boast strong financial health and solid fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.48 | HK$915.41M | ✅ 4 ⚠️ 1 View Analysis > |

| Asia Medical and Agricultural Laboratory and Research Center (SET:AMARC) | THB2.64 | THB1.11B | ✅ 3 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.53 | HK$2.1B | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB5.00 | THB3B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.104 | SGD54.45M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.37 | SGD13.26B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$0.79 | HK$2.11B | ✅ 3 ⚠️ 2 View Analysis > |

| NagaCorp (SEHK:3918) | HK$4.73 | HK$20.92B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.97 | NZ$138.07M | ✅ 2 ⚠️ 5 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.78 | NZ$233.79M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 978 stocks from our Asian Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Rongan PropertyLtd (SZSE:000517)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Rongan Property Co., Ltd. is engaged in the development and sale of real estate properties in China, with a market capitalization of CN¥5.99 billion.

Operations: The company generates its revenue primarily from operations in China, amounting to CN¥11.35 billion.

Market Cap: CN¥5.99B

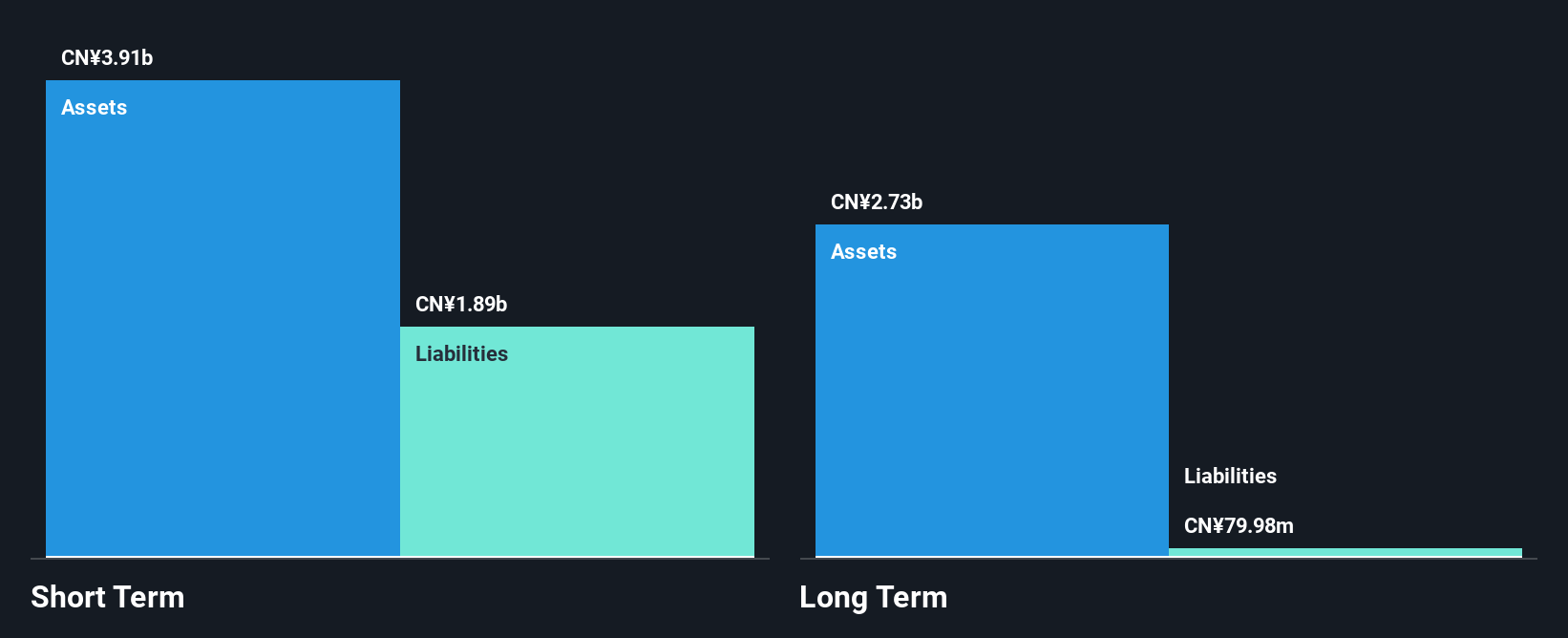

Rongan Property Ltd., with a market cap of CN¥5.99 billion, has faced financial challenges, reporting a significant drop in revenue to CN¥4.54 billion for the first nine months of 2025 compared to CN¥17.17 billion the previous year, alongside a net loss of CN¥64.24 million. Despite being unprofitable and experiencing increased losses over five years, its debt management is commendable with short-term assets exceeding liabilities and debt well-covered by operating cash flow. The stock trades below estimated fair value but remains volatile amid ongoing profitability issues and declining earnings growth over recent years.

- Unlock comprehensive insights into our analysis of Rongan PropertyLtd stock in this financial health report.

- Explore historical data to track Rongan PropertyLtd's performance over time in our past results report.

Baoxiniao Holding (SZSE:002154)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Baoxiniao Holding Co., Ltd. is involved in the research, development, production, and sale of branded men's and women's clothing products in China with a market cap of CN¥5.91 billion.

Operations: The company generates its revenue primarily from the textile and apparel segment, which accounts for CN¥4.96 billion.

Market Cap: CN¥5.91B

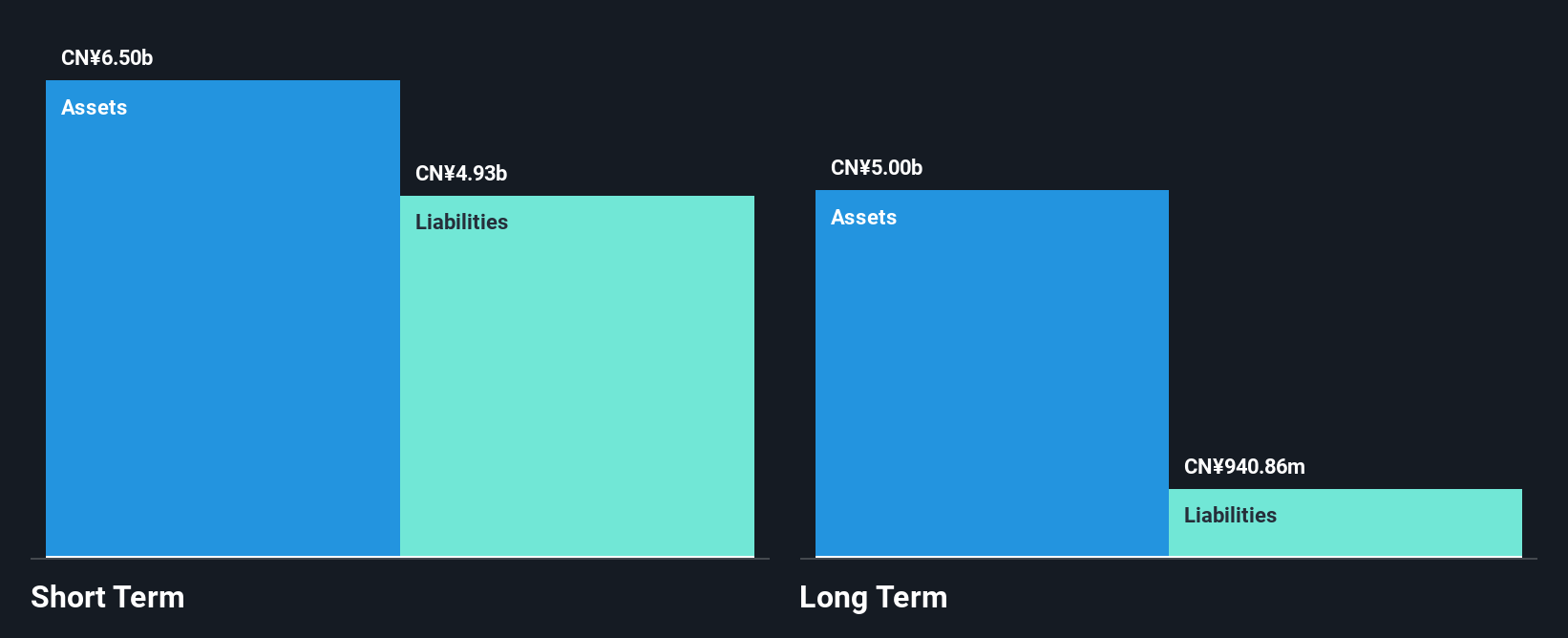

Baoxiniao Holding Co., Ltd. has demonstrated financial resilience with short-term assets of CN¥4.2 billion surpassing both its short and long-term liabilities, indicating strong liquidity. Despite a decline in net income to CN¥235.97 million for the first nine months of 2025, the company maintains a stable debt position with more cash than total debt and operating cash flow covering 99.4% of its debt. Although earnings growth has been negative over the past year, Baoxiniao's stock is trading at good value relative to peers and industry benchmarks, supported by an experienced management team with an average tenure of 8.3 years.

- Click here and access our complete financial health analysis report to understand the dynamics of Baoxiniao Holding.

- Understand Baoxiniao Holding's earnings outlook by examining our growth report.

Aotecar New Energy Technology (SZSE:002239)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aotecar New Energy Technology Co., Ltd. specializes in the production and sale of automotive thermal management systems and components, with a market cap of CN¥8.19 billion.

Operations: The company's revenue primarily comes from its Thermal Management Components Manufacturing segment, which generated CN¥8.50 billion.

Market Cap: CN¥8.19B

Aotecar New Energy Technology Co., Ltd. shows a mixed financial picture, with its earnings growing 23.8% over the past year, outpacing the broader Auto Components industry growth. The company's short-term assets of CN¥6 billion comfortably cover both short and long-term liabilities, highlighting liquidity strength. Despite low return on equity at 2.3%, operating cash flow robustly covers debt obligations by 130.2%. Recent earnings were impacted by a large one-off loss of CN¥66.4 million, yet interest coverage remains strong and shareholder dilution has been minimal over the past year, reflecting prudent financial management amidst market volatility.

- Navigate through the intricacies of Aotecar New Energy Technology with our comprehensive balance sheet health report here.

- Understand Aotecar New Energy Technology's track record by examining our performance history report.

Make It Happen

- Investigate our full lineup of 978 Asian Penny Stocks right here.

- Interested In Other Possibilities? Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com