Asian Undervalued Small Caps With Insider Action For December 2025

As 2025 draws to a close, Asian markets are navigating a complex landscape, with Japan's recent interest rate hike marking the highest level in 30 years and China's economic indicators reflecting tepid growth. In this environment, small-cap stocks in Asia are capturing attention as investors seek opportunities amidst shifting market dynamics and broader economic sentiment. Identifying promising stocks often involves evaluating factors such as financial health, industry position, and potential for growth within the context of current market conditions.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Paragon Care | 16.5x | 0.1x | 26.02% | ★★★★★☆ |

| Vita Life Sciences | 15.0x | 1.6x | 37.06% | ★★★★☆☆ |

| Chinasoft International | 21.0x | 0.7x | -1179.42% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 44.00% | ★★★★☆☆ |

| BWP Trust | 10.9x | 14.2x | 12.41% | ★★★★☆☆ |

| Dicker Data | 22.4x | 0.8x | -46.65% | ★★★☆☆☆ |

| Amaero | NA | 63.7x | 32.34% | ★★★☆☆☆ |

| PSC | 9.8x | 0.4x | 19.71% | ★★★☆☆☆ |

| Betr Entertainment | NA | 1.5x | 9.52% | ★★★☆☆☆ |

| Nufarm | NA | 0.2x | -118.97% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

BWP Trust (ASX:BWP)

Simply Wall St Value Rating: ★★★★☆☆

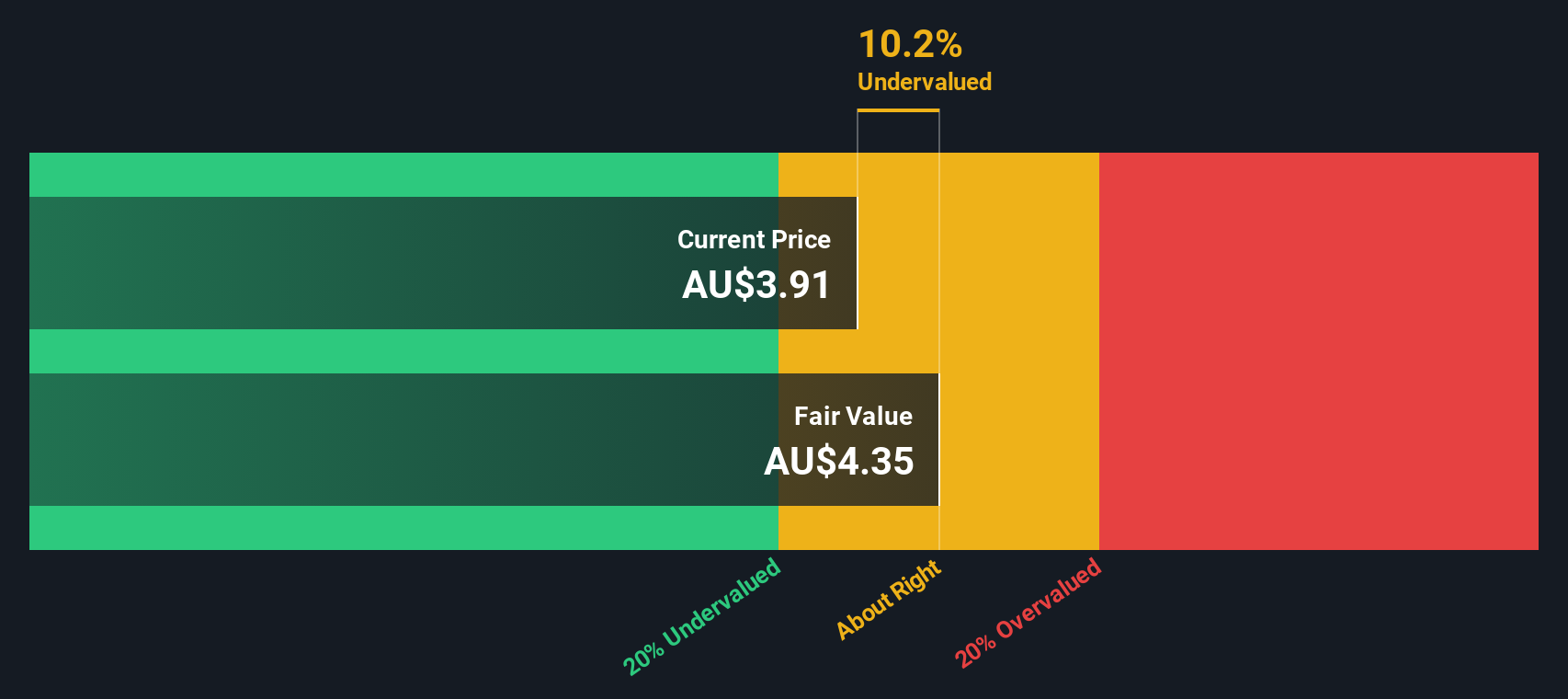

Overview: BWP Trust focuses on investments in commercial warehouse properties, with a market capitalization of A$2.54 billion.

Operations: The company's revenue primarily stems from investments in commercial warehouse properties, with a recent reported revenue of A$203.30 million. The gross profit margin has shown a slight upward trend, reaching 89.54% by the end of 2025. Operating expenses have gradually increased to A$14.02 million, while non-operating expenses have decreased to -A$97.57 million over the same period, affecting net income margins positively at 1.31%.

PE: 10.9x

BWP Trust, a smaller player in the Asian market, is attracting attention due to its perceived undervaluation. Recent insider confidence is evident from share purchases over the past year. Despite earnings forecasts predicting a 10.6% annual decline over the next three years, BWP's recent A$300 million fixed-income offering signals strategic financial maneuvering. The upcoming leadership transition with Ms Fiona Harris as Chair could influence future direction positively. Meanwhile, a distribution increase of 9.58 cents per security highlights stable income potential for investors amidst these changes.

- Click here and access our complete valuation analysis report to understand the dynamics of BWP Trust.

Gain insights into BWP Trust's historical performance by reviewing our past performance report.

HMC Capital (ASX:HMC)

Simply Wall St Value Rating: ★★★★☆☆

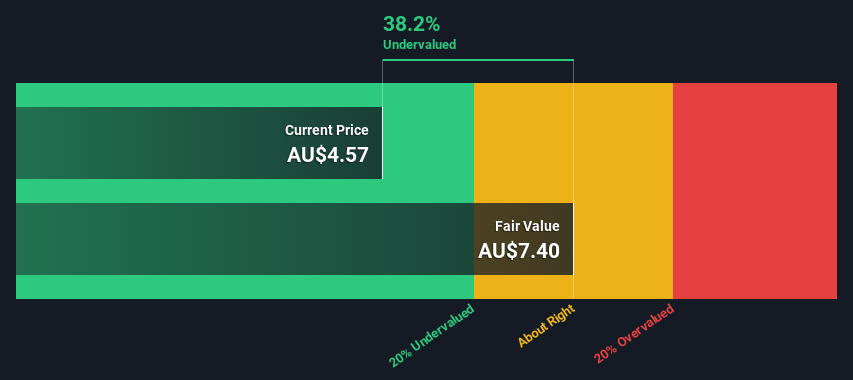

Overview: HMC Capital operates in digital, real estate, private credit, and private equity sectors with a market cap of A$2.5 billion.

Operations: HMC Capital generates revenue from four main segments: Digital, Real Estate, Private Credit, and Private Equity. Over recent periods, the company has achieved a gross profit margin of 100%, indicating that its revenue equates to its gross profit. Operating expenses have been significant but are partly offset by negative non-operating expenses. The net income margin has shown notable improvement, reaching as high as 112.27% in the latest period examined.

PE: 11.1x

HMC Capital, a smaller player in the Asian market, has caught attention due to insider confidence. Between late 2024 and early 2025, an insider purchased over 5.8 million shares at a transaction value of A$20.3 million, reflecting significant belief in its potential. Despite relying solely on external borrowing for funding—considered higher risk—the company projects earnings growth of 6.29% annually. Recent meetings have focused on strategic decisions like director elections and performance rights issuance, indicating active governance amidst evolving financial dynamics.

- Take a closer look at HMC Capital's potential here in our valuation report.

Examine HMC Capital's past performance report to understand how it has performed in the past.

oOh!media (ASX:OML)

Simply Wall St Value Rating: ★★★★☆☆

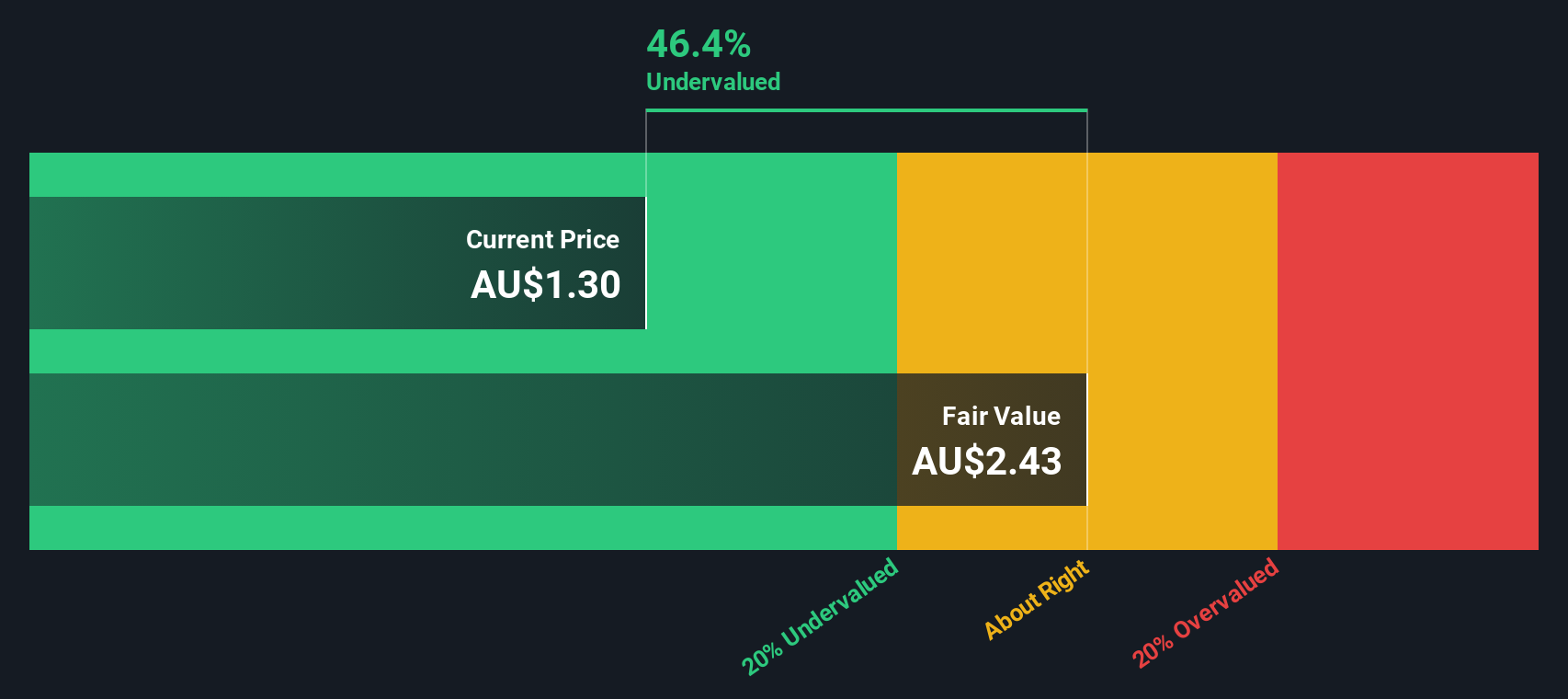

Overview: oOh!media is a company that specializes in providing a range of out-of-home advertising solutions, with a market capitalization of A$0.75 billion.

Operations: The company generates revenue primarily from out-of-home advertising solutions, with recent figures reaching A$683.49 million. Cost of Goods Sold (COGS) has been noted at A$218.33 million, leading to a gross profit margin of 68.06%. Operating expenses are significant, including a notable depreciation and amortization expense of A$194.98 million and general & administrative costs amounting to A$119.34 million. The net income margin stands at 2.84%, reflecting the impact of both operating and non-operating expenses on profitability.

PE: 36.0x

oOh!media, a small player in the Asian market, shows potential for growth despite challenges. The company anticipates earnings to grow 29% annually, indicating future promise. However, profit margins have decreased from 5.4% to 2.8%, reflecting some operational pressures. Insider confidence is evident as they purchased shares between January and March 2025, suggesting belief in its prospects. While reliant on external borrowing for funding, the company's strategic positioning offers intriguing possibilities for investors seeking opportunities in this segment of the market.

- Click to explore a detailed breakdown of our findings in oOh!media's valuation report.

Review our historical performance report to gain insights into oOh!media's's past performance.

Turning Ideas Into Actions

- Explore the 50 names from our Undervalued Asian Small Caps With Insider Buying screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com